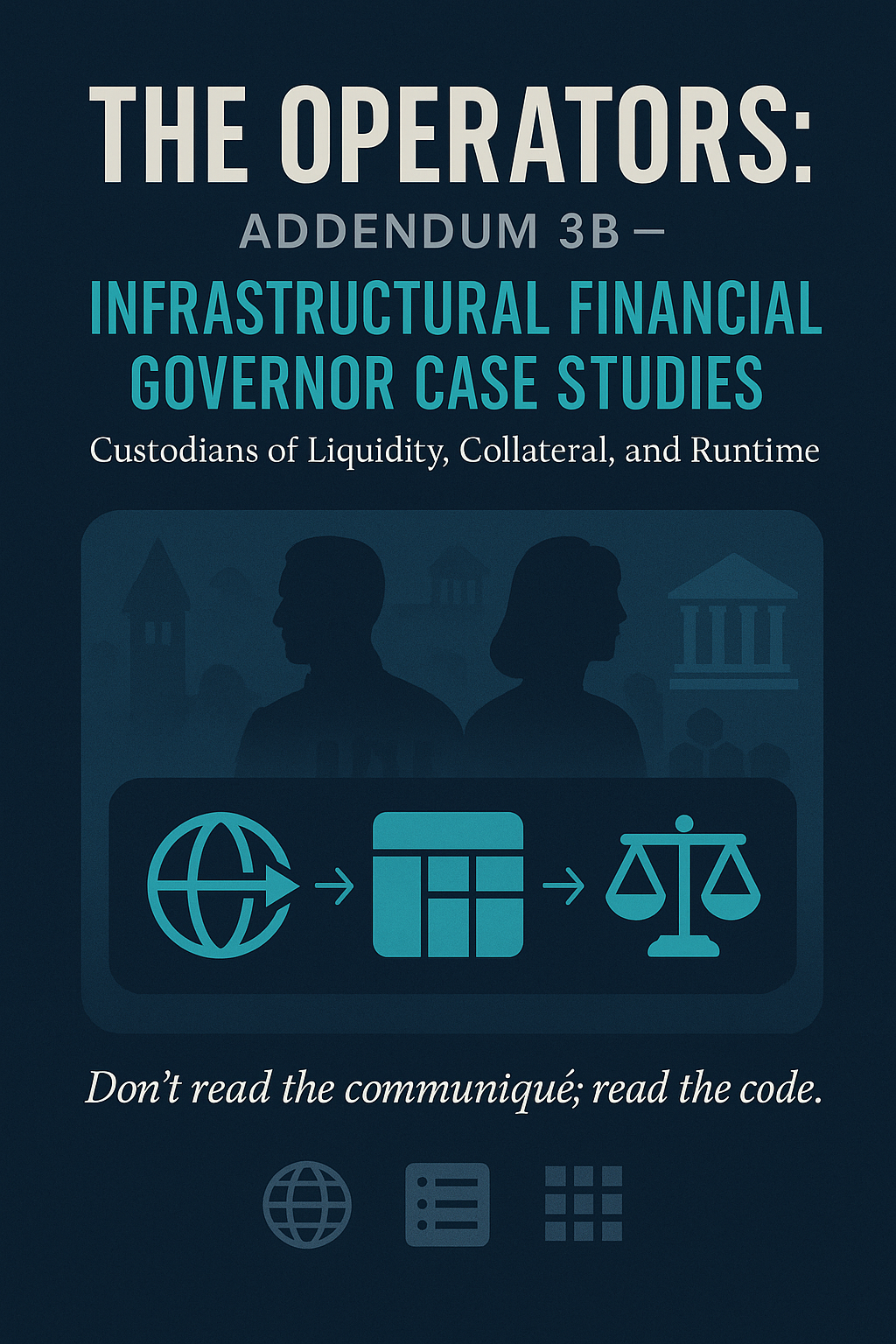

The Operators: Addendum 3b. Infrastructural Financial Governor Cases Studies

The backstage operators who turn technical standards into sovereign law.

Addendum 3a profiled sovereign operators—central bankers like Bernanke or Lagarde—who govern through visible decrees, acting as the public face of monetary power. Their control over financial Rails, Lists, and Weights, however, extends beyond borders through infrastructural runtime.

This infrastructural power—executed by systems like SWIFT, Bloomberg, LCH, and MSCI—is camouflaged as technical plumbing. Yet these entities govern decisively through artefacts: messaging protocols, eligibility lists, margin models, and index methodologies. They control access, solvency, and capital flow more durably than states.

