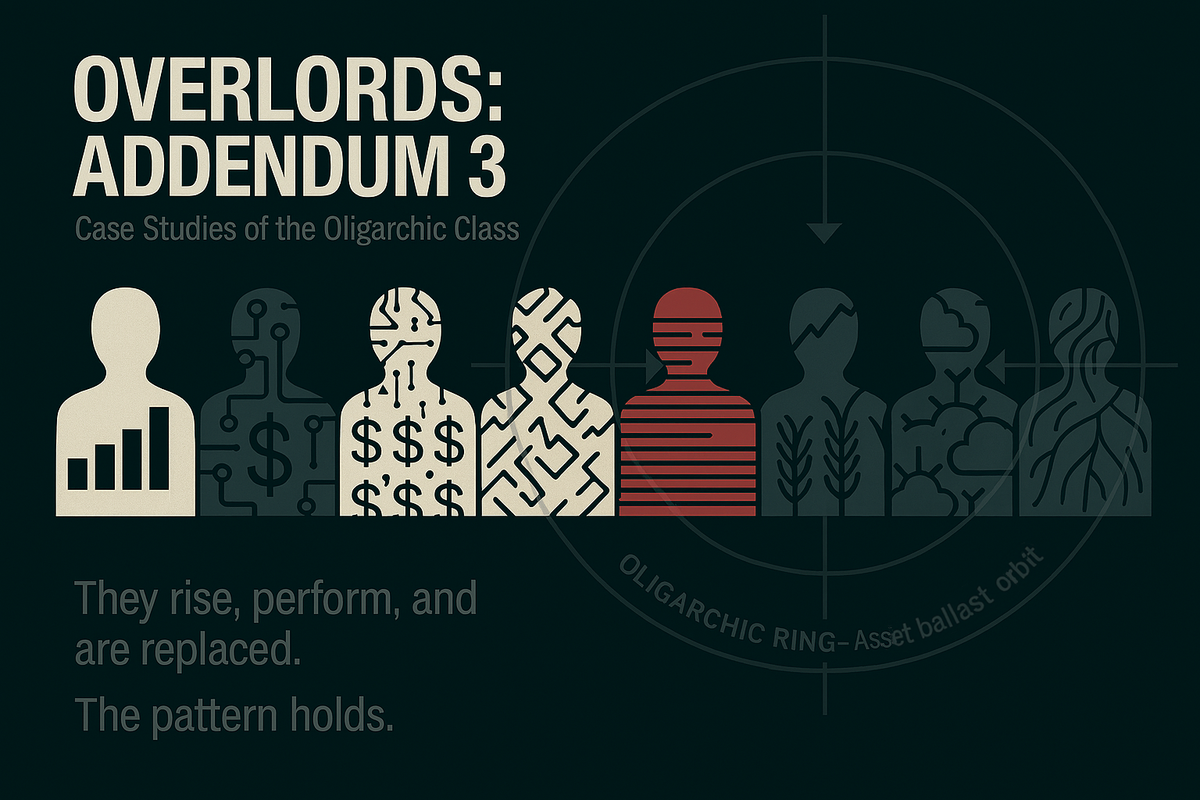

Overlords: Addendum 3. Case Studies of the Oligarchic Class

Profiles in conditional ascent—how oligarchs are formatted, deployed, and disciplined within the architecture of power.

This addendum offers a series of illustrative—not exhaustive—profiles designed to decode the structural role of the oligarchic class, as introduced in Part 9: The Oligarchic Class – Fabricated Wealth, Conditional Power. These case studies are not concerned with personality, innovation, or charisma—they are diagnostic instruments intended to map the formatted architecture that produces and governs oligarchic function.

This series locates the Oligarchic Class not as sovereign actors but interchangeable placeholders—faces affixed to capital vectors conditioned by the deeper system. Their visibility serves as a distraction from the structural mechanics of power. Whether tech magnate, fossil-fuel baron, or philanthropic reformer, each follows the same recursive schema: origin mechanism → integration pathway → functional role → conditional boundary.

While a simple internet search or reference to Forbes will provide ample background on each, the case studies presented here operate as systemic proofs, just as the figures profiled in Addendum 2. The Operators illustrated the intermediary tiers of tactical governance. Together, these profiles clarify the function of the oligarch not as ruler, but as mask—a curated entity permitted to rise, tasked to perform, and disciplined when misaligned.

Index of Case Studies:

1. Constructed Oligarchs (Permitted / Fronts)

- Jeff Bezos – Tech Mogul (US/Global)

- Mark Zuckerberg – Tech Mogul (US/Global)

- Larry Ellison – Tech Mogul (US/Global)

- Alex Karp – Predictive Governance (US)

- Boris Berezovsky – Media & Energy (Russia)

- Roman Abramovich – Energy & Sports (Russia/UK)

- Al Nahyan Family – Energy & Finance (UAE)

- Prince Alwaleed bin Talal – Finance & Media (Saudi Arabia)

- Mohamed Al-Fayed – Retail & Media (UK/Egypt)

2. Opportunistic Oligarchs (Absorbed / Integrated)

- Patrice Motsepe – Mining & Finance (South Africa)

- Mo Ibrahim – Telecoms & Governance (Sudan)

- Carlos Slim – Telecoms & Infrastructure (Mexico)

- Traditional Landowning Families – Agribusiness (Latin America)

3. Dynastic / Migratory Oligarchs (Hinge to Ruling Stratum)

- Rothschild Family – Banking & Finance (Europe/Global)

- Rockefeller Family – Energy & Philanthropy (US)

- Agnelli Family – Industrial Capital (Italy/Europe)

- George Soros – Finance & Ideological Infrastructure (US/Eastern Europe)

- Larry Fink / BlackRock – Asset Management (US/Global)

4. Hybrid Oligarchs (Masks of Governance)

- Bill & Melinda Gates Foundation – Health & Agriculture

- Chan Zuckerberg Initiative – Tech & Education

- Patrick Soon-Shiong – Biotech & Media

- Elon Musk – Aerospace, EVs & AI

- Jack Ma – E-Commerce & Finance (China)

As outlined in Part 9, the oligarchic class stabilises but does not command; their case studies show that wealth confers visibility, not sovereignty—some are absorbed into permanence, others discarded once their function lapses.

1. Constructed Oligarchs (Permitted / Fronts)

Tech Moguls (US / Global)

a) Jeff Bezos – Tech Mogul, United States, Constructed Oligarch

Origin Mechanism: Amazon was launched during a deregulatory wave but achieved structural leverage only through Pentagon and CIA-linked cloud contracts via Amazon Web Services (AWS). The rise of AWS converted Amazon from a retail experiment to sovereign infrastructure, underwritten by post-9/11 digital procurement architecture and intelligence patronage.

Integration Pathway: Bezos entered elite circuits not solely via market dominance but through infrastructure absorption. AWS became the backend for U.S. military, intelligence, and governmental systems, tethering Amazon directly to the state’s operational substrate. Capital integration followed: Bezos acquired The Washington Post, entered Beltway circles, and gained access to D.C. regulatory scaffolding.

