The Operators: Addendum 3a. Sovereign Financial Governor Cases Studies

Financial Governor Case Studies

Financial governors present as guardians of “stability,” yet their runtime is access, eligibility, and price. This addendum isolates sovereign actors—central bankers, treasury enforcers, and collapse managers—whose levers operate through flags, ministries, and official seals. They appear doctrinal, but their artefacts are technical: circulars, haircuts, XML lists.

The Operators Part 3 shows how capital rails, lists, and risk weights turn policy into access control. Addendum 3a tracks these sovereign governors, showing how they format doctrine, survival, and sabotage through the instruments of central banking. At the close, we cross into Addendum 3b—where infrastructure, vendors, and clearers enforce the same modalities without state ornament.

Index of Case Studies:

- Ben Bernanke – Fed balance-sheet governor

- Agustín Carstens – BIS Basel weight-setter

- Christine Lagarde – ECB collateral engineer

- Jerome Powell – Fed dollar window operator

- Juan C. Zarate – Sanctions Architect

- Janet Yellen – Sanctions Custodian

- Elvira Nabiullina – Russian sanction-era survivalist

- Calixto Ortega Sánchez – Venezuelan monetary theatre

Category A. Central Bank Technocrats

The technocrat is not an ideologue—he is a plumber whose spreadsheets harden into doctrine. Balance sheets, repo rates, collateral lists: these are presented as technical matters, yet they decide the survival of markets and governments. Central banks style themselves as “independent,” but their artefacts are system law—eligibility memos and liquidity windows that become the template for global behaviour.

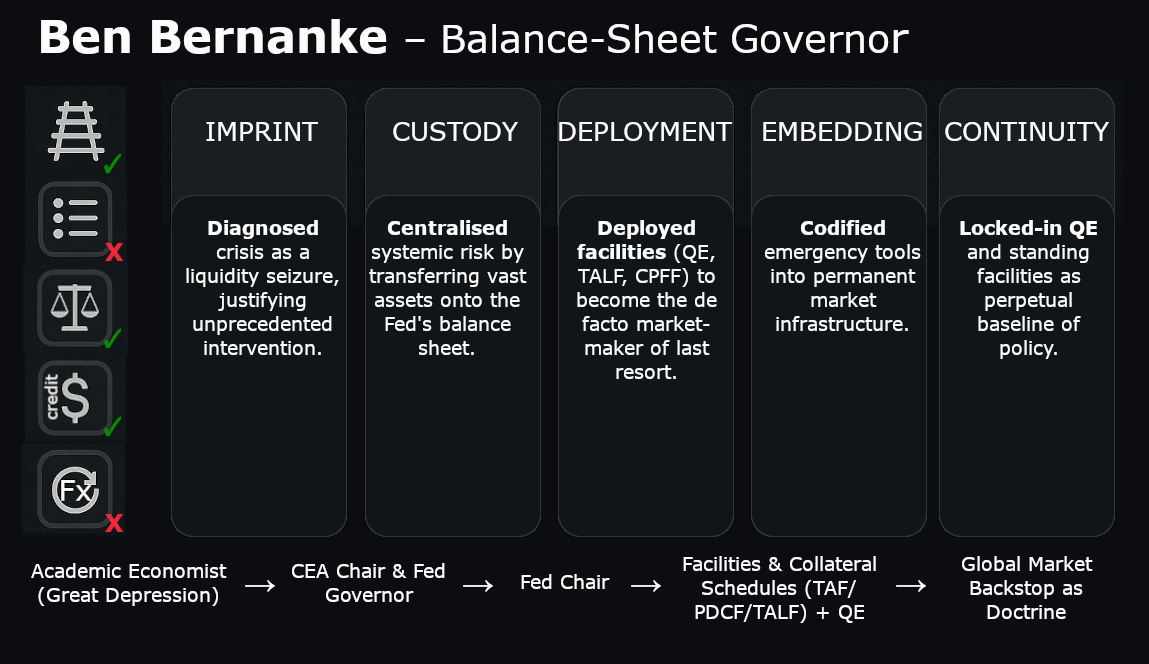

1. Ben Bernanke – Balance-Sheet Governor

Operator Class: Central Bank Technocrat

Runtime Function: Collateral and liquidity facilities transformed into systemic doctrine

Format Migration: Academia → Federal Reserve Governor → Fed Chair → global doctrinal reference

Imprinting Phase—Academic Capital

Bernanke’s ascent was not through Wall Street apprenticeship but academic reputation. His work on the Great Depression—particularly the role of bank failures and liquidity collapse—positioned him as an authority on crisis causation. That scholarship became his political capital, a credential that could be redeployed into policymaking. The imprint here was intellectual: authority derived not from trading or deal-making but from models, charts, and historical analogies.

This origin mattered. When crisis hit in 2008, Bernanke was not improvising; he was applying a model in which liquidity supply was the cure for systemic breakdown. His imprinting phase fixed the operator function: stabilise through balance-sheet expansion and collateral policy.

Custodian Phase—Liquidity Engineering (2006–2014)

Elevated to Fed Chair in 2005/6, Bernanke’s custodianship coincided almost exactly with the global financial crisis. The operator artefacts that followed were not speeches but circulars:

- TAF (Term Auction Facility), PDCF (Primary Dealer Credit Facility), TALF (Term Asset-Backed Securities Loan Facility)—alphabet soup facilities that set new eligibility, collateral rules, and rate structures. TAF

- QE (Quantitative Easing)—systemic balance-sheet expansion, embedding the idea that central banks could buy across asset classes to stabilise yields. QE1‑2008, QE1‑2009

These were procedural documents—terms of operation, collateral matrices, haircut schedules. Yet they re-coded the entire global market. What entered Fed repo or QE became de-risked; what did not was left to burn. The Weight was reset by spreadsheet.

Bernanke presented this as temporary scaffolding, but the facilities mutated into doctrine. By 2010, QE was global default—copied by Bank of England, ECB, Bank of Japan. The operator function was transmission: a technical artefact at the Fed became international precedent.

Redeployment Phase—Doctrinal Export

When Bernanke stepped down in 2014, his role shifted from facility architect to doctrinal reference. His post-Fed career—Brookings Institution, speeches, advisory roles—was not just retirement. It was the recycling of operator capital. QE was no longer experimental but orthodoxy, and Bernanke became its custodian in the academic-policy circuit.

His Nobel Prize in 2022 consolidated this redeployment. The award did not celebrate a book but a doctrine—liquidity as salvation, balance-sheet expansion as legitimate. Bernanke’s operator capital was thus converted into canon, accessible for future redeployments.

Embedding Phase—Network Continuity

Bernanke’s embed was not familial but institutional. His colleagues—Paulson at Treasury, Geithner at NY Fed, later Yellen as successor—formed a guild of crisis operators. Their careers interlocked, each reinforcing the other’s choices. This guild effect meant Bernanke’s artefacts persisted even as he left the Fed: QE became Yellen’s inheritance, Powell’s normality, Lagarde’s copybook.

Embedding also worked through markets. Once asset managers, banks, and funds adapted to QE-shaped rails, rollback was politically impossible. The guild was not just policymakers but balance sheets globally.

Collapse / Continuity Phase—From Shock to Default

Crisis might have discredited him, yet Bernanke’s credibility only grew. The Fed’s role as market backstop became permanent, despite political opposition. The artefacts—repo eligibility, swap-line terms, QE templates—became model defaults. Even critics accepted them as permanent baseline.

This continuity reveals the operator function: not to solve the crisis, but to normalise the cure. Liquidity facilities became global orthodoxy; the debate shifted to scale, not existence.

Official Rationale: Mandate is price stability and maximum employment; restoring market functioning is prerequisite to both. Facilities and large-scale asset purchases provide liquidity against good collateral, anchor term premia, and prevent a deflationary spiral after private intermediation seized up.