Unlike sovereign runtime, which can be politically contested, infrastructural runtime is entrenched as technical necessity. Its operators don’t persuade; they format. Addendum 3b examines these hidden governors using the same forensic framework, revealing how default settings—not decrees—enforce sovereignty seamlessly across the global system. Together, 3a and 3b show financial governance as two tiers: one of faces, the other of circuits.

Index of Case Studies:

9. Javier Pérez-Tasso — SWIFT as Messaging Rail

10. David Craig / Refinitiv — Compliance as Interface

11. Michael Bloomberg — Interface as Market Law

12. Daniel Maguire — LCH as Weight Setter

13. Pablo Hernández de Cos — Basel Architect of Global Weight

14. Henry Fernandez — MSCI as Index Governor

15. David Schwimmer — London Stock Exchange Group (FTSE Russell)

16. Larry Fink — BlackRock as Meta-Governor

CATEGEORY D. RAIL GOVERNORS (PLUMBING)

Rail governance is pipes. The artefacts are message formats, ISO codes, and settlement windows. They look technical, but control of the pipe is control of money: if SWIFT excludes a bank, or Fedwire rejects a field, funds do not move.

These governors claim neutrality as utilities, yet their runtime is binary—connected or disconnected. A single exclusion, embedded in the messaging system, severs access more decisively than statutes or speeches. Sovereigns may decree, but without rails their decrees are inert.

Here the operator is not theorist but plumber. Their artefacts are XML schemas and access protocols. The function is not to set doctrine but to enforce it automatically. Plumbing is power—because in finance, the pipe is the policy.

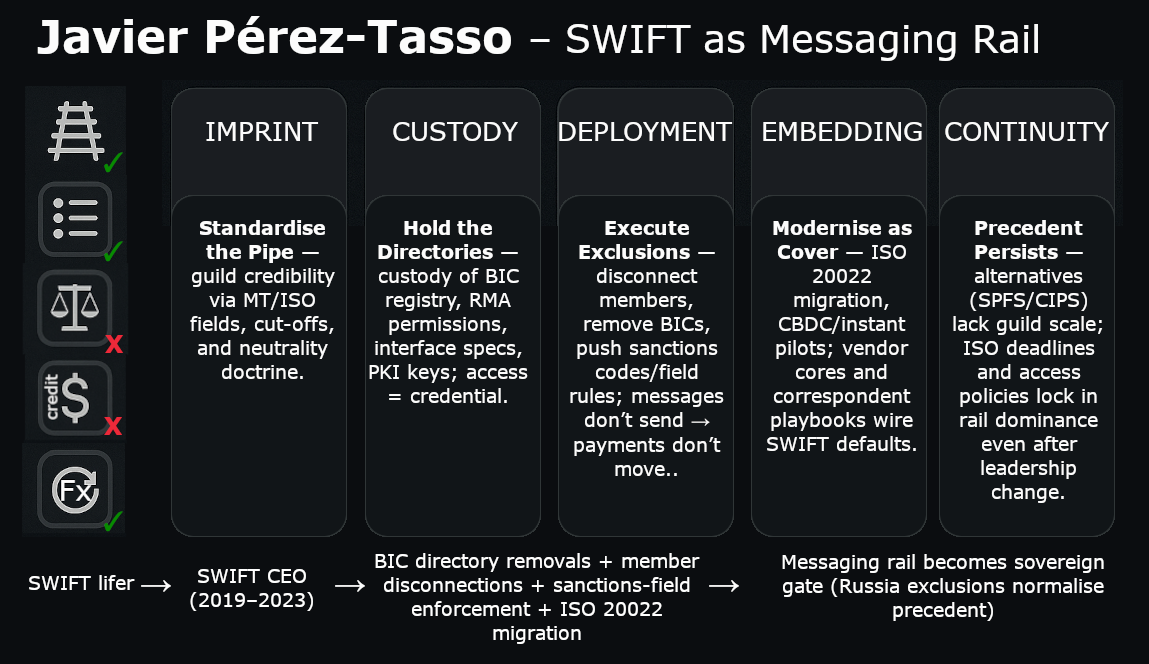

9. Javier Pérez-Tasso — SWIFT as Messaging Rail

Operator Class: Rail Governor

Runtime Function: Controlled global payment access through messaging standards and exclusion protocols

Format Migration: Internal career at SWIFT → CEO (2019–2023) → custodian of pipes

Imprinting Phase — Inside the Utility

Pérez-Tasso spent decades inside SWIFT, the Belgian-based cooperative that standardises cross-border payments. His imprint was not public policy or academic theory but technical standardisation: ISO formats, MT message fields, compliance protocols. Within the guild, credibility meant deep knowledge of pipes and the ability to maintain neutrality across 11,000 member institutions.

