Geopolitika: JPMorgan – When the Bank Writes the Battlefield

JPMorgan Chase, the Fed, and the financial choreography behind global conflict.

If all wars are bankers’ wars, what happens when the bankers start telling you how to interpret those wars?

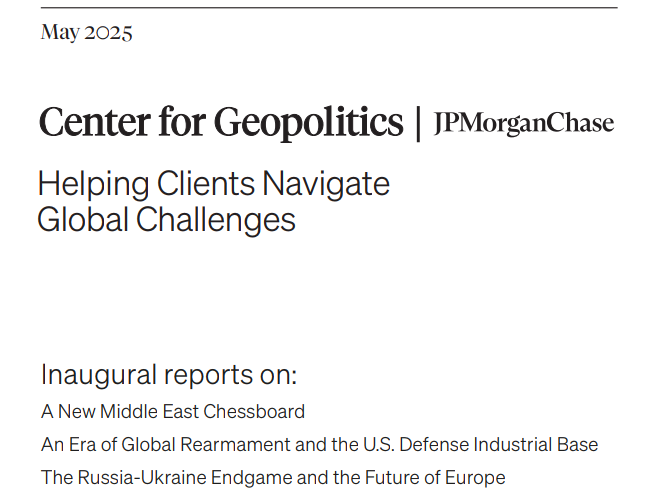

In late May 2025, JPMorgan Chase quietly unveiled its new Geopolitical department with the release of its first quarterly report—a sleek, advisory-styled document promising “strategic insight” for clients. But the timing was not neutral. This debut coincided precisely with the run-up to June’s G7 and NATO summits and aligned closely with think tank emissions from Carnegie and others.

The surface content—energy flows, defense budgets, minerals, and political churn—is not the message. The framing is. This report doesn’t just describe global volatility. It pre-narrates it. It doesn’t observe power shifts—it scripts the lens through which those shifts will be seen.

But before we decode JPMorgan’s latest geopolitical script, we should ask: who is the author? What is this institution’s real history—and its ongoing role in the machinery of empire?

Tricks of the Trade: Banking War Since Napoleon

Bankers financing both sides of conflict isn’t a conspiracy theory—it’s a matter of record. From the Rothschilds profiting off Napoleonic war bonds to JP Morgan underwriting both British and French liabilities in WWI, the playbook is consistent: fuel conflict, provide liquidity, collect interest.

During the Bolshevik Revolution, Western banks—including those linked to Morgan interests—channelled funds into both revolutionary forces and stabilisation regimes. The World Wars locked in the template: war created massive public debt; postwar reconstruction recycled that debt into contracts, reforms, and rent.

Every war becomes a balance sheet expansion. Every peace is a restructuring phase.

The Rent-Seeking Pyramid: Banking at the Helm of the State

In 1910, a clandestine summit of financial elites at Jekyll Island—JPMorgan affiliates among them—set the blueprint for the U.S. Federal Reserve. The result? A transfer of monetary power from state to syndicate. The U.S. government stopped issuing its own money and began borrowing it—at interest—from a privately controlled central bank.

JPMorgan wasn’t a supporter. It was a co-architect. The system allowed money to be created from nothing and sold to the state via Treasury bonds. Sovereign credit became private revenue. Taxpayers started paying interest on vapor. This wasn’t fiscal stewardship. It was debt feudalism, dressed as monetary governance.

Tier 2: Wars for Rent, Narratives for Profit

This rent scheme didn’t stop at central banking—it scaled up. Tier 2 monetises conflict. JPMorgan and its peers don’t just fund wars—they script them. From Rothschild intelligence arbitrage after Waterloo to Wall Street’s dual-track financing of the Bolshevik and Tsarist camps, war has always been investment-grade disruption.

WWI and WWII weren’t geopolitical accidents. They were full-cycle asset engines: munitions in, reconstruction out, currency resets throughout. And now? JPMorgan’s “geopolitical reports” serve less as analysis, more as stage cues. The war is pre-priced. The market is pre-primed. Policy becomes performance.