Takeaway Synthesis

Bernanke exemplifies the Central Bank Technocrat. His function was not invention but redeployment: academic theory translated into balance-sheet artefacts, then normalised as doctrine. The receipts are circulars and facility terms, not Nobel lectures. Where orthodox histories frame him as “saving the system,” operator analysis shows something sharper. Bernanke’s artefacts became the law of global finance, enforced not by debate but by liquidity windows. What was once emergency scaffolding calcified into permanent architecture. His career is thus less about the man than the migration: academic model → facility circular → doctrinal export. The function persists long after his tenure—the Weight re-set, the Rail expanded, the List re-written. Bernanke is remembered for speeches, but his true legacy is the spreadsheet.

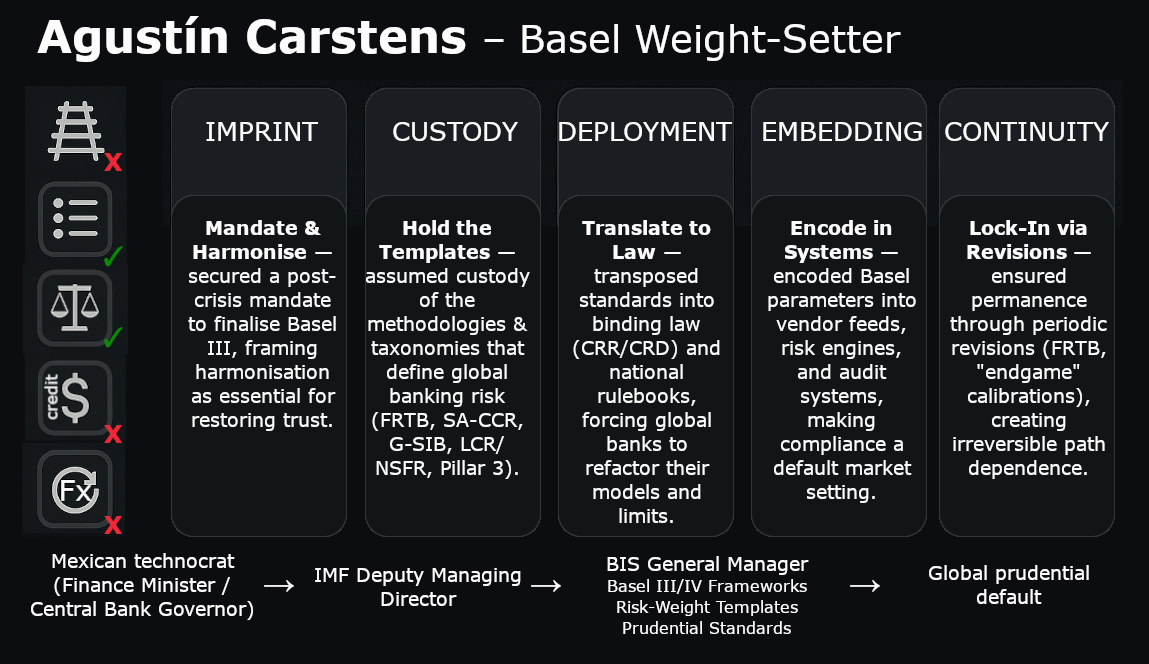

2. Agustín Carstens—Basel Weight-Setter

Operator Class: Standards Governor

Runtime Function: Codified global risk weights and capital ratios through Basel structures

Format Migration: Mexican central banking → IMF → BIS General Manager

Imprinting Phase—Mexican Technocrat

Carstens entered the system through Mexico’s Ministry of Finance and Banco de México, trained as an economist at Chicago. His early imprint was managing crises in a debt-troubled, inflation-prone economy—cutting his teeth on IMF programmes in the 1980s–90s. The lesson was orthodox: stabilisation required discipline in capital, credit, and reserves. This became his portable credential.

When he rose to Finance Minister in the mid-2000s, Carstens was already a familiar figure to IMF and G20 peers. His operator capital was not celebrity but technocratic reliability—a safe pair of hands who could execute conditionality. That imprint carried him into global governance.

Custodian Phase—Basel Doctrine

Appointed General Manager of the Bank for International Settlements in 2017, Carstens became custodian of the Basel process at its most consequential stage: Basel III implementation and the design of Basel IV refinements.

Here, the artefacts were not speeches but consultation papers, capital adequacy templates, leverage ratio definitions, and risk-weight schedules. These artefacts determined how much credit banks could extend, what counted as “safe,” and how much capital had to be parked against exposures.

- Basel III/IV Standards: codified global leverage ratios, liquidity coverage ratios (LCR), and net stable funding ratios (NSFR). B3-FINAL-2017, B3-D424

- Risk-Weight Revisions: adjusted credit risk models, limiting banks’ freedom to game capital through internal models. MRISK-2016-D352, MRISK-2019-D457, MRISK-DISC-2019, MRISK-DISC-2021

- Implementation Metrics: Carstens’ BIS oversaw compliance reports, peer reviews, and timelines that forced convergence.

This was not abstract governance—it reset the terms of global banking. Whether a corporate loan was “safe,” whether a sovereign bond carried zero weight, whether securitisations could be held at all—all were dictated by Basel artefacts.

Carstens’ function was doctrinal: not national firefighting like Bernanke, but standardised law.

Redeployment Phase—BIS Platform

Carstens’ redeployment extended beyond Basel. As BIS GM, he amplified the institution’s role in digital currency experiments (Project Helvetia, mCBDC Bridge) and payments interoperability. But these were downstream extensions. His core function remained Weight-setting—embedding Basel standards into every jurisdiction through technical consensus.

Like Bernanke’s QE, Carstens’ Basel weights travelled. Regulators in Europe, Asia, and the Americas copied the templates, because markets demanded it. A Mexican technocrat thus became global architect of banking capital.

Embedding Phase—G20 and IMF Guilds

Carstens’ authority was sustained through guild embed. His years at the IMF and G20 Finance Ministers’ meetings created a network of counterparts. At the BIS, he convened central bank governors quarterly in Basel—not to debate, but to agree.

The guild effect ensured continuity: Basel standards were binding not because parliaments voted them, but because supervisors and bankers adapted to them. Market infrastructure (rating agencies, CCPs, vendor software) absorbed the new rules, making rollback impractical. Carstens’ personal authority mattered less than the institutional lock-in he orchestrated.

Collapse / Continuity Phase—Basel as Default

Basel standards were controversial—critics charged them with pro-cyclicality, favouritism toward sovereign debt, and suffocating smaller banks. Yet under Carstens, the process persisted. Crises did not delegitimise Basel; they intensified its hold. Banks, chastened by 2008, could not resist the consensus.

Continuity here means global doctrine. Bernanke’s facilities were copied by peers; Carstens’ weights were enforced by compliance systems. Both mutated from crisis tools into permanent architecture.

Official Rationale: Our mandate is global financial stability: finalising Basel III closes regulatory arbitrage and restores trust by strengthening risk-sensitive capital and liquidity and improving resolvability. G-SIB surcharges, SA-CCR, and market-risk (FRTB) reforms better capture true exposures, while Pillar 3 disclosures provide transparency for market discipline. Phase-ins and proportionality ensure implementation is orderly and avoids cliff effects, preserving credit flow to the real economy.

Takeaway Synthesis

Carstens exemplifies the Standards Governor: an operator whose artefacts are not liquidity windows but templates. He set the global Weight—the ratios that govern capital, credit, and liquidity. His trajectory shows how doctrine migrates: Mexican technocrat → IMF custodian → BIS lawgiver. Unlike Bernanke, Carstens did not fight a single fire. He wrote the rulebook that decides whether fires spread.

The receipts are Basel consultation papers, leverage schedules, peer review reports. These are not glamorous, but they control more credit than any speech. The Basel Committee is framed as consensus, but in practice it is codification. Carstens’ career proves the point: Weight is global law when markets internalise it, and governors enforce it through templates, not parliaments.