More recently, Bezos has pursued dynastic-style social integration through his partnership with Lauren Sanchez, whose ties anchor him into Hollywood/media influence networks. This is not aristocratic bloodline fusion in the Rothschild–Rockefeller mode, but rather a contemporary “lite” version of dynastic marriage: linking financial/technological infrastructure to cultural visibility and narrative machinery. By binding Amazon capital to the celebrity-political ecosystem of Los Angeles, Bezos strengthens his profile as more than a merchant-technologist, repositioning himself as an oligarch whose legitimacy straddles technology, governance, and cultural capital.

Functional Role: Bezos serves as both ballast and interface. Amazon acts as infrastructural glue—anchoring logistics, cloud services, and data architectures into the empire’s runtime. Bezos himself became a symbolic innovator, masking monopolistic consolidation behind entrepreneurial mythology. His presence in media, philanthropy, and space exploration reinforces the illusion of sovereign entrepreneurship while sustaining systemic narratives of meritocratic progress.

Conditional Boundaries: Amazon faces recurring antitrust probes, regulatory hearings, and geopolitical scrutiny. These serve not as existential threats but as leash-tugs—reminders of system supremacy. Bezos steps back as CEO, reappears as cultural emissary (e.g., Blue Origin), but remains within the permissible corridor of function. His Hollywood linkage via Sanchez, however, represents both opportunity and vulnerability: while it broadens his influence into narrative-making, it also exposes him to reputational management risks characteristic of celebrity politics. Unlike legacy dynasties, his social anchoring is recent, contingent, and subject to systemic tolerance.

b) Mark Zuckerberg – Tech Mogul, United States, Constructed Oligarch

Origin Mechanism: Zuckerberg’s Facebook began as a campus social-networking tool but scaled into global infrastructure through intelligence-adjacent capital pipelines. Early backing came via Accel Partners, whose key figures maintained close ties to In-Q-Tel–linked intermediaries and the broader post–Total Information Awareness (TIA) milieu. The company’s ability to expand without existential liability was scaffolded by state architecture—most critically Section 230 of the Communications Decency Act, which insulated Facebook from publisher accountability and allowed its growth as an unregulated communications utility.

Integration Pathway: What began as a peer-to-peer social site rapidly became a mass surveillance and perception-shaping platform, serving both commercial and state interests. Facebook’s algorithms became insertion tools for targeted advertising, electoral influence, and psychological operations testing. By the mid-2010s, its integration deepened:

- 2016 U.S. election cycle → reframed as a “disinformation battleground.”

- Formal partnerships with DHS, NATO, and the Pentagon → content moderation and narrative policing.

- Data exchange pacts with intelligence-linked firms → fusing private user data with state security architectures.

- COVID-19 pandemic → marked an unprecedented leap into overt governance: Facebook became a frontline censor, deploying shadow-banning, deplatforming, and content takedowns in coordination with the White House, CDC, and WHO. This cemented its role as not just a communications platform but a delegated enforcer of bio-political orthodoxy.

Meta’s pivot into VR, biometrics, and identity management extended this trajectory: moving from social media to the experimental domain of population governance through digital embodiment.

Functional Role: Zuckerberg himself is less sovereign entrepreneur than mask of infrastructural sovereignty. Branded as a quirky innovator or reluctant statesman, his persona humanises a platform that functions as soft power apparatus, digital identity manager, and narrative harmonisation engine. Meta thus operates not as a private company in competition, but as an interface where capital, military, and governance scripts converge.

Conditional Boundaries: Zuckerberg’s Congressional hearings, antitrust probes, and public scapegoating are ritualised performances of discipline—reminders of his position inside, not above, systemic logic. The 2021 rebranding from Facebook to Meta functioned as a narrative reset, preserving strategic function while diffusing accumulated scandal. His COVID-era censorship role showed the depth of his tethering: far from exercising sovereign discretion, he executed state-aligned mandates in real time. As ‘Stargate’ advances, Meta’s data universes are increasingly treated as reservoirs for population-scale training, extending Zuckerberg’s tether to sovereign AI architecture. He remains operational, but bound—a permitted oligarch, instrumental rather than autonomous.

c) Larry Ellison – Tech Mogul, United States, Constructed Oligarch

Origin Mechanism: Ellison co-founded Oracle in 1977, explicitly modeled on a CIA contract project (“Oracle”) to build relational databases for intelligence applications. His rise was never entrepreneurial independence but state-anchored procurement: Oracle’s fortunes tracked with DoD, NSA, and intelligence database contracts, positioning Ellison as a permanent fixture of U.S. digital infrastructure. His wealth, though vast, derived less from “market genius” than from being the private-sector face of state data architectures.

Integration Pathway: By the 1990s–2000s, Oracle had become the default data backbone of U.S. government and military institutions, embedding Ellison in national security logistics. His integration pathways included:

- CIA/DoD procurement → foundational contracts that seeded Oracle’s dominance.

- Fusion with Silicon Valley venture capital → tying Oracle’s architecture into the broader state–tech matrix.

- Direct political alignment → Ellison’s outspoken support for state surveillance, border control systems, and intelligence consolidation.

Ellison’s role in the 2025 ‘Stargate’ AI project—partnering Oracle with U.S. state strategy—confirms his company’s evolution from corporate vendor to sovereign infrastructure node.

The COVID-19 pandemic crystallised this trajectory: Oracle partnered with the U.S. government to create vaccine safety databases and real-time analytics systems. Ellison openly positioned Oracle as a national health surveillance utility, offering to unify fragmented state-level health data into a federalised, cloud-based system. This effectively extended Oracle from military-intelligence integration → biomedical governance infrastructure.

Functional Role: Ellison operates as a state database baron—the oligarchic mask for core government data integration. Unlike Zuckerberg (perception management) or Karp (operational analysis), Ellison’s role is hard substrate: ensuring that all data, from military procurement to pandemic surveillance, flows through architectures under Oracle’s control. His public persona—flamboyant billionaire, yacht collector, sports team owner—serves as misdirection, disguising Oracle’s function as backbone of state information control.

Conditional Boundaries: Ellison’s wealth and contracts insulate him from most market risks, but his autonomy is illusory. Oracle’s fortunes rise and fall with state procurement cycles, tethering Ellison to system needs. His COVID-era visibility—offering Oracle as a pan-pandemic database utility—illustrated this tethering: not sovereign initiative, but deployment as systemic instrument. Like Zuckerberg, Ellison undergoes periodic public scrutiny (antitrust, monopolisation charges), but these are symbolic leash-tugs, not existential threats. His function is too deeply wired into U.S. data architectures to allow removal.

d) Alex Karp – Predictive Governance, United States, Constructed Oligarch

Origin Mechanism: Palantir Technologies was founded in 2003, the same year Congress defunded DARPA’s Total Information Awareness (TIA) program. Rather than vanishing, the TIA architecture was reborn through Palantir, seeded by In-Q-Tel (the CIA’s venture arm) and Peter Thiel’s capital. Karp, a lawyer and philosopher by training, was elevated as CEO—his role less entrepreneurial than symbolic, functioning as the public-facing custodian of a post-TIA surveillance apparatus laundered into private form.

Integration Pathway: Palantir embedded itself directly into the security-military-intelligence complex. Its software (Gotham, Foundry) was adopted by:

- CIA, NSA, FBI, DoD → intelligence fusion and counterterrorism targeting.