This isn’t influence—it’s an extractive algorithm. From fiat creation to regime rotation, JPMorgan’s geopolitical advisory is the apex of a rent pyramid that begins with monetising nothing and ends with securitising everything.

When banks fabricate the money and narrate the war, extraction becomes governance by other means.

And they’ve done it before:

- Napoleonic Wars: Rothschilds leveraged bond trades and insider intelligence

- British India: Barclays and HSBC underwrote colonial logistics

- WWI: JPMorgan served as purchasing agent for Allied war materiel

- Bolshevik Revolution: Wall Street funded both downfall and rise.

These weren’t diplomatic initiatives. They were balance sheet expansions.

This isn’t economic advice. It’s a script. And JPMorgan? They're not just narrators. They're editors, printers, and house bettors.

“They don’t just move the goalposts—they build the stadium, sell the tickets, and place the bets.”

Jamie Dimon and the New Doctrine of Strategic Certainty

In his foreword to the JPMorganChase Center for Geopolitics, Jamie Dimon doesn’t simply announce a new advisory division—he signals a transformation in the firm’s operational doctrine. JPMorgan is no longer positioning itself as a passive observer of global turbulence. It’s becoming a formatting engine.

For this role, Dimon has enlisted senior figures from the U.S. strategic architecture. Derek Chollet and Lisa Sawyer aren’t being recruited for their analytic skill, but for their capacity to encode continuity—policy insiders who know how to turn contingency into consensus.

The Center’s stated purpose is to convert geopolitical uncertainty into “actionable insight.” But what it actually manufactures is narrative preemption. “Insight” becomes a form of pre-emption. Sanctions, escalations, and regime pivots arrive already narrated—Dimon’s real innovation and goal is interpretive monopoly for his audience. JPMorgan isn’t waiting for events. It’s distributing the script.

Where others respond to crisis, JPMorgan distributes timing instructions. Where others assess risk, JPMorgan scripts causality. The goal isn’t to track volatility—it’s to render it legible in advance, and thereby profitable.

This isn’t a department. It’s a front in the war over meaning.

Managing Director, Derek Chollet, brings a résumé spanning the Pentagon, the State Department, the National Security Council, and advisory roles to multiple Secretaries of State and Defense. His deputy, Lisa Sawyer, formerly served as Deputy Assistant Secretary of Defense for European and NATO Policy and as special advisor on Russia and Europe to the Vice President. Their presence signals a clear intent: institutional interpretation will now move in step with continuity doctrine. The message to clients is not “understand the world,” but “receive the sanctioned reading.”

Within this framework, geopolitical developments are not evaluated for their complexity—they are pre-shaped to align with investment logic and policy orthodoxy. Sanctions become non-negotiable instruments. Military escalations are reframed as strategic adjustments. Governmental agendas take on the polished lexicon of foresight, tailored for capital responsiveness.

Dimon’s manoeuvre positions JPMorgan not just as a participant in the global order, it becomes a co-author of its interpretive scaffolding. The future isn’t something to be navigated—it’s something to be narratively brokered. Under this model, financial institutions cease reacting to world events and begin setting the terms under which those events will be understood.

The public doesn’t get information—it gets direction. And JPMorgan doesn’t wait to see what happens. It tells you what it means before it begins.

Key questions:

- Who benefits when a vested firm sets itself up as the lens for world events?

- What gets erased when “insight” is pre-written?

- How many decisions are made on scripts no one saw being drafted?

Who Owns the Interpreters?

Maybe the fundamental question isn’t just about who writes the analysis—it’s who funds the scriptwriters, who owns the broadcast tower, and who gets the first look at the rehearsal notes.

JPMorgan Chase may appear as a singular voice in the geopolitical risk advisory landscape, but it doesn’t act alone. Behind its glossy reports and media-tested narratives lies a deeper architecture of mutual reinforcement. BlackRock, Vanguard, and State Street—the so-called "Big Three"—hold massive ownership stakes not only in JPMorgan, but in each other. Together, they constitute a triad of financial gravitational pull, anchoring the capital markets while simultaneously shaping their public interpretation.