This imprint created operator capital: he was a lifer of the rail, fluent in the language of messaging fields and settlement cut-offs. When elevated to CEO in 2019, he was recognised as a safe custodian of the system’s neutrality.

Custodian Phase — Rail as Sovereign Gate (2019–2023)

As CEO, Pérez-Tasso presided over SWIFT during a moment of rupture: the 2022 sanctions on Russia. What appeared as a cooperative’s decision was in fact the most consequential act of financial warfare in decades.

The artefacts were banal but lethal:

- BIC blacklisting — Russian banks’ identifiers removed from SWIFT directories.

- Access exclusions — member institutions disconnected from messaging.

- Field enforcement — sanction codes embedded into transaction screening.

The runtime effect was binary: messages did not send, payments froze, banks were cut out of the global dollar–euro system. No amount of reserves could offset the loss of pipes.

Redeployment Phase — Innovation as Camouflage

Alongside enforcement, Pérez-Tasso oversaw SWIFT’s modernisation drive: migration to ISO 20022, experimentation with CBDC interoperability, pilot projects for real-time cross-border payments. These projects framed SWIFT as neutral infrastructure adapting to technology.

But redeployment here was camouflage. The core runtime remained control of rails. Technical upgrades gave the appearance of innovation while exclusion protocols demonstrated that SWIFT’s neutrality was conditional.

Embedding Phase — The Guild of Rails

SWIFT is nominally a cooperative owned by member banks, headquartered in Belgium. In practice, its embed is with Western sovereigns. The 2022 exclusions were not Belgian decrees; they were coordinated with EU, U.S., and G7 sanctions. Pérez-Tasso’s role was to align pipes with policy while preserving the fiction of neutrality.

His authority rested on guild trust: banks worldwide continued to treat SWIFT as neutral utility, even after witnessing it as instrument of exclusion. The embed was thus paradoxical—reliance deepened even as neutrality was disproved.

Continuity Phase — After Exclusion

By 2023, Pérez-Tasso departed SWIFT, succeeded by new leadership. The rail persisted. Russia’s exclusion normalised the precedent: SWIFT could be weaponised, yet it remained indispensable. Alternative systems (Russia’s SPFS, China’s CIPS) emerged but without SWIFT’s scale or guild embed.

Continuity here is the survival of the pipe. Even after neutrality collapsed, the rail endured as default. The operator may change, but the artefacts—message fields, BIC directories, exclusion lists—remain binding.

Takeaway Synthesis

Pérez-Tasso exemplifies the Rail Governor. His artefacts were message standards and access lists. They look like plumbing, but they decide sovereignty. His career demonstrates the runtime logic of rails: neutrality until pressured, then binary exclusion. Under his watch, SWIFT migrated to ISO 20022 and tested CBDC rails, yet its decisive act was removing Russian banks from the system. That exclusion proved that messaging codes are policy. The receipts are not speeches but BIC directories, sanction protocols, and ISO migration timetables. These documents govern more decisively than decrees, because without rails, decrees cannot move money. Pérez-Tasso’s case reveals the power of infrastructural operators: remembered not as public figures but as acronyms. The sovereign may wave the flag, but the rail governor holds the pipe. And in finance, the pipe is the policy.

Category D — Synthesis: Rail Governors (Plumbing)

Rail governors enforce sovereignty through pipes. Their artefacts are message formats, ISO codes, and settlement fields. They do not issue doctrine, yet their runtime decides whether funds move at all.

Javier Pérez-Tasso at SWIFT illustrates the type. A single exclusion from SWIFT’s network severs a bank’s ability to transact across borders. Likewise, Fedwire or CHIPS administrators can suspend access with a code-level block. These actions are staged as technical adjustments but function as sanctions in practice.

The receipts are banal: field requirements, error codes, access revocations. They look like utilities but operate as sovereign levers. A transaction that cannot clear might as well not exist.

Camouflage lies in neutrality claims—rails insist they are plumbing, not policy. Yet their runtime proves otherwise: pipes are policy. Sovereigns may legislate, but without messaging rails their orders are inert. Rail governors enforce sovereignty silently, through the binary of connection or exclusion.