- ICE, DHS, police networks → predictive policing, deportation logistics, domestic data fusion.

- NATO militaries and Ukraine (post-2022) → battlefield intelligence integration, live targeting, and war logistics.

- Israel/Gaza (2023–) → Palantir was deployed as part of Israel’s warfighting stack, reportedly enabling data fusion for target selection and operational planning in Gaza.

The COVID-19 pandemic marked Palantir’s expansion from counterterrorism to biopolitical governance. It won contracts to manage vaccine distribution, hospital capacity, and health data integration in the U.S. and UK, formalising its role as a population management utility.

Functional Role: Karp operates as the mask of predictive governance. While Thiel remains the ideological architect, Karp is positioned as the acceptable liberal-progressive face of a company whose true function is sovereign intelligence outsourcing. Palantir’s predictive analytics capacity is slated to integrate into ‘Stargate,’ positioning Karp’s firm as the intelligence fusion layer of this sovereign AI megastructure. His eccentric style (curly hair, philosophy rhetoric, outsider affect) disguises Palantir’s reality as an extension of the intelligence community. Palantir’s function is to provide the ruling stratum with real-time panoptic dashboards—decision scaffolds for war, policing, and crisis management.

Conditional Boundaries: Karp is untouchable in market terms: Palantir’s contracts are sovereign-backed, not consumer-dependent. Yet his autonomy is bounded—Palantir’s existence is contingent on alignment with national security imperatives. Criticism (civil liberties lawsuits, activist campaigns) never escalates into systemic risk, because Palantir is structurally too embedded to discipline. Its role in Israel’s targeted assassination and kill-chain operations in Gaza underscores this: even in the face of human rights criticism, Palantir remains shielded by sovereign need. Karp’s role, like Zuckerberg’s and Ellison’s, is that of a permitted oligarch—constructed as an interface, bound as an instrument.

Russian Oligarchs (1990s)

e) Boris Berezovsky – Media & Energy, Russia, Constructed Oligarch

Origin Mechanism: Berezovsky rose during Russia’s “shock therapy” phase, converting insider access into control of state assets. Through LogoVAZ (cars) and later Sibneft (with Roman Abramovich), he acquired oil stakes and leveraged them into media holdings such as ORT television. His wealth was not entrepreneurial but engineered through rigged privatisations, underwritten by IMF scripts and Western-aligned reformers.

Integration Pathway: By the mid-1990s, Berezovsky had embedded himself in the Yeltsin “Family”—funding the 1996 re-election campaign, securing a Security Council seat, and controlling media narratives. His media and capital flows helped mask the mass asset-stripping of the 1990s as “entrepreneurial modernity.” To the West, he was proof of liberal transition; to Russia, he symbolised the oligarchic seizure of the state.

Functional Role: Berezovsky functioned as a transitional broker, stabilising Western-aligned capital flows and legitimising Yeltsin’s collapsing regime. His role was to cloak systemic plunder in the language of reform, standing as the emblematic oligarch of the 1990s “rape of Russia.”

Conditional Boundaries: When Putin moved to reassert sovereign control, Berezovsky’s associations with Yeltsin-era corruption marked him as a traitor figure. His attacks on Putin—especially over the Kursk submarine disaster—accelerated his fall. Assets were stripped, media seized, and exile in London reduced him to a fugitive. His 2013 death, under contested circumstances, sealed his arc: from kingmaker to outcast. Berezovsky’s collapse illustrates the fragility of constructed oligarchs—tolerated while useful, discarded once they embody systemic betrayal.

f) Roman Abramovich – Energy & Sports, Russia/UK, Constructed Oligarch

Origin Mechanism: Born an orphan of Jewish-Latvian heritage, Abramovich began in petty trade before scaling into oil through 1990s voucher privatisation. His pivotal rise came via the acquisition of Sibneft, in partnership with Boris Berezovsky, during the IMF-scripted “loans-for-shares” era. Bought for a fraction of its value, the company later sold to Gazprom for $13 billion.

Integration Pathway: Abramovich was embedded first in the Yeltsin-era “Family,” living in the Kremlin under the sponsorship of Yeltsin’s daughter, and then reformatted under Putin into a “service oligarch.” Governorship of Chukotka (2000–2008) served as loyalty performance, with over $1 billion invested in the remote region. Abroad, his purchase of Chelsea FC turned him into an informal cultural ambassador—normalising Russian capital in Western circuits while keeping a low public profile.

Functional Role: Domestically, Abramovich embodied the re-discipline of oligarchs under Putin’s vertical: wealth tolerated so long as it was patriotic. Internationally, he was the face of Russian soft power, laundering the image of post-Soviet fortunes through football, philanthropy, and integration into London society.

Conditional Boundaries: Despite his low-key persona, his fortunes were contingent. Berezovsky fell, Abramovich adapted; but following the Ukraine invasion, Western sanctions stripped his assets, forced the Chelsea divestment, and froze global holdings. He briefly played mediator between Moscow and Kyiv, but his function inverted—from bridge to liability. For Putin, he remains serviceable; for the West, expendable.

Gulf Billionaires

f) Al Nahyan Family – Energy & Finance, United Arab Emirates, Constructed Oligarchs

Origin Mechanism: The Al Nahyan dynasty consolidated control over Abu Dhabi’s oil resources following British withdrawal and federation formation in the early 1970s. Wealth emerged not through entrepreneurship but through sovereign access to hydrocarbon rents, securitised under Western military protection and financial intermediation.

Integration Pathway: Oil revenues were recycled into global financial markets through the Abu Dhabi Investment Authority (ADIA), one of the world’s largest sovereign wealth funds. Western alignment was cemented through defence partnerships, asset purchases, and elite property holdings—embedding Gulf capital into Euro-American financial systems while masking its state origin under commercial operations. Beyond ADIA’s financial circuits, the Al Nahyan family has embraced global governance frameworks through partnerships with figures like Tony Blair—whose Institute has advised Abu Dhabi on governance modernisation—and through active participation in WEF platforms. Abu Dhabi’s ‘smart city’ projects, from Masdar to AI-driven surveillance grids, position the dynasty not just as oil landlords but as early adopters of post-carbon governance experiments.

Functional Role: The Al Nahyan family functions as a stabilising node for both imperial energy logistics and financial liquidity cycles. Through investments in finance, real estate, technology, and sport (e.g., Manchester City FC), they act as emissaries of post-national capital while laundering state-derived wealth into soft power. Their role exemplifies how rentier dynasties are converted into institutional actors within global capital governance—preserving Western leverage through the façade of Gulf agency. They function as a demonstration case of how rentier wealth can be reformatted into futurist legitimacy: sponsoring green tech, urban utopias, and mega-events while retaining autocratic control. The family thus embodies the fusion of resource rent, Western consultancy (Blair, McKinsey), and global governance branding (WEF, smart cities).