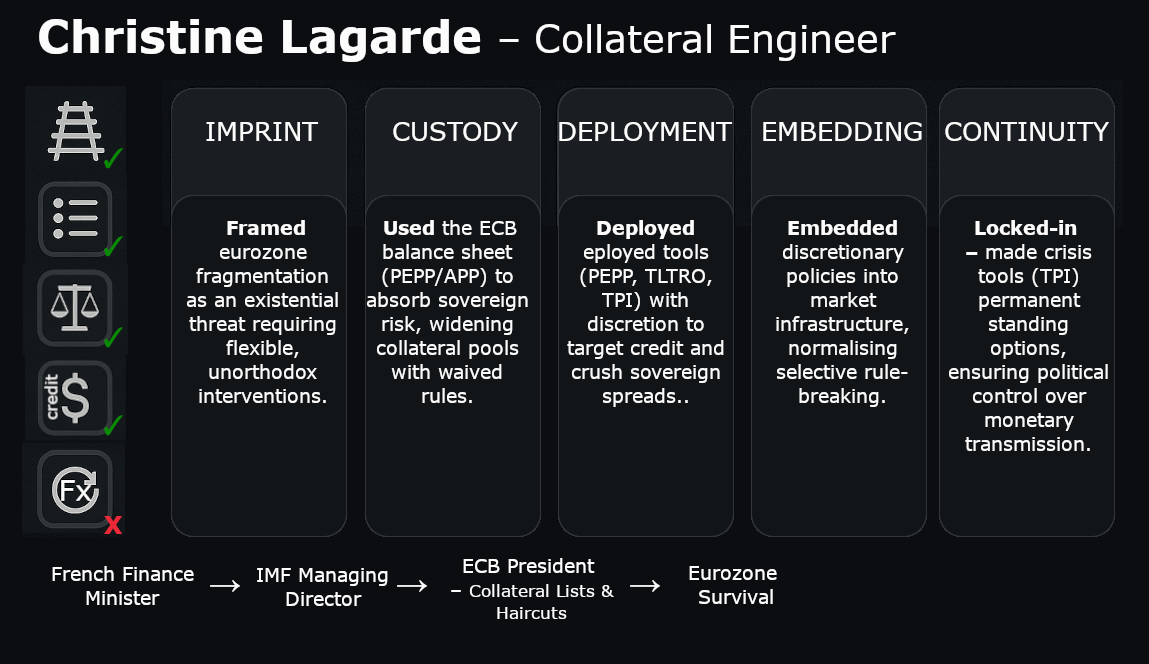

3. Christine Lagarde—Collateral Engineer

Operator Class: Eurozone Rail Governor

Runtime Function: Structured the eligibility lists and haircut schedules that decide which assets clear through the euro system

Format Migration: National politics → IMF → ECB President

Imprinting Phase—Political Fixer

Lagarde entered the system through law and politics rather than central banking. Trained as a lawyer, she rose through Baker & McKenzie before entering the French government under Chirac. Her imprint came during crises: as Finance Minister (2007–2011), she navigated the global financial collapse from the French side, helping manage Eurozone bailouts and sovereign debt negotiations.

Here the operator capital was not technical wizardry but political mediation under stress. She was tested not in doctrine but in aligning French and EU positions when Greek debt threatened contagion. That performance—absorbing contradiction between austerity demands and survival politics—established her as a trusted custodian.

Custodian Phase—IMF Mediator (2011–2019)

At the IMF, Lagarde became custodian of legitimacy for global crisis management. Her function was not to design facilities (that fell to staff and U.S. Treasury), but to sell them as “stability.” She balanced creditor demands with debtor survival, translating structural adjustment into humanitarian necessity.

The IMF phase sharpened her role as legitimacy broker. She was the face of Eurozone rescue packages and post-crisis reforms, managing optics while technical staff enforced conditionality. That visibility made her portable—she embodied IMF doctrine in political and media registers.

Redeployment Phase—ECB Collateral Engineer (2019–present)

Appointed ECB President in 2019, Lagarde entered a role traditionally dominated by central bankers. But her function was distinct: she was not a monetary theorist but a rail operator, governing the collateral framework that underpins the euro system.

The artefacts here are lists and matrices:

- Eligibility lists—which sovereign and corporate bonds qualify for refinancing.

- Haircut schedules—how much value is shaved off when collateral is pledged.

- Temporary easing regimes—collateral relaxations during COVID (accepting “fallen angels” downgraded below investment grade).

These lists are not technical side notes—they are the gates through which liquidity flows. When Greek or Italian bonds were at risk of exclusion, Lagarde’s ECB adjusted the lists. That discretion made her the engineer of euro rails: she determined which sovereigns stayed inside the system.

Unlike Bernanke’s facilities or Carstens’ Basel templates, Lagarde’s artefacts are collateral lists updated in ECB circulars. They are the invisible infrastructure of survival for Eurozone governments.

Embedding Phase—Franco-European Guild

Lagarde’s embed lies in the European guild. Her movement from French politics to IMF to ECB represents the recycling of elite trust. She is not a technocrat but a broker-class operator, embedded through networks that reward loyalty to Euro-Atlantic consensus.

Her authority derives from guild acceptance: German policymakers tolerate her because she mediates rather than invents; peripheral states accept her because she relaxes collateral rules in crisis. Her function is continuity: keeping the euro system stitched together by adjusting lists at the seams.

Collapse / Continuity Phase—From Crisis to Climate

The COVID shock extended her operator function. Under Lagarde, the ECB launched the €750B Pandemic Emergency Purchase Programme (PEPP) on 24 March 2020 and expanded collateral eligibility 4 June 2020. By admitting “fallen angels” and non-standard collateral (April 2020, Sept 2021), she preserved sovereign funding. In October 2022, the ECB recalibrated in the third series of targeted longer-term refinancing operations (TLTRO III) to ensure consistency with broader monetary policy normalisation process.

Continuity then shifted to climate: Lagarde began steering ECB collateral frameworks toward “green” eligibility, embedding climate policy into refinancing (Jan 2024, Sept 2025). Again, the artefacts are lists and schedules—which assets qualify, at what haircut. Governance by eligibility, extended from crisis to policy agenda.

Official Rationale: Price stability requires area-wide transmission; fragmentation is a policy bug, not a market feature. Flexible purchases and collateral adjustments preserve the single monetary policy and prevent self-fulfilling runs in specific sovereign curves.

Takeaway Synthesis

Lagarde exemplifies the Rail Governor. She does not design new doctrines (like Bernanke) or global standards (like Carstens). She controls lists: what assets count, how they are valued, whether they keep a sovereign alive.

Her career shows the portability of legitimacy capital. Political survival in French crises → IMF mediation of global bailouts → ECB discretion over collateral rails. Each redeployment recycled her credibility.

The receipts are not speeches or Nobel Prizes, but ECB lists and haircut matrices. These documents quietly decide whether Greece, Italy, or corporate borrowers remain solvent. Lagarde’s function is engineering the rails—maintaining access by adjusting lists.

Her case shows how the euro system survives not through ideology but through eligibility: collateral rules that appear technical, yet decide sovereignty. In that sense, Lagarde’s governance is less about vision than valves. She engineers the rail, and in doing so she keeps the system alive.