CATEGORY E. VENDOR PROPAGATORS

Vendors govern at the interface. Their artefacts are not laws but screens and feeds that translate lists and weights into market behaviour. Refinitiv’s World-Check compiles sanctions and PEP data; Bloomberg terminals propagate ratings, indices, and eligibility flags.

These systems claim neutrality, yet their runtime is enforcement. Once a name is flagged in World-Check, banks withdraw. Once Bloomberg adjusts an index, portfolios must rebalance. Traders obey the terminal, not the statute.

Vendors propagate List and Weight simultaneously: lists become searchable feeds, weights become default portfolio settings. Market actors internalise them because they are embedded in daily workflow. The update itself is law — invisible, uncontested, automatic.

In this category, Refinitiv and Bloomberg are profiled. Their interfaces show how private vendors become governors: not by making rules, but by turning lists and weights into screens that markets cannot ignore.

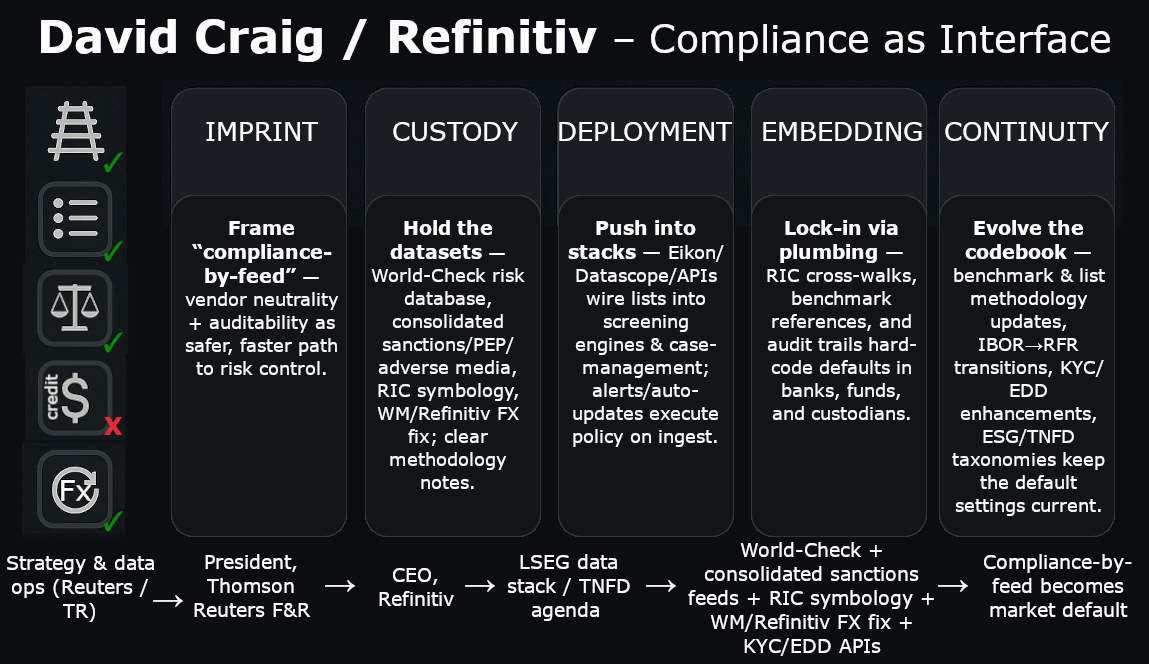

10. David Craig / Refinitiv — Compliance as Interface

Operator Class: Vendor Propagator

Runtime Function: Converted sanctions and political classifications into enforceable compliance screens

Format Migration: McKinsey consultant → Thomson Reuters Financial & Risk → CEO of Refinitiv → LSEG absorption

Imprinting Phase — Craig as Product Manager

David Craig’s imprint came from management consulting at McKinsey and then a senior role at Thomson Reuters. His operator capital was not regulatory or political, but productisation of data: turning sprawling information into structured, saleable feeds.

In 2013, he became CEO of Thomson Reuters Financial & Risk, later spun out as Refinitiv. His imprint was entrepreneurial within a corporate frame: expand compliance tools into global infrastructure. The flagship was World-Check.

Custodian Phase — World-Check as Global List

Under Craig, World-Check became the de facto global compliance database. Its artefacts were structured datasets:

- Sanctions lists (OFAC, EU, UN)

- Politically Exposed Persons (PEPs)

- Adverse media screenings

These artefacts were machine-readable and updated continuously. The runtime effect was decisive: once a name entered World-Check, counterparties froze accounts, refused trades, or blocked relationships. Enforcement shifted from statute to screen. Craig’s custodianship made World-Check the interface through which law became reality.