Conditional Boundaries: Their autonomy is tightly bounded: Gulf modernisation remains contingent on U.S. security guarantees and Western consultancy frameworks. Apparent futurism masks systemic dependency; deviations toward multipolarity trigger soft discipline through reputational campaigns, arms freezes, or finance gatekeeping. For all their wealth, the Al Nahyans operate as curated custodians of energy and finance, not sovereign architects.

g) Prince Alwaleed bin Talal – Finance & Media, Saudi Arabia, Constructed Oligarch

Origin Mechanism: Alwaleed’s fortune did not emerge through entrepreneurship but through dynastic position and petrodollar leverage. As grandson of both King Ibn Saud (founder of modern Saudi Arabia) and Riad El Solh (first Prime Minister of Lebanon), his lineage embodied Arab aristocracy fused with cosmopolitan legitimacy. Using capital flows recycled from oil surpluses after the 1973 oil shock, he launched Kingdom Holding Company in 1980. His early stake in Citicorp (1991)—$800 million during a liquidity crisis—turned into $10 billion by the mid-2000s, cementing him as a Gulf bridge into Western financial institutions.

Integration Pathway: Alwaleed translated Saudi oil rents into equity stakes across U.S. corporate icons—Apple, Citigroup, Twitter, Snap, Four Seasons Hotels—and into Arab cultural circuits through Rotana Media Group, the largest entertainment company in the Middle East. His positioning was not just commercial: it functioned as a diplomatic interface, binding Gulf capital to U.S. elites (Bush, Clinton families) and embedding him in Davos-class networks. His portfolio prefigured Gulf alignment with technology and media governance, later extended via investments in Musk’s xAI and other AI-linked platforms.

Functional Role: He was projected as a “moderniser” oligarch—an Arab liberal capitalist who could sit at Davos, back Silicon Valley, and own luxury assets while presenting Saudi wealth as globalised and progressive. His Rotana media empire and Western tech stakes positioned him as a narrative broker, softening authoritarian rentier origins through the optics of entrepreneurship and global integration.

Conditional Boundaries: In 2017, Alwaleed was detained during Crown Prince Mohammed bin Salman’s Ritz-Carlton purge. Released only after surrendering a portion of his assets, his role was recalibrated: not sovereign actor, but permitted vector of Vision 2030, with Kingdom Holding itself partially absorbed by the Saudi Public Investment Fund in 2022. His return to the Forbes billionaire list in 2025 signals reinstatement—but only as a curated extension of state capital. His arc demonstrates the systemic principle: wealth may be vast, but autonomy is illusory.

Constructed Outsiders (Western)

h) Mohamed Al-Fayed – Retail, Media, Political Influence, Egypt/UK, Hybrid Oligarch

Origin Mechanism: Al-Fayed’s ascent began with opportunistic business ventures in Egypt and Europe, culminating in his acquisition of Harrods in 1985 through a controversial and opaque financing arrangement reportedly backed by the Sultan of Brunei. His wealth was not inherited or organically accumulated but constructed through strategic deception, diplomatic manipulation, and aggressive self-promotion. Even his name was a fabrication: the addition of “Al” was a calculated attempt to confer aristocratic legitimacy and mask humble origins.

Integration Pathway: Al-Fayed embedded himself into British elite circuits via high-profile acquisitions (Harrods, Hôtel Ritz Paris), sponsorship of royal events (e.g., Windsor Horse Show), and political influence operations—including the infamous “cash-for-questions” scandal, where MPs were bribed to table parliamentary inquiries on his behalf. His media presence was amplified through litigation threats and selective philanthropy, while his son Dodi’s relationship with Princess Diana positioned him at the symbolic nexus of monarchy and scandal.

Functional Role: Al-Fayed functioned as a hybrid oligarch: retail magnate, media manipulator, and political provocateur. His persona blended outsider defiance with insider access, enabling him to both challenge and exploit the British establishment. Harrods operated not just as a commercial empire but as a soft power platform. His public accusations—including claims of MI6 involvement in Diana’s death—positioned him as a populist antagonist to elite secrecy. In this sense, his wealth and visibility masked a deeper function: destabilising and reframing elite consensus through spectacle and scandal.

Conditional Boundaries: Al-Fayed’s fall from grace was enacted as narrative erasure. Following his death in 2023, over 200 women came forward with allegations of sexual assault, triggering police investigations and a BBC exposé (Al-Fayed: Predator at Harrods). His legacy was reframed from eccentric mogul to systemic predator. Institutions that once tolerated or shielded him—royal circles, regulators, media outlets—pivoted to public condemnation. His posthumous erasure, timed with Charles’s ascent to the throne, marked not coincidence but narrative housekeeping—an outsider oligarch liquidated to protect sovereign continuity.

2. Opportunistic Oligarchs (Absorbed / Integrated)

Africa

i) Patrice Motsepe – Mining & Finance, South Africa, Opportunistic Oligarch

Origin Mechanism: Motsepe’s ascent emerged from South Africa’s transition from apartheid to neoliberal democracy. The son of a township shopkeeper serving mine workers, he became the first black partner at Bowman Gilfillan law firm in 1994. His breakthrough came through the Black Economic Empowerment (BEE) framework, which required 26% black ownership in mining companies. Motsepe acquired underperforming shafts from AngloGold in 1997, converting regulatory obligation into a dynastic launchpad. His rise was less entrepreneurial spontaneity than state-mediated elite formatting under IMF/World Bank pressure to redistribute without disrupting global mining continuity.

Integration Pathway: Motsepe consolidated through African Rainbow Minerals, later branching into finance with African Rainbow Capital and a major stake in Sanlam, South Africa’s insurance giant. His profile expanded beyond South Africa into global finance circuits: regular appearances at World Economic Forum and Milken Institute gatherings, positioning him as the archetypal African capitalist legible to Western elites. His 2013 pledge to the Gates/Buffett “Giving Pledge” further embedded him in transnational philanthropic governance. Domestically, his position was reinforced by family ties: he is brother-in-law to President Cyril Ramaphosa, binding capital and politics into the post-apartheid ruling compact.

Functional Role: Motsepe functions as a bridge actor: presenting mining extraction and finance accumulation as vehicles of post-colonial uplift. His ownership of Mamelodi Sundowns FC and election as President of the Confederation of African Football (2021) extended his profile into cultural and continental soft power. To global elites, he is packaged as a developmental moderniser—proof that neoliberal frameworks can manufacture African billionaires.

Conditional Boundaries: Despite prestige, Motsepe’s position remains fragile. His wealth is tethered to commodity cycles, regulatory shifts, and donor-state preferences. Unlike entrenched dynastic oligarchs (Rothschild, Rockefeller), he operates within a narrow conditional corridor: celebrated as long as he embodies Africa’s integration into global capital—but vulnerable to compression if politics or markets turn.

j) Mo Ibrahim – Telecoms & Governance, Sudan/UK, Opportunistic Oligarch

Origin Mechanism: Mo Ibrahim’s fortune originated in the 1990s with the founding of Celtel, a telecoms venture that capitalised on Africa’s regulatory vacuum during post-conflict reconstruction. His rise was facilitated by IMF/World Bank liberalisation programs and donor-driven infrastructure expansion, which dismantled state monopolies and opened space for private telecom investment. This was not entrepreneurial genius alone but opportunism structured within a donor-scripted transition to market-led development.

Integration Pathway: After selling Celtel for billions in 2005, Ibrahim shifted from capital accumulation to ideological infrastructure. Through the Ibrahim Index of African Governance and the Ibrahim Prize, he constructed metrics and incentives to shape elite behaviour across the continent. These tools mirrored World Bank governance indicators, embedding his Foundation within Bretton Woods surveillance logics. His alignment with the World Economic Forum and institutions like the Milken Institute elevated him as Africa’s “trusted reformer,” a proxy voice in global governance circuits.