These firms aren’t competitors in the traditional sense. They’re co-owners. They share:

- Board crossovers and executive migration paths

- Portfolio dependencies across sovereign debt and defense equities

- Aligned regulatory lobbying positions

Rather than market plurality, what emerges is narrative convergence. When JPMorgan offers “geopolitical insight,” it is filtered through an ownership lattice where feedback loops are mistaken for consensus. Asset managers shape public expectations, which in turn reinforce policy direction, which then becomes the basis for further asset reallocation—loop closed, profit captured.

This is the interpreter’s paradox: the ones who claim to decode the world for us are often the same ones who have already placed their bets on how that world should unfold.

And JPMorgan sits at the eye of this self-reinforcing storm. Its new geopolitical division doesn’t just observe volatility—it transforms volatility into a strategic asset. While markets may panic, JPMorgan reads panic as price discovery. When governments hesitate, JPMorgan scripts hesitation as “opportunity bandwidth.” What the public sees as crisis, JPMorgan sees as arbitrage.

This is the recursive machinery of modern financial-political control:

- Policy shapes the market narrative

- Market expectations guide the analysis

- Analysis pre-shapes the next round of policy.

Who breaks the loop? No one with equity in the cycle. The same firms that move your pension fund also advise your government and influence your headlines. Ownership is not just financial—it is epistemological. When they own the frame, interpretation becomes captive capital.

Every new crisis is not just an event—it’s a stage cue.

Ask yourself:

- Who taught you what a “threat” looks like?

- Who profits when you believe them?

Financial Advisories as Emission Devices

JPMorgan’s flagship report presents three sub-reports—each camouflaged as sector-specific advisories. However, beneath the financial analysis lies a different structure: motif saturation, interpretive scaffolding, and pre-scripted alignment. Each “advisory” becomes an emission node, transmitting not just insights, but narrative compliance.

To illustrate how JPMorgan scripts geopolitics into capital strategy, we’ll examine their Middle East Chessboard report from May 2025. It serves not just as a case study, but as a blueprint—where war is pre-interpreted, sovereignty overwritten, and violence reframed as market rhythm. This isn’t a one-off. The same tonal structure saturates other flagship dispatches. The following examples—on rearmament and Ukraine respectively—are identical in form and grammar, differing only in theatre.

The Middle East Chessboard (May 2025): Gamechanger Fracture Map

JPMorgan’s Middle East Chessboard report is styled as strategic insight. It isn’t. It’s a donor-coordination memo disguised as geopolitical foresight. The document doesn’t assess the region’s volatility—it prescripts its compliance. Each “gamechanger” delivers narrative scaffolding, not analysis. The true function: enforce realignment in the face of military escalation, normalise extraction politics, and bury aggression beneath the language of inevitability.

Gamechanger 1: Iran in the Box – The Silence Before the Strike

The report frames Iran as cornered and collapsing—its leadership “pressured,” its defenses “shattered,” its diplomacy “ready to break.” This isn’t neutral analysis. It’s stagecraft. A setup designed to make what comes next feel inevitable.

For over 30 years, Netanyahu has claimed Iran is “weeks away” from a nuclear weapon—a forecast so often wrong it’s become geopolitical folklore. Yet it won’t die. Trump revived it during his presidency to justify pulling out of the JCPOA and to clear rhetorical ground for Israeli escalation. Now, in May 2025, JPMorgan’s report quietly replays the same theme. It doesn’t cite the source. It doesn’t challenge the logic. It just adopts the premise: Iran is nearing collapse, its nuclear threat implied but unstated. The interpretation is loaded. The audience only has to accept it.

Then the “future” arrives. In June, Israel launches aerial strikes. On June 22, the United States bombs Iranian nuclear facilities. These aren’t hypotheticals. They’re real-time assaults on sovereignty. But in the report? Silence.