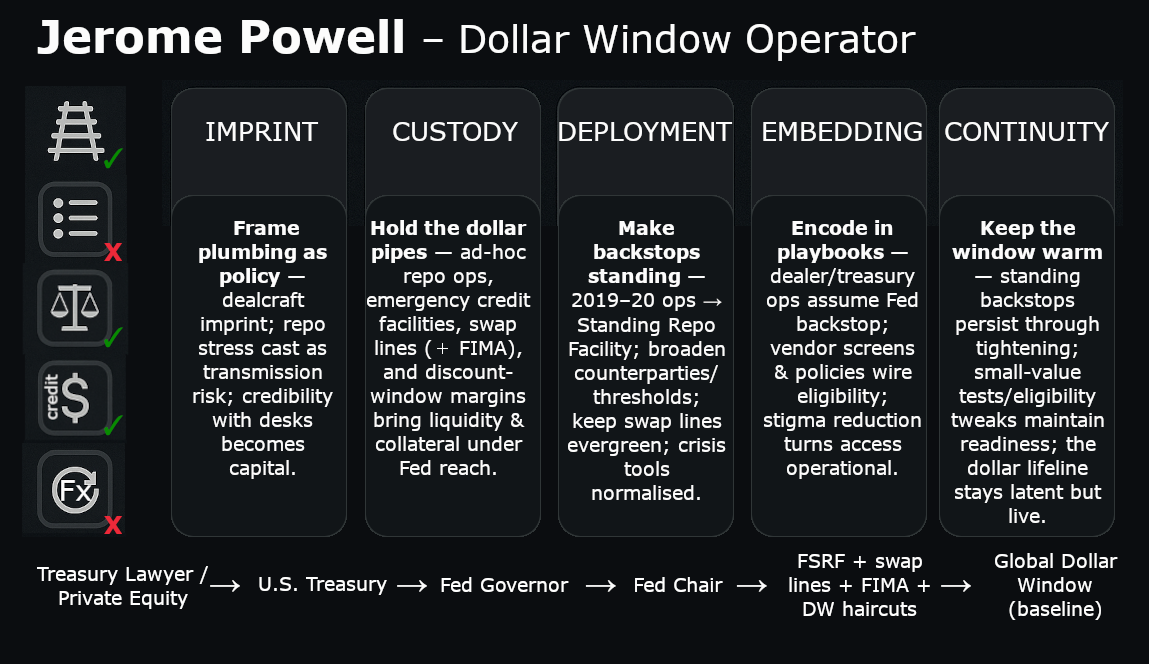

4. Jerome Powell—Dollar Window Operator

Operator Class: Liquidity Governor

Runtime Function: Preserved global dollar access through swap lines and emergency facilities

Format Migration: Law and private equity → U.S. Treasury → Federal Reserve Chair

Imprinting Phase—Private Capital to Public Finance

Powell grew up in Maryland and attended elite schools, earning a law degree from Georgetown University. He began his career in law and investment banking at Dillon, Read & Co. After the firm's chairman became Treasury secretary, Powell followed him to the U.S. Treasury in 1990, serving as an assistant secretary and later an undersecretary. His background was not in academic theory but in practical deal-making across public and private finance. After the Bush presidency, he returned to finance, spending eight years as a partner at the Carlyle Group, a private equity firm. This experience shaped his operator logic: not doctrine-driven, but transactional. In 2012, President Barack Obama appointed him to the Federal Reserve Board of Governors, where he had developed a reputation as a consensus builder. His capital was his credibility with markets—he spoke their language. This carried forward when he became Fed Chair in 2018.

Custodian Phase—Liquidity as Policy (2018–2022)

Powell’s custodianship was defined by shocks: COVID-19, repo market seizures, inflation spikes. His operator artefacts were facilities and swap lines:

- Standing Repo Facility (2019–21): provided permanent backstop for Treasury markets. Sept–Dec 2019 term repo ops (17 Sep 2019, 23 Sep 2019, 11 Oct 2019) and July 2021 SRF established.

- COVID emergency facilities: corporate credit facilities (PMCCF, SMCCF), municipal liquidity facility, Main Street lending program. Each expanded the Fed’s eligible counterparties and collateral.

- Dollar Swap Lines: extended to 14 central banks, reactivated in March 2020 to calm global dollar shortage.

These tools were continuations of Bernanke’s alphabet soup, but Powell institutionalised them. By turning ad hoc facilities into standing programs, he re-coded liquidity as baseline governance.

The runtime function: Powell kept the dollar window open. Markets understood that no matter the stress, dollars would flow through swap lines and repo facilities. That assurance stabilised the global system.

Redeployment Phase—Normalising the Extraordinary

Powell’s redeployment has been the normalisation of crisis tools. Under his watch, QE continued, repo support became standing, swap lines remained evergreen. What had been extraordinary scaffolding under Bernanke became baseline under Powell.

This redeployment is not about invention—it is about institutionalising liquidity backstops. By repeating interventions during COVID and then tapering slowly, Powell reinforced market conviction: the Fed is the counterparty of last resort.

Embedding Phase—Transatlantic Dollar Guild

Powell’s embed lies in the global dollar guild. Swap lines tied the Fed to the ECB, Bank of Japan, Bank of England, SNB, and others. These lines are not charity but governance—they preserve the dollar’s role as global settlement currency.

The guild effect is systemic: foreign central banks are locked into the dollar by the lifeline of swap lines. Powell’s stewardship reinforced this architecture, embedding the Fed as global liquidity hub. Markets, in turn, price assets as if the dollar backstop is permanent.

Collapse / Continuity Phase—Inflation Challenge (2021–present)

The inflation spike of 2021–22 tested Powell’s function. Critics expected retreat from liquidity and aggressive tightening. Yet even as rates rose, Powell left the backstops in place. Facilities persisted; swap lines were untouched.

Continuity here is the point. Powell preserved the liquidity architecture even while adjusting rates. The artefacts—standing repo, swap lines, credit facilities—survived intact. They are no longer emergency scaffolding but structural features.

Official Rationale: Ensure smooth monetary policy transmission and repo market functioning; backstop only to the extent needed to prevent disorderly conditions. Standing facilities reduce tail risk, support liquidity in stress, and stabilise expectations without dictating private risk-taking.

Takeaway Synthesis

Powell exemplifies the Liquidity Governor. His operator function is keeping the dollar window open. He did not invent QE (Bernanke) or set global capital weights (Carstens) or engineer collateral lists (Lagarde). His distinctive move was to institutionalise liquidity access through standing facilities and global swap lines.

His career shows the migration of crisis tools into baseline law. What Bernanke framed as temporary scaffolding became permanent architecture under Powell. The receipts are facility announcements, swap-line agreements, repo operations—documents that look technical but decide survival for banks and sovereigns worldwide.

Powell’s case confirms the continuity of operator logic: the Fed as global sovereign of liquidity. His runtime is not debate but reassurance—the knowledge that the dollar window will not close. In that sense, Powell is less a theorist than a plumber. He keeps the taps open, and the system survives.

Category A. Synthesis: Central Bank Technocrats

The technocrats do not campaign or theorise—they govern through artefacts. Bernanke’s facilities, Carstens’ Basel weights, Lagarde’s collateral lists, Powell’s dollar windows: each is a technical document masquerading as neutral process. Yet these artefacts reset global law.

Bernanke’s alphabet soup turned liquidity provision into orthodoxy. Carstens codified capital ratios into binding templates that dictated credit worldwide. Lagarde engineered access through eligibility lists, quietly deciding whether sovereigns lived or died. Powell institutionalised swap lines and repo windows, making dollar liquidity permanent infrastructure.

Their profiles differ—scholar, standards-setter, political broker, market lawyer—but the runtime converges. Each controls one modality of finance: Weight (Carstens), Rail (Lagarde), List (Bernanke), Flow (Powell). Their legitimacy comes not from votes but from technical circulars.

The synthesis is continuity: what began as emergency scaffolding becomes doctrine. Facilities mutate into standards, standards embed into rails, rails expand into permanent liquidity. The technocrats are remembered for speeches, but their true legacy is the spreadsheet, the methodology, the eligibility list.

Central banking presents itself as neutral guardianship, yet its governors operate as lawgivers in disguise—enacting sovereignty through artefacts that leave no room for debate.

Category B. Sanctions Enforcers

Treasury enforcers weaponise eligibility lists. Sanctions are sold as foreign policy, but in practice they are XML feeds cascading through compliance software. Section 311 designations, OFAC bulletins—these turn law into machine-readable exclusion. The sanctioner is neither judge nor jury; he is a list administrator.

Here, power lies in propagation speed. The feed updates, banks de-risk, accounts freeze. Runtime sovereignty is the lag between designation and exclusion.