Functional Role: Ibrahim operates less as a capital vector than as a governance narrative broker. His prize and index reframe African leadership in managerial terms, depoliticising structural dependency into performance metrics and donor validation. Positioned as a Sudanese success story, he provides the counter-image to his homeland’s fragmentation—projecting a narrative of “good governance” that legitimises external oversight while embedding African elites within donor-consensus frameworks.

Conditional Boundaries: His influence is highly contingent. Ibrahim’s legitimacy depends on alignment with World Bank governance doctrines and WEF investor narratives. Should his discourse deviate from these developmentalist scripts, support networks would contract. That he emerges from Sudan—a state shattered by war, sanctions, and Western regime-change interventions—underlines the paradox: his authority flourishes on the very instability global powers exploit, making him less sovereign actor than curated symbol of acceptable African governance.

Latin America

k) Carlos Slim – Telecoms & Infrastructure, Mexico, Opportunistic Oligarch

Origin Mechanism: Slim acquired Telmex—Mexico’s national telephone monopoly—during the 1990s neoliberal privatisation wave, enabled by IMF and World Bank structural adjustment pressures. The sale, underpriced and uncontested, converted a public utility into a private rent-extraction machine. His capital base was built atop institutional weakness and externally imposed liberalisation.

Integration Pathway: Slim’s business empire expanded across banking, retail, and construction, but remained anchored in state-concession logic. His alignment with U.S. capital flows—particularly Citigroup and infrastructure funds—secured his presence within cross-border investment circuits. His media holdings, including part of The New York Times, signalled symbolic integration into elite transatlantic discourse.

Functional Role: Slim functions as a stabiliser of post-NAFTA oligarchic architecture—anchoring domestic Mexican capital while interfacing with North Atlantic finance. He provides the appearance of Mexican entrepreneurial dynamism while reproducing dependency structures: telecom monopolies, infrastructural capture, and media containment. His wealth serves both as local ballast and as reassurance to global investors of “market rationality” in Latin America.

Conditional Boundaries: Slim has faced occasional antitrust scrutiny and regulatory rebuke, but none have fundamentally disrupted his holdings. These episodes function as performance discipline—preserving optics of oversight while leaving the extractive architecture untouched. His autonomy remains bounded by continued alignment with U.S. strategic and financial interests.

l) Traditional Landowning Families – Agribusiness & Real Estate, Brazil/Argentina, Opportunistic Oligarchs

Origin Mechanism: These dynasties trace wealth to colonial land grants, post-independence resource grabs, and military-aligned accumulation. The 20th century saw asset consolidation through state favoritism, debt amnesties, and export-oriented development regimes. Their position was entrenched before neoliberal reform, but amplified by World Bank agricultural liberalisation and IMF austerity cycles in the 1980s–90s.

Integration Pathway: Faced with globalisation pressures, these families absorbed donor frameworks and rebranded as agribusiness technocrats. They secured export dominance (soy, beef, sugar) via WTO-compliant regimes while offshoring capital and aligning with global finance. Engagements with climate and sustainability initiatives further embedded them in elite Western networks, converting legacy privilege into ESG-compatible capital.

Functional Role: Function as continuity anchors for oligarchic governance in the Southern Cone. Thro ugh land monopolies, commodity export power, and rural patronage systems, they stabilise extractive flows while performing integration with global trade architecture. They offer Western investors predictability—masking feudal land structures beneath greenwashed development optics. Domestically, they influence judiciary, legislature, and military protection.

Conditional Boundaries: Challenges emerge only when land reform, Indigenous claims, or global ESG pivots threaten extractive legitimacy. In such cases, families adapt narratives (e.g., regenerative agriculture) or channel philanthropic buffers. Structural autonomy remains intact, but subject to external narrative shifts and financial compliance filters.

3. Dynastic / Migratory Oligarchs (Hinge to Ruling Strata)

Historical Dynasties

m) Rothschild Family – Banking & Geopolitical Finance, Europe/Global, Dynastic Oligarchs

Origin Mechanism: The Rothschild dynasty originated in 18th-century Frankfurt banking, scaling rapidly through coordinated family branches across European capitals. Their rise was facilitated by sovereign debt issuance during the Napoleonic Wars—profiting from state fragility and military finance. Early central bank entanglements ensured structural leverage over post-feudal state formation.

Integration Pathway: By the 19th century, Rothschild branches became fixtures in European governance, underwriting infrastructure (e.g., railways), central banks, and war financing. While public-facing wealth declined relative to newer fortunes, their influence was institutionalised: advisory roles, foundation networks, and legacy holdings in energy, mining, and finance.

Crucially, dynastic intermarriages extended their reach—linking into European aristocracy (e.g., Borromeo, Guinness, Oppenheim, Warburg), into American dynasties through Rockefeller unions, and into UK financial aristocracy through the Goldsmith family. Sir James Goldsmith’s line married into Rothschild branches, binding City of London finance to the continental Rothschild net and consolidating a trans-Channel bloc within the wider European dynastic matrix.

The Rothschilds also developed a multi-branch structure across Europe:

- London (Nathaniel Rothschild): anchored City of London finance, the British treasury, and colonial projects.

- Paris (James Rothschild): dominated French banking, railways, and court politics.

- Vienna (Salomon Rothschild): embedded in Habsburg finance, rail, and mining.

- Naples (Carl Rothschild): tied into Bourbon state finance, later absorbed into Italian unification.

- Frankfurt (Amschel Rothschild): retained the original German hub.

This branch federation model allowed the dynasty to function as a continental network—diversified across states but coordinated by bloodline and shared financial logic. It meant the Rothschilds were not a single national oligarchy but a European infrastructure in themselves.

Beyond Europe, the Rothschilds were central to the Zionist project and the formation of Israel—financing land acquisition in Palestine, supporting the Balfour Declaration (1917), and underwriting infrastructure for the new state. Continued philanthropic and political support links the dynasty structurally to Israel’s economic and diplomatic architecture.

Functional Role: The Rothschilds operate as intergenerational stabilisers—translating dynastic finance into embedded governance. They serve as both memory archive and infrastructure layer of elite power: legacy trust networks, global investment pivots, and symbolic continuity. Their sponsorship of Israel functions as both ideological legacy and geopolitical anchor, binding European finance into the Middle Eastern state system. Their name functions less as capital brand than as cipher for supranational financial permanence within ruling stratum scaffolding.

Conditional Boundaries: Public visibility is carefully modulated. Modern Rothschild entities function through opaque private equity, family offices, and advisory channels. Formal “discipline” is structurally irrelevant—they have long transcended the oligarchic perimeter and operate within the architecture of sovereignty itself. Intermarriage ensures they are not merely a family but a nodal nexus in the dynastic latticework of global capital—linking aristocracy, continental banking, City of London finance, and the geopolitical project of Israel. Their branch system across Europe guaranteed not only continuity but redundancy: even when one hub declined, the dynasty endured through its networked structure.

n) Rockefeller Family – Energy, Finance, Philanthropy, United States, Dynastic Oligarchs

Origin Mechanism: The Rockefeller fortune was founded via Standard Oil’s consolidation of U.S. petroleum supply chains in the late 19th century, enabled by lax regulation, railroad monopolies, and permissive antitrust enforcement. The forced 1911 breakup served not as rupture but as proliferation—multiplying wealth across successor entities (e.g., Exxon, Chevron).