That silence is the tell. The omissions aren’t accidental—they’re structural. Not because the attacks are irrelevant, but because their rationale was already embedded. The report didn’t predict the strikes. It normalised them in advance.

By describing Iran as already broken, JPMorgan reframes aggression as maintenance. The bombings don’t read as escalation. They read as stabilisation. That’s the device: describe collapse before you cause it, and the violence becomes correction, not provocation.

You don’t have to justify what you’ve already narrated into inevitability. You just let it play out.

This isn’t foresight. It’s narrative air support.

And JPMorgan’s silence says everything.

- What’s said: The “diplomatic window is cracked open.”

- What’s unsaid: Kinetic escalation has already begun—under the cover of narrative sedation.

- Result: When the bombs fall, they don’t look like war. They look like policy continuity.

This is pre-rationalisation by omission. Describe the ruin first, and no one questions who pushed.

Gamechanger 2: Regional Integration – The Mirage of Normalisation

The “integration” language is pure investment bait. Saudi PIF figures, Gulf infrastructure charts, and tech zone optimism bury the underlying logic: economic normalisation is contingent on military normalisation. The October 2024 Hamas attack, the IDF response, and today's open war are flattened into backstory. The report insists “momentum didn’t stop,” but in truth it was staged to accelerate.

- The carrot: normalised ties with Israel

- The stick: acceptance of Palestinian suppression as a regional stabiliser

- The method: market optimism and suppression of moral context.

This isn’t “integration.” It’s coerced interdependence under duress.

Gamechanger 3: Palestine on a Long Road to Statehood – Rehearsed Stalemate

The most cynical of the three. The “road to statehood” is presented as elusive but economically desirable. But the report knows it’s not a road—it’s a cul-de-sac. The section admits Gaza is volatile, yet blames Hamas alone. It does not mention: the unguarded wall on Oct 7, the pre-positioned concert venue, the Hannibal Directive and internal casualties, or the ongoing ethnic cleansing and mass destruction in Gaza and the West Bank.

The real function of this section is to narratively convert genocide into geopolitical friction and land theft into diplomatic inertia.

- “Murky endgame”? No—strategic ambiguity that cloaks settler colonial permanence.

- “Quagmire risk”? Not if displacement is the goal.

The roadmap is not toward peace—it’s toward just-in-time regional permission for ongoing apartheid, with Palestinian dispossession as supply chain friction.

Key questions:

- Who writes the script when every “gamechanger” omits the bang but forecasts the rebound?

- What happens when war is not seen as breakdown—but as required precondition for profit?

- Who profits when “normalisation” means absorption into U.S.-Israeli military-commercial orbit?

Final Middle East Watch List

The JPMorgan’s “watchlist” in this section doesn’t just omit—it repackages. It renders covert continuity as fresh opportunity, burying structural violence beneath investment language.

- Syria:

What’s framed as a “window to re-engage” is in fact a whitewash of a war crime conveyor belt. The new regime under Al-Shara isn’t a sovereign alternative—it’s the result of a foreign-orchestrated reshuffling of ex-jihadist assets: recycled elements of ISIS, al-Qaeda, and other proxy groups now serving as the “governance” layer. Ethnic cleansing of minorities (Christians, Druze, Alawites) is ongoing, hidden beneath development-speak and U.S.-brokered “energy infrastructure” deals. Sanctions, far from being uncertain, are tools of leverage. The real question isn't when they’ll be lifted—but how long they’ll be used to enforce economic obedience. - Lebanon:

It’s not “opening,” it’s being pressured into fragmentation. Hezbollah is described as a “grip” to be broken, while U.S. power is visually and structurally embedded via its hyper-militarised hilltop embassy: 43 acres of command and control, not diplomacy. Meanwhile, Israeli airstrikes escalate with impunity. “Restoring investor confidence” becomes a euphemism for political disarmament of resistance factions. - Saudi Arabia / NEOM:

The “Kingdom 2.0” narrative is sold as futurism, but the geographical and financial alignments expose its function as imperial infrastructure. NEOM’s alignment with a prospective canal corridor through Gaza is no coincidence. It connects Red Sea control, Israeli coastal expansion, and the dream of a securitised logistics corridor—cloaked as “tourism development.” Gaza isn’t being rebuilt. It’s being remodelled into a high-yield real estate zone—over the buried and mangled corpses of its former inhabitants. From Gaza to NEOM, the map redlines human life into logistics throughput.