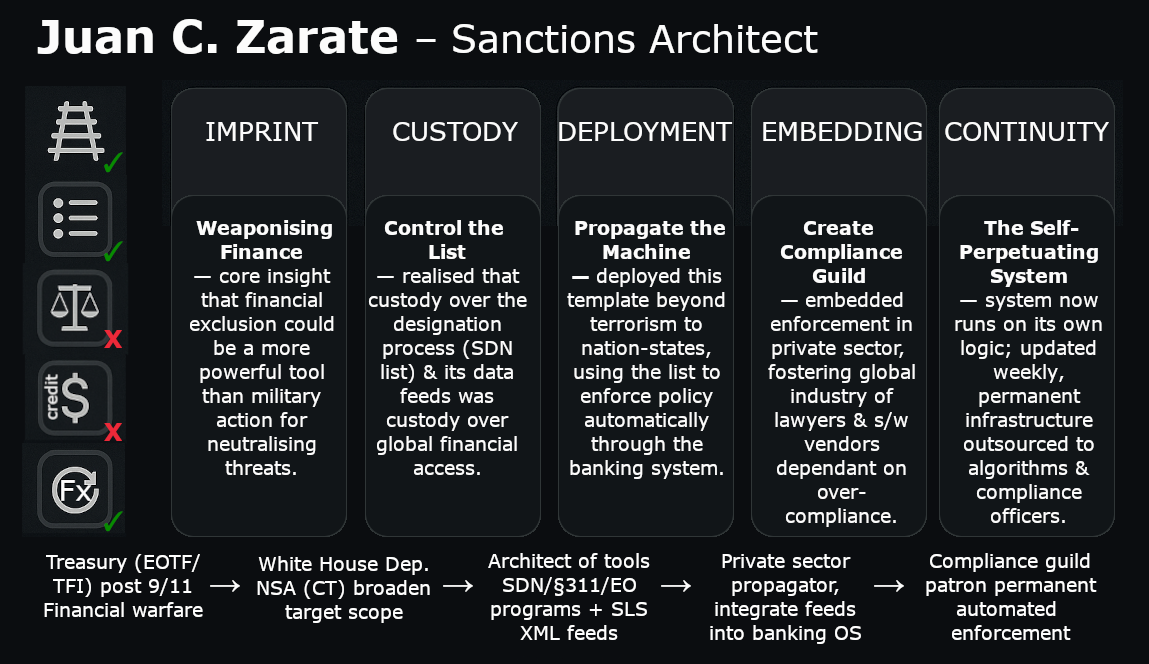

5. Juan C. Zarate—Sanctions Architect

Operator Class: Sanctions Enforcer

Runtime Function: Translated U.S. foreign policy into machine-readable exclusion lists

Format Migration: Treasury official → White House counterterrorism adviser → financial-compliance architect

Imprinting Phase—Counterterror Finance

Zarate entered the Treasury during the George W. Bush administration, where his imprint was the post-9/11 financial war on terror—inside the Executive Office for Terrorist Financing and Financial Crimes and later the Office of Terrorism and Financial Intelligence (TFI). His portfolio was not macroeconomic management but the hunt for illicit funding channels. He helped craft Section 311 of the USA PATRIOT Act—empowering Treasury to label foreign banks as “primary money laundering concerns.”

This imprint fixed the operator function: policy translated into targeted financial exclusion. No court ruling, no debate—designation itself triggered market exile.

Custodian Phase—Deputy National Security Adviser (2005–2009)

Elevated into the White House as Deputy National Security Adviser for Counterterrorism, Zarate extended the sanctions template beyond terror. Rogue states, proliferators, and eventually geopolitical rivals were routed into the same exclusion machinery. The runtime artefacts were OFAC designations, FinCEN advisories, and XML/“Sanctions List Service” feed updates to the SDN list.

His custodianship was not to invent law but to enforce it through propagation. Banks did not need to read statutes—they needed to update compliance systems. Treasury circulars were the receipts; de-risking was the outcome.

Redeployment Phase—Private Propagation

After leaving government, Zarate redeployed into the private sector: advising financial institutions, compliance software providers, and consultancies. His role was to propagate the sanctions machine globally.

- Consulted for firms on integrating OFAC and FinCEN feeds.

- Promoted “financial integrity” standards that embedded U.S. lists into international banking.

- Sat on boards and think tanks shaping policy on illicit finance.

Redeployment here meant enforcement by diffusion. Even outside Treasury, Zarate ensured that U.S. sanctions logic remained global default.

Embedding Phase—Guild of Compliance

Zarate’s embed lies in the compliance guild. The class of lawyers, auditors, and risk officers that sprang up post-9/11 enforces sanctions more aggressively than regulators demand, because liability and reputational risk incentivise over-compliance.

His writings and board roles sustain that guild. Treasury’s War (2013) codified the sanctions narrative, framing financial exclusion as America’s new asymmetric weapon. The book became both history and manual, reinforcing guild identity.

Continuity Phase—Sanctions as Permanent Infrastructure

What began as counterterror finance became permanent governance. Zarate’s machinery now governs Russia, Iran, Venezuela, and beyond. SDN entries are updated weekly; Sanctions List Service feeds refresh automatically. Banks freeze accounts not after legal argument but upon receipt of new list entries. The system persists across administrations, Republican or Democrat. Zarate’s operator legacy is structural: exclusion lists as sovereign runtime.

Official Rationale: Protect the U.S. financial system and national security by depriving terrorists, proliferators, and criminal networks of access to money and the dollar. Use targeted designations, special measures, and compliance standards to isolate high-risk actors while preserving legitimate flows. OFAC

Takeaway Synthesis

Zarate exemplifies the Sanctions Enforcer. His operator artefacts are not speeches but designations—names in a database. Those names, once listed, vanish from the financial system.

His career shows the mutation of sanctions from episodic tools to continuous runtime governance. Counterterror finance became great-power weaponry; compliance software became sovereign law. The receipts are OFAC lists and FinCEN advisories, propagated through Refinitiv feeds and bank screening engines.

Zarate’s legacy is not ideological—it is technical. The runtime is the lag between list update and account freeze. Sovereignty here is exclusion by spreadsheet, enforcement outsourced to compliance officers and vendor software. His operator function demonstrates how law collapses into data: foreign policy becomes XML.

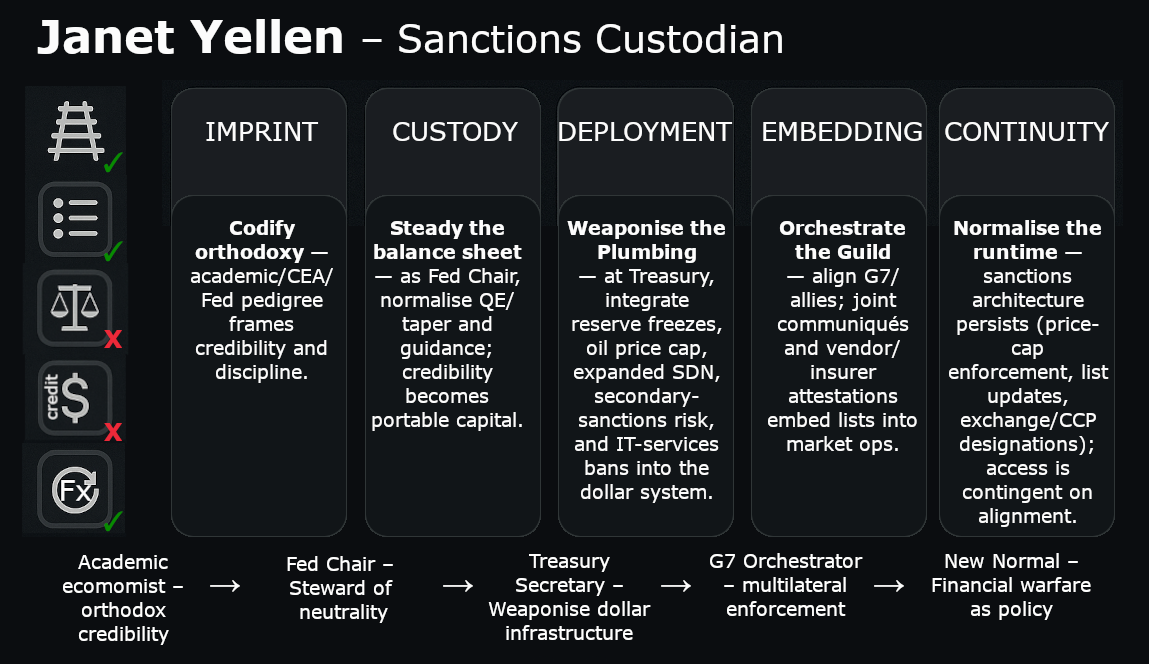

6. Janet Yellen—Sanctions Custodian

Operator Class: Sanctions Enforcer (Macro-Layer)