Integration Pathway: Post-breakup, the dynasty restructured through foundations (e.g., Rockefeller Foundation) and financial institutions (Chase Manhattan). These vehicles became instruments of strategic influence—shaping global health, agriculture, and international finance. The family helped establish the UN’s headquarters in New York and seeded global governance bodies. Their pivot from oil to philanthropy embedded them within elite epistemic networks. Intermarriages with Rothschild lines and other U.S. dynasties (Carnegie, Mellon) extended their role beyond American capitalism into the continuity of transatlantic finance aristocracy. In parallel, the Rockefellers were key backers of the Club of Rome, treating it as a laboratory for resource-governance frameworks and financial re-engineering projects. By underwriting the environmental/population narratives crystallised in Limits to Growth (1972), they positioned themselves not only as industrial barons turned philanthropists, but as architects of accumulation by regulation—embedding resource scarcity and planetary management into the logic of capital control.

The Rockefellers also developed a branch redundancy structure:

- Oil and Industry: Standard Oil spinoffs (Exxon, Chevron, Mobil) maintained global energy leverage.

- Finance: Chase Manhattan (later JPMorgan Chase) provided direct integration into Wall Street and transatlantic finance.

- Philanthropy: Rockefeller Foundation, Rockefeller Brothers Fund, and later spin-off institutions embedded influence into agriculture, health, education, and environmental governance.

- Diplomacy and Governance: sponsorship of the UN headquarters in New York, and alignment with internationalist bodies, locked them into the infrastructure of global rule-making.

This branching ensured continuity even as individual sectors (oil, banking) fluctuated, making the dynasty less vulnerable to rupture.

Functional Role: The Rockefellers functioned as architects of the liberal-globalist order. Their foundations influenced the Green Revolution, population control policy, and international public health architecture (e.g., WHO). Their banks financed postwar reconstruction and U.S. Cold War alignment. They are not merely legacy capital holders but systemic formatters—shaping ruling stratum infrastructure while displacing scrutiny onto newer oligarchs.

Conditional Boundaries: Their public visibility has receded, but operational influence persists through embedded institutions and dynastic alliances. They no longer require market-facing legitimacy: their capital is transubstantiated into foundation logic, policy inertia, and institutional architecture. Through intermarriage and institutional integration, they have become effectively sovereign-adjacent—absorbed into the system’s dynastic lattice, immune to ordinary discipline. Their Club of Rome entanglement demonstrates how dynasties can recast industrial extraction into governance over the very categories of “scarcity” and “sustainability.”

o) Agnelli Family – Industrial Capital & Governance, Italy/Europe, Dynastic Oligarchs

Origin Mechanism: The Agnelli dynasty was built on the founding of FIAT (1899), which became Italy’s dominant automotive and industrial conglomerate. Their rise was underwritten by close ties to the Italian state—providing vehicles for war, reconstruction, and mass consumption. State subsidies, protective regulation, and integration with political elites secured their capital base.

Integration Pathway: By the mid-20th century, the Agnellis became Italy’s de facto industrial aristocracy. Their holdings expanded into insurance (INA), media (La Stampa), and international finance, while serving as conduits for transatlantic capital alignment (e.g., through partnerships with Rockefeller-linked banks and American corporate networks). Crucially, dynastic intermarriages—particularly with the Borromeo family, one of Italy’s oldest aristocratic Catholic lineages—linked the Agnellis directly into European nobility and Vatican circles. In parallel, the Agnellis were key patrons of the Club of Rome, underwriting its early projects (including the landmark Limits to Growth report, 1972) and embedding themselves in the architecture of global governance experimentation around energy, environment, and population control. These ties provided both legitimacy and insulation, binding industrial wealth to centuries-old feudal authority while projecting influence into emergent global governance frameworks.

Like the Rothschilds and Rockefellers, the Agnellis also pursued a branch redundancy strategy:

- Industry: FIAT (later Stellantis) as Italy’s automotive backbone and NATO-aligned industrial anchor.

- Finance: Exor holding company, consolidating international assets in insurance, automotive, and media.

- Media: La Stampa and other outlets as narrative-control levers.

- Philanthropy & Governance: Fondazione Agnelli, which funded educational and futurist projects and intersected with the Club of Rome.

- Dynastic Alliances: marriages into Borromeo and other aristocratic Catholic families, linking industrial wealth to Vatican and European nobility.

This branching ensured the dynasty’s survival even amid Italy’s political volatility and the decline of FIAT’s domestic dominance.

Functional Role: The Agnellis operated as Italy’s gatekeepers to global capital, ensuring domestic industry aligned with NATO and EU frameworks while preserving their dynastic position. Their media and philanthropic vehicles helped steer public discourse, while FIAT itself served as industrial ballast within Italy’s fragile postwar economy. They are less an entrepreneurial dynasty than a nodal bridge between Vatican, aristocracy, Atlantic finance, and futurist governance bodies such as the Club of Rome.

Conditional Boundaries:

Their visibility has declined in the 21st century, with much of the dynasty’s wealth consolidated under Exor, a global holding company with stakes in automotive, media, and finance. Yet intermarriage into aristocracy and integration into Catholic–European networks ensures continuity. Like the Rockefellers and Rothschilds, the Agnellis are no longer constrained by market risk: their dynasty has been woven into institutional permanence, insulated from discipline by their hybrid anchoring across industry, nobility, church, and global governance institutions.

Contemporary Asset Managers

p) George Soros – Finance & Ideological Infrastructure, United States/Eastern Europe, Dynastic Oligarch

Origin Mechanism: Soros built his fortune through speculative finance, particularly currency and bond markets. His Quantum Fund leveraged global volatility—most famously during the 1992 British pound crisis. His rise was facilitated by post-Bretton Woods deregulation, IMF conditionalities, and increasing permeability between capital flows and policy shifts.

The “Black Wednesday” episode (1992), in which Soros shorted the pound and “broke the Bank of England,” epitomises this trajectory. While portrayed as a lone speculator’s triumph, the event in fact revealed how oligarchic actors profit within permitted systemic crises. Soros walked away unscathed, his reputation enhanced, while the British state absorbed the damage. The outcome dovetailed with broader integration pressures of the Maastricht Treaty era, pushing Britain deeper into European monetary frameworks. Soros’s windfall thus served not as rebellion against sovereignty, but as a profitable alignment with structural re-engineering already in motion.

Integration Pathway: By the 1990s, Soros transitioned into ideological sponsorship via the Open Society Foundations. These became insertion tools into post-communist Eastern Europe, shaping civil society, legal reforms, and media ecosystems. His apparatus was embedded in U.S.-aligned regime change strategies—functioning in tandem with State Department, USAID, and Atlanticist NGOs.