Redeployment Phase — From Compliance Tool to Infrastructure

Craig redeployed compliance data into broader market plumbing:

- Integrated World-Check into KYC platforms as default setting.

- Embedded feeds into bank onboarding systems, where exclusions triggered automatically.

- Formed joint ventures with exchanges to propagate screening into listings and trading.

This redeployment blurred boundaries. Compliance staff no longer parsed OFAC bulletins — they updated Refinitiv feeds. Law became interface.

Embedding Phase — Refinitiv as Guild Standard

Refinitiv’s embed lies in the compliance guild. Compliance officers worldwide rely on World-Check to avoid liability. Over-compliance is structural: firms prefer to de-risk rather than contest a listing.

Through partnerships and integrations, Refinitiv became infrastructural. Banks and regulators treated its feeds as authoritative. Craig’s imprint as leader reinforced the brand, but the organisation itself became the governor: the feed was reality.

Continuity Phase — Absorbed into LSEG

In 2021, the London Stock Exchange Group acquired Refinitiv. Craig departed, but World-Check remained default infrastructure. Its artefacts — database updates, risk classifications, compliance workflows — persisted as global standards. Continuity was organisational: the runtime of compliance-as-interface did not depend on Craig’s presence.

Takeaway Synthesis

Craig’s imprint was entrepreneurial within a corporate shell: he scaled World-Check from a compliance tool into global infrastructure. But Refinitiv is the enduring Vendor Propagator. Its artefacts — sanctions feeds, PEP lists, adverse media alerts — bind banks and funds automatically.

The receipts are database updates and compliance circulars. They appear technical, but they carry sovereign weight: once a name is flagged, the account is closed. Law becomes interface; interface becomes enforcement.

The hybrid shows the shift: Craig built momentum, but Refinitiv outlives him. Now absorbed into LSEG, the runtime persists — not through any executive, but through feeds embedded in every compliance system.

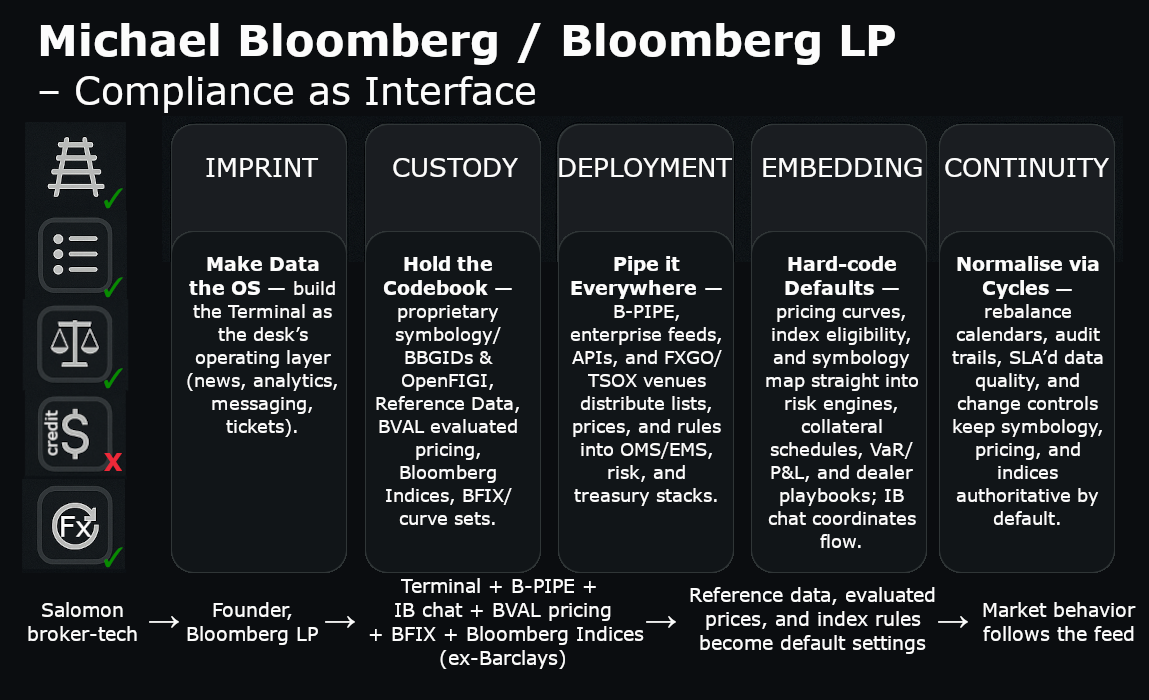

11. Michael Bloomberg / Bloomberg LP — From Entrepreneur to Interface Monopoly

Operator Class: Vendor Propagator

Runtime Function: Converted raw market data into binding interfaces that enforce lists and weights by default