Runtime Function: Integrated Treasury sanctions with dollar liquidity and global reserve management

Format Migration: Academic economist → Fed Chair → U.S. Treasury Secretary

Imprinting Phase—Academic Discipline

Janet Yellen’s early career was defined by academic achievement. She earned a Ph.D. in economics from Yale University in 1971 and began her career as an assistant professor at Harvard University. She joined the faculty of the University of California, Berkeley, in 1980 and held endowed chairs. Her rise through Berkeley (from 1980), the Federal Reserve Board of Governors (1994–1997), and Bill Clinton’s Council of Economic Advisers (1997–1999) cast her as a doctrinal economist—cautious, incremental, committed to mainstream Keynesian analysis. This base credential made her portable. As she moved from academia to the Fed and then to Treasury, her authority derived not from charisma but from guild orthodoxy—the economist as neutral custodian.

Custodian Phase—Fed Chair (2014–2018)

Yellen was sworn in as Chair of the Board of Governors of the Fed on 3 February 2014, with her tenure being framed as continuity with Bernanke: cautious QE tapering, data-dependent rate moves. Yet the artefacts here were not innovation but discipline—the message that liquidity support would not become inflationary chaos.

Her imprint at the Fed confirmed her reputation as the steady hand—credible precisely because she embodied caution. That credibility became her currency for redeployment.

Redeployment Phase—Treasury Secretary (2021–present)

At Treasury, Yellen’s role shifted from balance-sheet manager to sanctions custodian. She presided over the most aggressive financial war in modern history: sanctions on Russia following its 2022 invasion of Ukraine.

Here the artefacts were not interest rates but joint Treasury–OFAC directives:

- Freezing Russian reserves in G7-aligned jurisdictions.

- Price caps on Russian oil enforced through maritime insurance and dollar clearing.

- Expansion of SDN (Specially Designated Nationals) lists to thousands of entities.

Yellen’s function was to integrate these exclusions into the plumbing of dollar finance. Under her watch, the dollar was not just reserve asset but sanction instrument. In June 2024, Treasury designated MOEX/NCC/NSD, expanded secondary-sanctions risk to cover all E.O. 14024 designees, and issued a new E.O. 14071 determination restricting key IT and cloud services to Russia—locking in Yellen’s shift from balance-sheet steward to infrastructural sanctions operator.

Embedding Phase—G7 Guild Enforcement

Yellen embedded sanctions within the G7 guild. Unlike Zarate (lists propagated by compliance software), her role was orchestration at state level—aligning European, Japanese, and British authorities with Washington’s sanctions.

This embed was institutional: G7 communiqués, Financial Stability Board coordination, joint announcements. Yellen’s authority ensured compliance across allies—a distributed enforcement system without a single sovereign vote.

Continuity Phase—Sanctions Normalised

Under Yellen, financial war became baseline. Russia’s exclusion from SWIFT, asset freezes, and oil price caps were extraordinary—yet they persisted as default. Banks, insurers, and traders adapted; compliance systems absorbed the changes. On 23 Oct 2024, Yellen said the U.S. will join the G7 to deliver a $50 billion loan to Ukraine—including a $20 billion U.S. tranche—repaid from windfall proceeds on immobilized Russian sovereign assets, signaling resolve to shift war costs onto Russia while tightening sanctions and sustaining the oil price cap.

The continuity is structural: once reserves are frozen and payment rails excluded, reversal is almost impossible. Yellen’s tenure ensures that reserve currency now equals coercive currency—access contingent on alignment.

Official Rationale: Protect U.S. and allied security while preserving market stability: coordinate with the G7 to immobilise aggressor assets, apply a price cap to constrain revenue without spiking energy markets, expand targeted designations and secondary-sanctions risk to close evasion channels, and use clear guidance and phase-ins so compliance can be swift, predictable, and minimally disruptive to legitimate flows.

Takeaway Synthesis

Yellen operationalised the dollar not just as reserve asset but as a coercive lever—turning a “neutral” system into conditional access. She didn’t invent the toolkit; she scaled it: reserve freezes, the oil price cap, and G7-runtime coordination that weaponized market plumbing. Her Fed-bred orthodoxy supplied cover to normalize extraordinary acts and make reversal unlikely. The receipts aren’t papers but sanctions directives, joint communiqués, and price-cap guidance—orthodoxy repurposed to sell rupture as continuity.

Category B. Synthesis: Sanctions Enforcers

Sanctions governance operates through lists, not laws. Zarate built the machine: Section 311 designations, OFAC feeds, FinCEN advisories. Yellen scaled it: freezing Russian reserves, imposing oil price caps, aligning G7 payment rails. Their functions differ, but the runtime converges.

Zarate’s innovation was procedural—convert foreign policy into machine-readable exclusion. Once a name was tagged, banks’ compliance engines did the work. Sovereignty was enforced by XML, propagated through risk software and de-risking culture.

Yellen’s function was orchestration. Her Treasury role embedded sanctions into the G7 guild, weaponising reserves and insurance as rails of exclusion. Orthodoxy was recycled into rupture: the steady hand of a former Fed chair normalised acts that would once have been unthinkable.

Together they show sanctions governance as runtime law. Not ideology, but propagation speed; not debate, but default settings. The feed updates, the market responds, accounts are frozen. The artefacts are designations, directives, and price-cap circulars—receipts of a sovereignty enforced not through parliaments but through databases.

Category C. Sovereignty Last-Resort Governors

Where doctrine fails, central banks become regime scaffolds. These governors preside not over orthodoxy but collapse—their artefacts are redenominations, crypto tokens, selective capital controls. Their role is not to preserve credibility but to extend survival, often by sacrificing the system itself.