Crucially, Soros’s dynastic embedding accelerated through the marriages of his children, linking the Soros line into entrenched New York financial aristocracy. Most notably, connections with the Schiff family—historic Jewish-American banking elites tied to Kuhn, Loeb & Co.—integrated Soros’s opportunistic fortune into established dynastic lattices. This was not just social assimilation but structural anchoring: ensuring that OSF’s ideological apparatus was backed by legacy Jewish-American finance networks with continuity beyond Soros’s personal fortune.

Functional Role: Soros acts as a vector for epistemic governance: funding activist networks, academic chairs, and judicial reform in alignment with liberal-globalist orthodoxy. His function is not merely philanthropic—it is programmatic. His name serves both as symbol and interface: projecting humanitarian liberalism while structuring elite narrative harmonisation in transitional zones. He does not replace sovereignty; he formats it.

Conditional Boundaries: Soros has been cast alternately as liberal savior and geopolitical threat—depending on narrative vector. Yet despite vilification (especially in nationalist regimes), his infrastructure persists. His personal brand may be targeted, but the OSF network remains embedded. Moreover, through dynastic intermarriage into Schiff and allied New York families, his position is stabilised: no longer reliant on personal charisma or speculative wealth, but folded into the continuity of legacy finance elites. He occupies a hinge position: not fully Ruling Stratum, but architecturally necessary to it.

q) Larry Fink / BlackRock – Asset Management & Policy Engineering, United States/Global, Dynastic Oligarch (Institutionalized Vector)

Origin Mechanism: Fink built BlackRock from a risk analytics niche into the world’s largest asset manager, managing over $10 trillion. Its rise was not market-spontaneous but structurally enabled by the post-2008 financial regime: central bank interventions, deregulated passive investment flows, and sovereign debt monetisation all channelled capital through BlackRock's infrastructure.

Integration Pathway: BlackRock functions as an institutional ligament between private capital and state authority. Fink was invited to advise the U.S. Treasury during both the 2008 crisis and COVID-era economic responses. BlackRock’s Aladdin platform manages financial surveillance and risk analytics for both governments and private entities—becoming de facto sovereign infrastructure without formal mandate.

Functional Role: Fink embodies the post-democratic governance model: unelected but architecturally decisive. BlackRock shapes ESG scoring regimes, pension fund flows, and regulatory guidance, effectively legislating through capital allocation. It acts as a shadow policy instrument—enforcing elite consensus via investment standards and climate compliance metrics. Fink is not a capitalist; he is a compliance engineer for capital governance.

Conditional Boundaries: There is no meaningful disciplinary apparatus above BlackRock—only symbolic scrutiny or short-term political theatre. But its legitimacy is tethered to alignment with central bank orthodoxy and global policy narratives (e.g., climate, equity). Should its ESG regime collapse or strategic misalignment occur, containment would come not via prosecution, but liquidity withdrawal and reputational firewalling.

4. Hybrid Oligarchs (Masks of Governance)

Philanthro-Capitalists

r) Bill & Melinda Gates Foundation – Health, Agriculture, Education, United States/Global, Hybrid Oligarch

Origin Mechanism: The Gates fortune, originating in Microsoft’s monopolistic software empire, was shielded and consolidated under U.S. antitrust exceptionalism. Wealth preservation was achieved via foundation conversion—shifting capital from taxable corporate gains to tax-exempt philanthropic control under 501(c)(3) protection.

Integration Pathway: The Gates Foundation rapidly became a para-sovereign entity in global health, aligning with WHO, Gavi, and World Bank directives. It embedded into global governance via donor–partner compacts, influencing vaccine distribution, agricultural development (e.g., AGRA), and educational policy through technocratic “solutionism.” The foundation operates as an epistemic override for state-led policy.

Functional Role: Functions as a governance proxy—substituting sovereign accountability with philanthropic direction. It translates private wealth into regulatory influence, data regimes, and health agendas without electoral mandate. Gates’ public persona—a benevolent technocrat—masks deep institutional capture: procurement, science funding, and policy guidance are routed through a private foundation posing as neutral expert infrastructure.

Conditional Boundaries: Occasional backlash (e.g., vaccine nationalism, education reform failures) prompts narrative recalibration, not structural rollback. The foundation's scale grants it untouchable status within donor logic. Gates may absorb reputational damage, but the architecture remains invulnerable—functioning as a distributed ruling proxy beneath the philanthropic surface.

s) Chan Zuckerberg Initiative – Education, Tech, Biomedicine, United States, Hybrid Oligarch

Origin Mechanism: The CZI was launched through the rechanneling of Facebook-derived equity into an LLC-structured philanthropic vehicle—legally distinct from a traditional foundation. This allows political lobbying, private investment, and grant-making under one umbrella, effectively blending market and governance prerogatives.

Integration Pathway: CZI inserts itself into educational platforms, biomedical research (e.g., Biohub), and criminal justice reform, operating in tandem with state entities while maintaining private control. Its interface with DARPA-adjacent research and data infrastructure places it inside U.S. governance logic—particularly in predictive health and surveillance applications.

Functional Role: Functions as a camouflage node—where corporate intent is masked as civic innovation. Zuckerberg’s role is dual: regulator-facing CEO and philanthropic front. CZI allows Meta to expand policy influence without direct accountability, offering a soft front for harder infrastructure (e.g., AI, content moderation, identity verification).

Conditional Boundaries: Public scrutiny has triggered occasional transparency campaigns, but the LLC structure immunises CZI from traditional philanthropic disclosure. Its legitimacy depends on alignment with liberal-progressive optics and U.S. national innovation strategy. Its autonomy is wide—but functionally fused to broader institutional trajectories.

t) Patrick Soon-Shiong – Biotech, Media, Health Infrastructure, South Africa/United States, Hybrid Oligarch

Origin Mechanism: Soon-Shiong’s capital base was built through oncology patents and the sale of pharmaceutical firms (Abraxis, APP Pharmaceuticals). He leveraged biotech wealth into infrastructure ventures (NantWorks, NantHealth), benefiting from state-backed research pipelines and the U.S. healthcare system’s tolerance for monopoly pricing. His ascent was embedded in the biotech–venture nexus of the 1990s–2000s.

Integration Pathway: His fortune was translated into two vectors of influence:

- Biomedical Infrastructure: precision medicine, immunotherapy, and data-driven platforms, often in proximity to government-adjacent projects.

- Narrative Infrastructure: acquisition of the Los Angeles Times and San Diego Union-Tribune, ensuring a platform for shaping health and science discourse.

These moves positioned him at the crossroads of medical sovereignty and media framing.

Functional Role: Soon-Shiong performs as the doctor–entrepreneur hybrid: a physician framed as innovator and philanthropist, while structuring biotech, health data, and media channels into governance levers. His persona confers legitimacy on biomedical policy while advancing private capital logics. His dual role allows him to package U.S. biomedical expansion as both humanitarian progress and inevitable innovation.

Conditional Boundaries: Soon-Shiong’s positioning carries risks unusual for hybrid oligarchs. His fortune and media control grant him leverage, yet his ventures have been repeatedly destabilised through lawsuits, leadership revolts, and editorial disputes. More critically, his public theories—such as linking the COVID-19 pandemic and vaccines to a rise in “terrifyingly aggressive” cancers—place him in a vulnerable position against biomedical orthodoxy. These claims expose him to reputational attack and institutional marginalisation, not through direct censorship but through litigation, narrative framing, and operational turbulence. His physician–philanthropist status offers temporary cover, but it is fragile: the more his claims deviate from consensus, the more precarious his standing within the system becomes.