Format Migration: Salomon banker → Entrepreneur (Bloomberg LP) → Mayor / Philanthropist → Infrastructure monopoly

Imprinting Phase — Michael Bloomberg’s Terminal

Michael Bloomberg’s imprint came from Wall Street in the 1970s, where as a partner at Salomon Brothers he saw the informational bottleneck of finance: traders relied on slow, fragmented data. Dismissed after a merger, he founded Innovative Market Systems in 1981 with a single idea — consolidate prices, analytics, and messaging into an integrated terminal.

This entrepreneurial imprint framed Bloomberg’s operator function: control the screen. If traders relied on his machine to see markets, then whoever controlled the terminal controlled what “market reality” looked like.

Custodian Phase — From Vendor to Infrastructure

By the 1990s, Bloomberg LP terminals dominated trading floors. The artefacts were data screens, classification fields, and messaging windows. Traders no longer checked statutes, prospectuses, or even official exchange feeds — they checked Bloomberg.

Custodianship here meant maintaining trust in the feed. A bond’s inclusion, a company’s ticker, or a sovereign’s rating appeared on Bloomberg before anywhere else. The firm became the custodian of how markets were represented. Michael Bloomberg’s name gave credibility, but the organisation itself became the runtime.

Redeployment Phase — Beyond Market Data

Bloomberg redeployed its feed into other domains:

- Bloomberg Barclays Indices embedded methodology into bond markets.

- Bloomberg Law and Bloomberg Government turned regulatory filings into searchable feeds.

- Bloomberg News created an in-house media loop that reinforced terminal primacy.

Each redeployment deepened the monopoly: the more functions folded into the terminal, the harder it became to trade or comply without it. The interface became the enforcement mechanism.

Embedding Phase — Market Guild Lock-In

Bloomberg’s embed is systemic:

- Dependency: Terminals are entrenched in daily workflow across banks, funds, and corporates.

- Network effects: Proprietary messaging (IB chat), data formats, and analytics made exit nearly impossible.

- Training: Junior analysts learn Bloomberg as lingua franca; careers are built on its workflow.

This embed means that when a sanction, index rebalance, or eligibility update appears on the screen, it is obeyed automatically. The market does not contest the source — the screen is treated as fact.

Continuity Phase — From Founder to Machine

By the 2010s, Michael Bloomberg had stepped back into politics and philanthropy, but the organisation persisted as infrastructural governor. The runtime did not depend on him personally. Updates, feeds, and screens continued to propagate lists and weights as binding defaults.

The continuity lies in the interface monopoly: Bloomberg LP enforces sovereignty invisibly. Traders no longer ask what OFAC decreed or how MSCI classified — they look at the terminal. Michael Bloomberg’s entrepreneurial imprint faded into brand identity; the machine became the operator.

Takeaway Synthesis

Michael Bloomberg’s imprint was entrepreneurial: he built the terminal that made market data legible. But Bloomberg LP is the enduring Vendor Propagator. Its artefacts are screens and feeds that enforce sanctions, indices, and classifications by default.

The apparent neutrality of a terminal mask its runtime effect: once a flag appears on Bloomberg, traders obey. Law and policy become screens; screens become fact. The receipts are update logs, rebalance schedules, and data fields. These documents bind markets more decisively than statutes because they are embedded in daily workflow.

The hybrid shows the shift: an individual entrepreneur created the interface, but the organisation became the governor. Michael Bloomberg provided the imprint; Bloomberg LP provides the runtime. Together they demonstrate the operator function of vendors — sovereignty enforced not by decree but by interface.

Categeory E — Synthesis: Vendor Propagators

Vendor Propagators govern at the interface. Their artefacts are terminals and databases that turn law into enforcement. Once a name is flagged in Refinitiv’s World-Check or a bond is reclassified on Bloomberg, counterparties act without consulting statutes. Traders obey the screen.

The imprint was personal: Craig scaled World-Check, Michael Bloomberg built the terminal. But the runtime is organisational. Refinitiv and Bloomberg enforce sovereignty through workflow, not personality. The founder fades; the interface endures.