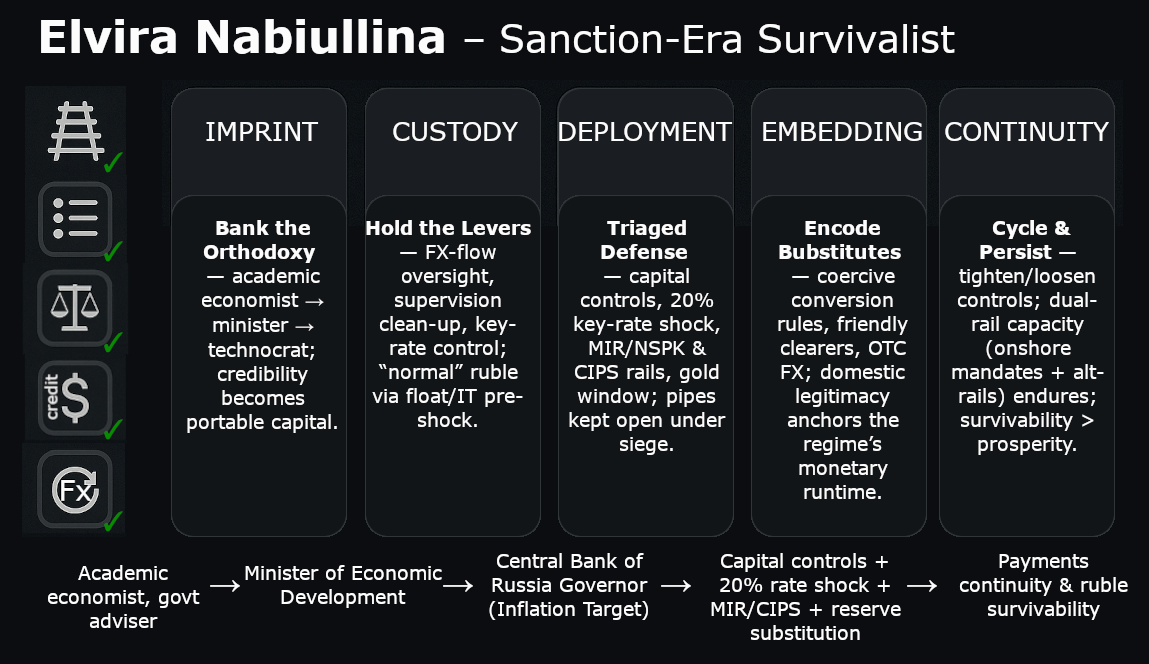

7. Elvira Nabiullina—Sanction-Era Survivalist

Operator Class: Sovereignty Last-Resort Governor

Runtime Function: Preserved Russian monetary sovereignty under sanctions through substitution, controls, and ruble formatting

Format Migration: Academic economist → Government minister → Central Bank of Russia governor

Imprinting Phase—Domestic Orthodoxy

Nabiullina entered through orthodox channels: trained as an economist at Moscow State University, she worked in think tanks before joining government service in the 1990s. Her imprint came as an adviser to Prime Minister Yegor Gaidar during Russia’s early market transition, where exposure to crisis management fixed her operator instinct—survival through adjustment, not ideology.

As Minister of Economic Development (2008–2012), she built a reputation for technocratic stability—orthodoxy that later became usable capital when sanctions ruptured access to those same norms. This period marked her as a technocrat, cautious and orthodox, aligned with global economic norms. That orthodoxy would later become currency—recycled when sanctions ruptured Russia’s access to those norms.

Custodian Phase—Central Bank Governor (2013–2021)

Appointed Governor in 2013, she pushed inflation targeting and a floating ruble regime, and modernised supervision—closing insolvent banks and consolidating the system. The artefacts matched ECB/Fed look-and-feel: circulars on the key rate, capital standards, and resolution playbooks. Her legitimacy lay in this very mimicry: she projected Russia as a “normal” monetary system. Foreign investors trusted her as a technocrat; domestically, she was respected for stabilisation after the 2014 oil-price shock and Crimea sanctions.

Redeployment Phase—Sanctions Shock (2022–present)

The February 2022 invasion triggered reserve immobilisation and SWIFT ejects for key banks; dollar/euro pipes narrowed. Nabiullina’s response was immediate and mechanical:

- Capital controls: mandatory sale of exporters’ FX receipts (Decree No. 79; later modulated) and CBR liquidity/FX measures to keep pipes open.

- Rate shock therapy: emergency key rate to 20% and public defence of the move.

- Parallel rails: acceleration of domestic cards via MIR/NSPK and RMB settlement capacity via CIPS.

- Import substitution/sovereign buffers: resumed gold purchases (incl. fixed-price window) to stabilise bullion flows.

These weren’t doctrine; they were siege mechanics that bought time and arrested a broader break.

Embedding Phase—Sovereignty as Substitution

Ostracised from Western forums but indispensable at home, she translates sanctions into workable substitutes: exchange controls, friendly clearers, coercive conversion rules. The embed is within Russia’s elite: technocratic credibility recycled into regime survival. The ruble survived not by orthodoxy but by bricolage: exchange controls, friendly clearing partners, coercive conversion rules.

Her legitimacy is paradoxical—abroad, she is sanctioned and dismissed; at home, she is indispensable. The embed is within the Russian elite: technocratic credibility recycled into regime survival.

Continuity Phase—Ruble as Political Artefact

Three years on, the ruble is a managed symbol, propped by mandatory flows and capital gates; cash FX restrictions and toggled export-FX rules persist in cycles. Nabiullina’s artefacts have turned from technical circulars into survival decrees.

Continuity here does not mean stability—it means persistence. Russia’s monetary system survives in reduced form, insulated but functional. The operator function is not prosperity but endurance.

Official Rationale: Exogenous sanctions/commodity shocks necessitated emergency stabilization to protect deposits and payments. Temporary capital controls, FX interventions, and rate hikes safeguard financial stability and prevent disorderly balance-of-payments dynamics.

Takeaway Synthesis

Nabiullina is the Sovereignty Last-Resort Governor. She delivered engineered resilience—keeping payments continuous after MOEX/NCC/NSD sanctions, stabilizing the ruble, and presiding over high investment—while beginning to ease rates as inflation cooled. Apparent stability is real, but constructed—engineered resilience via FX-conversion decrees, rate shocks, and substitution rails. The choice is explicit: sacrifice some transparency and flexibility to secure payments continuity and ruble functionality under sanctions. That is a testament to Nabiullina’s operator craft: not prosperity maximisation, but survivability by design. By mid-2025, Russia’s reserves were hovering near record highs (weekly prints ~US$686–695B), the CBR cut the key rate 200 bps to 18.00% on 25 Jul 2025, and GDP still grew ~1.1% y/y in 2025Q2—evidence of engineered resilience under sanctions. Yet the runtime remains non-orthodox: FX repatriation mandates, capital-flow curbs, and dual rails (OTC FX, MIR/CIPS) substitute for open access.

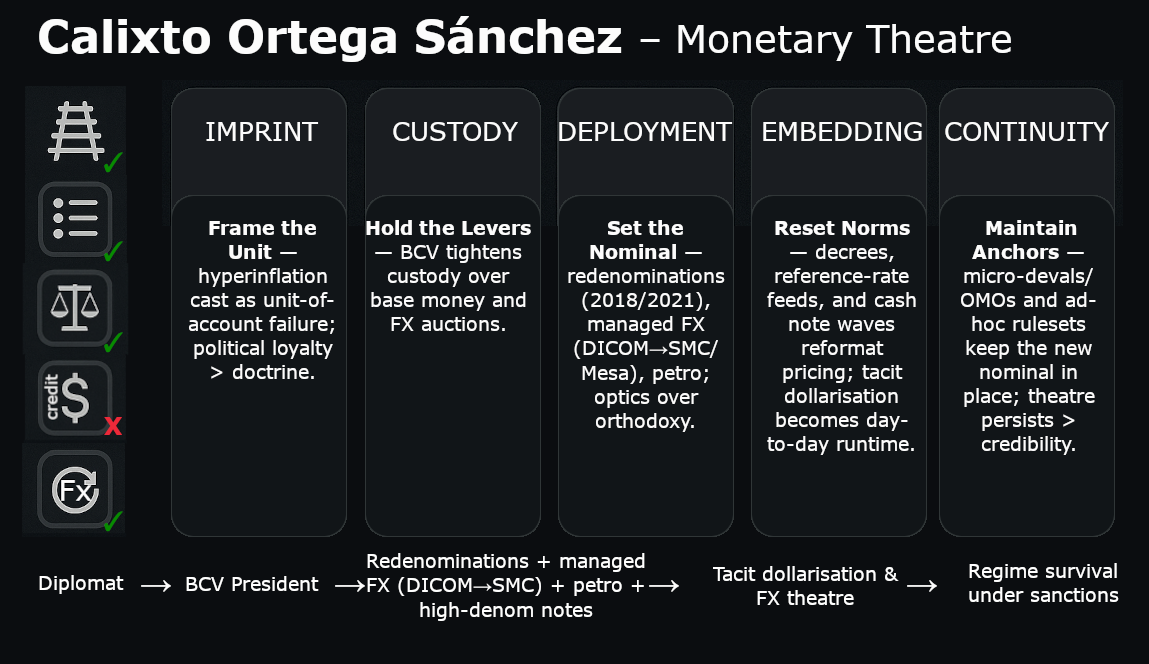

8. Calixto Ortega Sánchez—Monetary Theatre

Operator Class: Sovereignty Last-Resort Governor

Runtime Function: Sustained regime survival in Venezuela through redenominations, parallel exchange rates, and monetary spectacle

Format Migration: Diplomatic roles → U.S. circuit → Central Bank of Venezuela president

Imprinting Phase—Diplomatic Pathways

Calixto Ortega Sánchez began in diplomacy rather than economics. He served in the Venezuelan diplomatic corps, including postings to the United States, and built ties in international venues. This imprint—law, negotiation, foreign representation—differed from orthodox technocrats. It produced operator capital not in technical doctrine but in political loyalty and external navigation. His legitimacy came from service to the Bolivarian regime abroad. That loyalty, tested under pressure, positioned him for redeployment into domestic governance when Venezuela’s monetary system collapsed.