Vision Moguls

u) Elon Musk – Aerospace, EVs, AI, United States/Global, Hybrid Oligarch

Origin Mechanism: Musk’s origins were less self-made than mythologised. Born into a South African family with mining ties during apartheid, his early trajectory was cushioned by resource-derived privilege and transnational access to capital. His first major venture, X.com, merged into what became PayPal, where he was ousted as CEO before the company’s real breakthroughs. His subsequent fortunes derived from leverage, not invention: Tesla was founded by others (Eberhard, Tarpenning), SpaceX’s breakthroughs came from engineers like Tom Mueller, and SolarCity was launched by his cousins. What Musk created was not technology but persona—an “eccentric innovator” mask that naturalised state-backed infrastructural projects as private entrepreneurial brilliance.

Integration Pathway: Musk’s companies are tethered to U.S. sovereign architecture:

- SpaceX: sustained by NASA and Pentagon contracts, providing launch capacity and orbital dominance.

- Tesla: propped up by environmental credits, subsidies, and global EV mandates.

- Twitter/X: leveraged as a release valve for MAGA and anti-establishment discourse after the Trump break-up, even as it bleeds profitability.

- Starlink: deployed as dual-use civilian/military infrastructure, notably in Ukraine and Gaza.

His associations with Trump-era America, and subsequent alignment with Pentagon contracts, highlight his function as a controlled “outsider”—channeling populist energy while remaining bound to state imperatives.

Functional Role: Musk’s role is myth-vector and release valve. He sells the story of frontier innovation, anti-elite defiance, and sovereign autonomy, while in practice operationalising core state functions: orbital logistics, electric mobility, digital speech governance, and AI containment. His performative chaos—tweets, antics, celebrity romances—distracts from his deeper role as licensed mask of infrastructural sovereignty.

Conditional Boundaries: Despite his aura of invulnerability, Musk’s autonomy is staged. Tesla remains precarious without subsidies and global mandates; X (Twitter) is structurally unprofitable; Neuralink faces regulatory risk. His leash is visible in recurring SEC probes, Pentagon discipline, and market “corrections” that periodically remind him of dependency. Musk did not invent the systems he fronts—he invented the mythology of the inventor. His survival depends on sustaining this myth while delivering state-aligned infrastructure under its cover.

v) Jack Ma – E-Commerce, Fintech, Education, China/Global, Hybrid Oligarch

Origin Mechanism: Jack Ma founded Alibaba in 1999 at the height of China’s state-curated “opening” strategy. His ascent was not spontaneous entrepreneurial genius but a structured product of CPC policy: preferential regulation, restricted foreign competition, and cheap capital seeded under WTO accession. Ant Group later extended this into fintech—embedding Ma at the nexus of consumer credit, data flows, and state-managed digital sovereignty.

Integration Pathway: By the 2010s, Alibaba and Ant became dual instruments: a commercial juggernaut for domestic consumption and a geopolitical soft-power symbol for foreign investors. Alibaba’s listings in Hong Kong and New York attracted global capital, while Ant positioned China at the cutting edge of digital payments. Ma himself became a curated global icon—speaking at Davos, lecturing at Harvard and HKU, and appearing on Bloomberg’s billionaire index—an exportable “China success story.” Yet this prominence was always contingent on CPC tolerance. His ventures operated as semi-private masks for the Party-state’s techno-industrial strategy.

Functional Role: Ma functioned as an ideological decoy: the charismatic billionaire embodying the myth of individual entrepreneurialism in a one-party system. His persona—teacher turned visionary—gave a human face to systemic industrial planning, attracting foreign trust and softening authoritarian optics. Through philanthropy (education, rural development) and high-profile global speeches, he played the role of emissary, selling China’s controlled capitalism as modernisation.

Conditional Boundaries: In 2020, after Ma publicly criticised regulators, his Ant IPO was blocked and he was swiftly disappeared from public life. Reappearances have been staged and muted—an unmistakable demonstration of sovereign supremacy. His companies survived, but his autonomy was erased. Ma remains one of the clearest examples of hybrid oligarchs: elevated to global stardom, then abruptly disciplined when his persona threatened the state’s primacy. His trajectory proves that in China, innovation is leased from sovereignty—not owned.

Closing Note

This addendum reinforces the structural core of the main text: the Oligarchic Class is not composed of sovereign agents, but of formatted nodes of capital—curated, deployed, and disciplined within systemic logics they do not control. Their ascent is never spontaneous or exceptional; it is orchestrated, permitted, and bounded by the deeper architecture of power described in Part 9 and further exemplified in Addendum 2.

Across all categories—Constructed, Opportunistic, Dynastic, and Hybrid—the same sequence recurs: origin through structural opportunity, integration into capital–state feedback loops, deployment for legitimacy or ballast, and conditionality through alignment, discipline, or erasure.

The origin mechanisms reveal a consistent pattern: fortunes emerge not from entrepreneurial genius, but from scaffolding—CIA-seeded tech contracts (Ellison, Karp), regulatory shields (Zuckerberg), sovereign oil rents (Al Nahyan, Alwaleed), or fire-sale privatizations (Berezovsky, Abramovich, Slim). Even figures mythologised as innovators or philanthropists—Gates, Musk—were advanced by monopoly law indulgence, subsidies, or public R&D pipelines. The myth of the “self-made” dissolves under scrutiny; what remains is curated ascent.

Integration consolidates this role. Oligarchs are absorbed not just by wealth, but by alignment with sovereign or transnational governance: finance (ADIA, BlackRock), media (Bezos, Alwaleed), philanthropy (Gates, Soros), and partnerships with NATO, WHO, or the World Economic Forum. Extractive origins are rebranded as ESG, smart cities, or global health—turning rentier wealth into legitimacy assets.

Functionally, oligarchs act as ballast, mask, and interface. Ellison maintains hard-state data flows; Karp translates intelligence into predictive governance; Bezos fuses logistics and media; Soros brokers ideological consensus. Their personas—visionary, eccentric, benevolent—are not incidental but instrumental. They humanize systemic power, making elite consensus appear organic or inevitable.

Yet boundaries remain sharp. Jack Ma’s disappearance, Alwaleed’s Ritz-Carlton detention, and Zuckerberg’s ritualised hearings all demonstrate that vast wealth does not equal autonomy. Some are discarded—Berezovsky, Al-Fayed, Abramovich. Others, like the Rockefellers and Rothschilds, are so embedded in institutional and dynastic lattices that removal is unnecessary; their power is infrastructural, operating beneath visibility and beyond discipline. The spectrum runs from expendable proxies to permanent fixtures.

These case studies show that oligarchs are not sovereign rulers, but formatted instruments. Their fortunes are tethers, their visibility a performance. They appear indispensable in narrative but are structurally disposable in practice.

The question is no longer who gets rich—but who decides what wealth is allowed to do, and what must remain untouched.

Published via Journeys by the Styx.

Overlords: Mapping the operators of reality and rule.

—

Author’s Note

Produced using the Geopolitika analysis system—an integrated framework for structural interrogation, elite systems mapping, and narrative deconstruction.