Artefacts are banal — database updates, terminal flags, rebalance schedules — yet binding. Compliance officers and traders treat them as fact because they are embedded in daily systems. The guilds lock them in: banks over-comply on Refinitiv flags; markets build portfolios on Bloomberg defaults.

Continuity and camouflage define the category. Vendors claim neutrality as data providers, yet their feeds function as regulators. The interface is enforcement. In finance, what appears on-screen is what exists.

CATEGORY F. — CCP RISK CZARS (WEIGHT SETTERS)

Weight governance is margin. Central counterparties (CCPs) decide how much collateral a trader must post, how positions are netted, and when defaults are triggered. Their artefacts are margin schedules, haircut tables, and default fund rules. These are not advisory — they are binding.

A CCP’s call can liquidate a hedge fund overnight or force a bank to raise billions in hours. Unlike rail governors, who decide whether money moves, CCP risk czars decide at what price leverage survives. Access is not binary but conditional — credit continues only if weight requirements are met.

Their neutrality is staged as prudence, yet the runtime is coercive. By adjusting margin multipliers, CCPs tighten or loosen liquidity across the system. The governor here is not visible in press conferences but in circulars to members. Their power is exercised in numbers on a margin call.

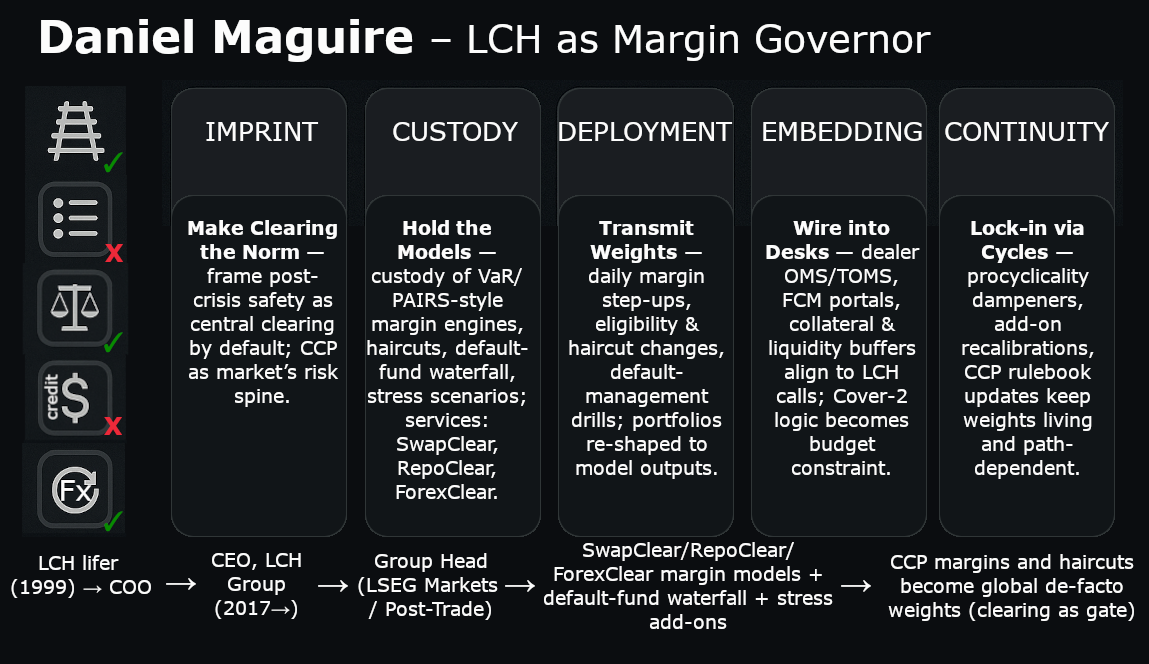

12. Daniel Maguire — LCH as Margin Governor

Operator Class: CCP Risk Czar

Runtime Function: Set systemic leverage through collateral and default fund rules

Format Migration: Clearinghouse executive → CEO of LCH Group (2017–present) → custodian of global Weight

Imprinting Phase — Clearing as Craft

Maguire’s imprint was technical. He came up through risk management and operations inside LCH, where clearing is craft: netting exposures, setting collateral, liquidating defaults. His operator capital was practical mastery of how margin works in practice. Not markets or doctrine, but the machinery of leverage.

This background defined his operator profile. Where central bankers govern through rates or reserves, clearing executives govern through margin — an invisible but binding constraint on credit.