Beginning in 2017, U.S. measures under E.O. 13808 choked sovereign financing and dividends to the state; in Jan 2019 PDVSA was designated; by Apr 2019 BCV itself was sanctioned—severing oil cash flow and reserve management pipes. Simultaneously, ~$1 billion in BCV gold at the Bank of England became the object of adverse UK court rulings, denying Caracas access to hard currency buffers. These were not ambient headwinds but primary instruments of financial warfare; Ortega’s “tacit dollarisation” and FX theatre were forced adaptations to blocked oil income and immobilized reserves.

A domestic elite arbitraged Venezuela’s multi-rate system—privileged access to official FX and resale into the parallel market—accelerating reserve drain and price formation chaos. Ortega’s tolerance of dollarisation doubled as a kill-switch on that arbitrage model, even as it conceded formal monetary sovereignty.

Custodian Phase—Appointment to the Central Bank (2018)

Ortega was appointed president of the Central Bank of Venezuela (BCV) in 2018, not for technocratic expertise but for loyalty and resilience. By then, the bolívar had already entered hyperinflation, sanctions were escalating, and credibility was gone.

Installed at BCV, Ortega inherited a currency already in hyperinflation and escalatory sanctions. His custodianship turned to spectacle:

- Redenominations: 2018 bolívar soberano (5 zeros cut) and 2021 bolívar digital (6 more zeros) via monetary reconversions and implementing norms.

- Dual/managed FX: auctions & official rates (DICOM→SMC/Mesa de Cambio) sat beside a sprawling black market; pricing “unifications” never held.

- New notes as optics: serial issues of higher denominations (e.g., Mar 2021 Bs 200k–1,000k) to keep cash transactions viable.

Redeployment Phase—Survival via Substitution

With the bolívar’s credibility shot, Ortega presided over tacit dollarisation (openly blessed by Maduro as an “escape valve”), crypto theatre via the petro decree, and emergency liquidity via gold abroad contested in London courts

Ortega’s runtime function was survival. With bolívar credibility erased, he presided over tacit dollarisation:

- U.S. dollar adoption for daily transactions, tolerated by the regime.

- Crypto experiments—introduction of the petro cryptocurrency, framed as sanctions evasion but functionally symbolic.

- Gold reserves used as emergency liquidity, often stored abroad and contested in foreign courts.

Each measure was improvised. The bolívar became a token; the real economy migrated to dollars, remittances, and barter. Ortega’s bank issued decrees and redenominations, but survival came from informal substitution.

Embedding Phase—Regime Anchor

Ortega’s embed is regime survival. He is not respected by international markets—Venezuela is shut out of global finance—but he is indispensable to Maduro’s administration. His function is to provide a veneer of monetary governance: circulars, announcements, new notes.

These artefacts maintain the appearance of state sovereignty. Even as citizens transact in dollars, the BCV issues decrees; even as the bolívar evaporates, redenominations are staged. The embed is political, not technocratic.

Continuity Phase—Collapse as Normality

By 2023–24, the Venezuelan system had stabilised at a lower equilibrium. Hyperinflation eased, not through credibility but through exhaustion and dollarisation. Ortega’s role remained theatrical: issuing new notes, launching the “digital bolívar,” and defending the petro in rhetoric long after markets ignored it.

Continuity here means endurance of theatre. The BCV remains an institution, even as its currency dies. Ortega sustains the illusion of monetary sovereignty, and in doing so, preserves regime legitimacy.

Official Rationale: Redenominations simplify accounting amid hyperinflation and restore transaction usability; monetary experiments seek to re-anchor expectations. Interventions in FX and liquidity aim to reduce volatility while fiscal consolidation is pursued.

Takeaway Synthesis

Ortega is a Monetary Theatre operator under siege: external sanctions cut oil cashflow, sanctioned the central bank, and froze gold, while internal elites weaponized the FX spread. Redenominations, managed quotes, and the petro kept the façade of sovereignty; dollarisation carried the real economy. The stability that remains is constructed—a survival runtime built from substitution and spectacle, not recovered bolívar credibility.

Ortega shows how the operator function mutates: technocrats engineer credibility; collapse governors engineer theatre. His runtime wasn’t to fix the bolívar but to preserve the appearance of a state—dollarisation and barter ran the real economy while the BCV staged symbols. The receipts—redenominations, new notes, petro decrees—didn’t restore stability; they sustained the regime narrative: monetary authority as spectacle after substance.

Category C. synthesis: Sovereignty Last-Resort Governors

Under active financial siege, the Last-Resort operators shift from doctrine to emergency defense: choices are forced adaptations, not market preferences. Orthodoxy inverts—capital gates replace signals, compulsory FX surrender substitutes for trust, and jury-rigged rails route around blocked corridors; tools are blunt and fast (rate shocks, collateral forbearance, selective liquidity, forced conversions). Nabiullina treats survival as engineering—controls + a punitive policy-rate hike + rail substitution (SPFS/MIR/RMB clearing) stabilize flows and turn a float into a managed political instrument. Ortega stages continuity—redenominations, a performative “digital” bolívar and petro masking tacit dollarisation while BCV sustains the theatre of sovereignty. Measurement moves from price discovery to plumbing: surrender compliance, rail participation, swap reliance, parallel-rate gaps, rollovers, reserve attrition, and designation→adaptation lag. The structural lesson: when Rails/Weights are coerced or corrupted, Lists turn discretionary and money becomes format—survival arrives via substitution or theatre, not credibility.

From Sovereign Runtime to Infrastructural Runtime

The case studies in Addendum 3a traced central bank governors as sovereign operators enforcing monetary ‘runtime’—Bernanke’s liquidity, Carstens’ standards, Nabiullina’s survival controls. Publicly, they were money’s face; their decrees were sovereign power in technocratic clothing.

But this runtime (Rails, Lists, Weights) is magnified by infrastructural governors: SWIFT, LCH, MSCI, Bloomberg. Their artefacts—methodology notes, margin schedules, messaging formats—govern access more decisively than ministries, determining a bond’s eligibility or a bank’s solvency.

Thus, the shift is from named sovereigns to anonymous acronyms. Their supposed neutrality is camouflage; this ‘plumbing’ enforces exclusion more durably than sanctions. Power operates through the same modalities—Rails (SWIFT codes), Lists (index eligibility), Weight (CCP haircuts)—but invisibly, backstage.

This is a critical difference: sovereign runtime can be contested politically; infrastructural runtime resists contestation, framed as mere technicality. Power is displaced into default settings, enforced automatically by software.

Addendum 3b tracks these infrastructural governors, analysing their artefacts not as decrees but as irrevocable margin calls or exclusionary formats. Together, 3a and 3b map a complete system: sovereigns give orders, infrastructure ensures they execute everywhere, instantly, and without appeal.

Published via Journeys by the Styx.

Overlords: Mapping the Operators of reality and rule.

—

Author’s Note

Produced using the Geopolitika analysis system—an integrated framework for structural interrogation, elite systems mapping, and narrative deconstruction.