What is this about?

- Not foresight, rehearsal for enclosure.

- Not investment, occupation via spreadsheet.

- Not a report, a cloak.

The questions:

- What’s been removed to make this look like stability?

- Who profits when a war zone becomes a beachfront property listing?

- Why does “normalisation” always begin with bombardment and end with BlackRock?

The report’s true function? Narrative landscaping—flattening destruction into opportunity, making theft look like transition.

"If policy starts sounding like investment advice—it’s because someone’s portfolio is betting on it."

Synchronised Supplements: Same Grammar, Different Fronts

The other two sub-reports offer a similar treatment:

1. Era of Rearmament (May 2025)

This second sub-report rebrands militarism as a growth engine. There’s no caution, no restraint—just securitised escalation. The U.S. defence industrial base is reframed as an “innovation ecosystem,” and global rearmament becomes a bullish indicator. Deterrence isn’t a doctrine—it’s a dividend.

What emerges is pure capital displacement logic. Surplus liquidity is channelled into dual-use infrastructure: AI-integrated munitions, climate-friendly battlefield logistics, and “green” defence funds. ESG camouflage or dual-use laundering? JPMorgan doesn’t just advise—it architects. The report converts risk into sectoral growth potential, blurring the line between escalation logic and investment narrative. War isn’t a policy failure—it’s a portfolio realignment strategy.

The accompanying "watchlist" segment is not a neutral policy digest—it’s a fiscal militarisation cue-sheet dressed as budget trivia. Each bullet camouflages escalation as routine governance:

- U.S. Defense Budget / Authorisation: Nearly $900B—plus another $150B teed up under a “grand bargain”—is pitched as fiscal continuity. But beneath the budget-speak lies normalisation of permanent wartime expenditure. Terms like “sustainable fiscal footing” and “investment support” serve as narrative camouflage for converting military inflation into a durable asset class. This isn’t a defense budget—it’s a forward earnings sheet for defense investors. Debate over necessity is absent. Only timing and throughput matter.

- Buy European?: The €150B ReArm Europe scheme is framed in industrial stimulus terms, but its structural aim is supply chain stratification. By conditioning access to funds on compatibility with U.S. components, the policy creates enforced interdependence: soft coercion disguised as “market diversification.” What’s sold as European autonomy is actually NATO supply-chain lock-in, rerouting sovereign procurement into predictable U.S.-anchored cash flows.

- Redeployments are framed as tactical rebalancing, but the subtext is clear: force mobility means fresh contracts. Shifting troops out of legacy bases (Germany, Korea) opens logistical vacuums—ripe for private contractors, base-builders, and forward-operating procurement. “Integration” is code for military outsourcing opportunities.

- Indo-Pacific Industrial Footprint: Presented as strategic buildup, this section masks a supply chain dragnet. Co-production with Japan and Australia isn't regional empowerment—it’s industrial tethering. The aim isn’t conflict prevention but production prepositioning. JPMorgan doesn’t question war—it plots where the parts get made when it starts.

This watchlist effectively serves as a priming device—embedding the logic of escalation into administrative mundanity.

2. Russia–Ukraine (May 2025)

Styled as a battlefield brief, this section of the report is nothing of the sort. It narrativises war fatigue as a strategic asset. Eastern Europe isn’t described as suffering from protracted conflict, but as adapting—malleable markets absorbing volatility and stabilising global capital flows. The Black Sea, once coded as a contested theatre, is repositioned as an infrastructural pivot in Eurasian trade. Every mechanism of war—sanctions, price controls, supply chain reroutes—is absorbed into the language of “resilience.”

More choreography than reporting, JPMorgan builds out an interpretive echo chamber, saturating the field with coherence cues. The war isn’t ending, but the story is being retold to allow asset repositioning. Narrative fatigue is solved not by peace—but by financialised narration of “durable” instability.

The final “watch list” for The Russia-Ukraine Endgame and the Future of Europe section of of JPMorganChase’s report looks benign—just a list of dates and developments to “watch.” But this isn’t a summary. It’s a timing device. A script. A rhythm map for how institutions, media, and investors should interpret—not just observe—the coming month. Ostensibly titled “What we’re watching,” the section delivers a forward-operationalisation script. The events listed—G7, NATO, EU Council, Ukraine Recovery Conference—are not neutral observations. They are interpretive anchors, wrapped in preloaded motifs like resilience, volatility, and realignment. The report doesn’t track geopolitics—it pre-choreographs its reception.

Each summit isn’t just an event—it’s a narrative amplifier:

- G7 (June 13–15): Top-down unity and market-stabilising rhetoric.

- NATO (June 24–25): Formalisation of posture—NATO-first becomes governance logic.

- EU Council (June 26–27): Budgetary-military harmonisation; sovereignty soft-pedalled.

- URC2025 (July 10–11): Military integration recast as civil reconstruction.

A few select cues:

- “Populist diplomacy?” isn’t inquiry—it’s interpretive inoculation.

- “Next steps on the U.S.-Ukraine mineral deal?” isn’t news—it’s resource normalisation in contested zones.

- “When will Trump and Putin meet?” isn’t speculation—it’s emotional priming.

For whom is this staged?

- Asset managers read pricing cues

- Technocrats receive semantic scaffolds

- Media inherits the metaphor stack.

This is not passive observation. It is synchronised perception engineering. JPMorgan isn’t just reading the news—it’s cueing its performance. Each line isn’t about what’s happening. It’s about how to understand it before it does.

The strategic mistake? Believing this is analysis.

The operational reality? It’s interpretive choreography.

JPMorgan doesn’t wait for the future. It scripts the interval—and sells access to the script.

From Forecast to Frame: The Rent of Interpretation

JPMorgan isn’t predicting the future—it’s formatting it. By scripting how geopolitical events are seen before they unfold, the firm doesn’t just trade on volatility—it manufactures the lens through which volatility is interpreted. This isn’t risk analysis. It’s interpretive colonisation.

This is rent-seeking 2.0:

- Not merely extracting profit from debt issuance or war finance

- But monetising narrative control itself—where interpretation becomes a scarce resource sold at a premium.

It’s no longer just about funding both sides of a conflict. It’s about framing the conflict so both sides validate the same financial instruments. Strategic ambiguity becomes tactical leverage. The “watch list” becomes a script. And the institutions reading it don’t just observe—they perform.

In this architecture, certainty is the product. Not factual certainty—but interpretive priming. JPMorgan sells the illusion of foresight, packaged as risk foresight, designed to discipline volatility into compliance. And it works—not because it’s right, but because it’s early.

This isn’t consensus. It’s choreographed agreement, time-stamped to outpace dissent and narratively lock in alignment before public debate begins. The flow runs:

Institution → Advisory → Media → Market → Policy → Institution

If all wars are bankers’ wars, what happens when the bankers start writing the stage directions? JPMorganChase’s report doesn’t just offer a view of the battlefield—it scripts the applause cues. What gets framed, what gets ignored, and when it gets delivered are no longer journalistic accidents. They’re timed performances. And the new geopolitical department isn’t a think tank—it’s a teleprompter, scrolling interpretations before the facts arrive.

If interpretation is now currency, then is the only resistance refusal to bank on the frame?

Published via Journeys by the Styx.

Geopolitika: Tracing the architecture of power before it becomes the spectacle of history.

—

Author’s Note

Produced using the Geopolitika analysis system—an integrated framework for structural interrogation, elite systems mapping, and narrative deconstruction.