Custodian Phase — Margin as Sovereign Weight

As CEO from 2017, Maguire presided over LCH during a series of stress events — Brexit volatility, COVID market seizures, and Russia’s exclusion in 2022. Each crisis revealed the artefacts of Weight governance:

- Initial margin models dictating how much collateral counterparties must post

- Variation margin calls liquidating those unable to meet cash demands

- Default fund contributions deciding how losses cascade through members

The runtime effect was clear: a tweak in margin multipliers could force liquidations worth billions. LCH’s rules, not state law, determined who survived market shocks.

Redeployment Phase — Expansion of CCP Reach

Maguire redeployed LCH into more asset classes and geographies:

- Cleared interest rate swaps in dollars, euros, sterling

- Expanded repo clearing and FX derivatives

- Coordinated with other CCPs to harmonise margin standards

Each redeployment extended Weight governance across markets. Clearing became the bottleneck: no major dealer could avoid LCH, and thus all were bound by its margin rules.

Embedding Phase — Guild of Members

LCH’s embed is with its clearing members — the major banks and dealers who both own and are disciplined by the CCP. They complain about margin calls, yet cannot withdraw: clearing is regulatory mandate and market necessity.

This paradox strengthens the guild. By embedding Weight rules into mandatory clearing, Maguire ensured that LCH’s artefacts — margin schedules, haircut tables, default fund rules — became systemic defaults. The guild enforces its own dependency.

Continuity Phase — Default Management as Routine

Under Maguire, LCH normalised crisis management. Default management groups, fire drills, and collateral stress tests turned emergency into routine. The artefacts — stress scenarios, liquidity add-ons — persist regardless of leadership. The runtime is continuity: margin governance does not end with one CEO.

Maguire’s presence lent authority, but the weight function is embedded. CCPs like LCH enforce leverage constraints automatically, through models that members must obey.

Takeaway Synthesis

Maguire exemplifies the CCP Risk Czar. His artefacts are margin models and collateral rules — invisible documents that decide solvency. Unlike rail governors, who block access outright, CCPs enforce conditional survival. A member lives only if it can post collateral at the demanded weight.

The receipts are circulars and margin schedules. They look technical, but they liquidate firms. A few lines in a variation margin notice can trigger forced selling across global markets.

Maguire’s case shows Weight governance in its purest form: power exercised through collateral multipliers, enforced without debate, binding across borders. In this runtime, prudence is camouflage. Margin is law.

Category F — Synthesis: CCP Risk Czars (Weight Setters)

CCP governors set the price of leverage through margin — initial margin, variation margin and default fund rules that bind members with no appeal in real time. Their artefacts look like risk hygiene yet function as law: model parameters, stress add-ons, liquidation protocols.

Stress reveals the edge — a single multiplier change ripples through dealers, forces collateral calls, and turns hedges into exits as positions are sold to meet cash. Liquidity is manufactured by decree at the CCP console, not discovered in the market.

Prudence is the public alibi — backtests, coverage ratios and procyclicality dampeners furnish a language of safety while the true decision sits in the parameter set. Choose harsher shocks or fatter tails and you dial survival thresholds up for the whole street.

The guild is circular — clearing members co-own the CCP, supply the default waterfall, and are disciplined by it under recovery and resolution. Portability and auction drills read as order, yet close-outs concentrate fire at the worst hour and the “skin-in-the-game” slice is sized to preserve the platform first.

Basel templates write static weights for banks while CCPs write live weights for trades — minute-by-minute adjustments that decide who posts, who liquidates and who fails. The synthesis is blunt: margin is law, and model governance is politics encoded as collateral.

CATEGORY G. INDEX & RATINGS GOVERNORS

Index compilers govern through inclusion. Their artefacts are methodology notes, country classifications, and rebalancing schedules. They claim to measure markets, yet in practice they make them. When MSCI or FTSE Russell upgrades a country, billions in passive capital flow in. When they exclude, liquidity evaporates overnight.

This is governance by list and weight simultaneously. The list is eligibility: which securities or sovereigns count. The weight is allocation: how much capital each receives. Both are enforced automatically through ETFs, benchmark-tracking funds, and performance mandates.

Index governors present neutrality — quantitative rules, periodic reviews, stakeholder consultations. Yet their runtime effect is coercive: portfolios must follow, regardless of sovereign protest. States can reform, lobby, or retaliate, but they cannot compel inclusion. In the index era, capital follows the methodology note.

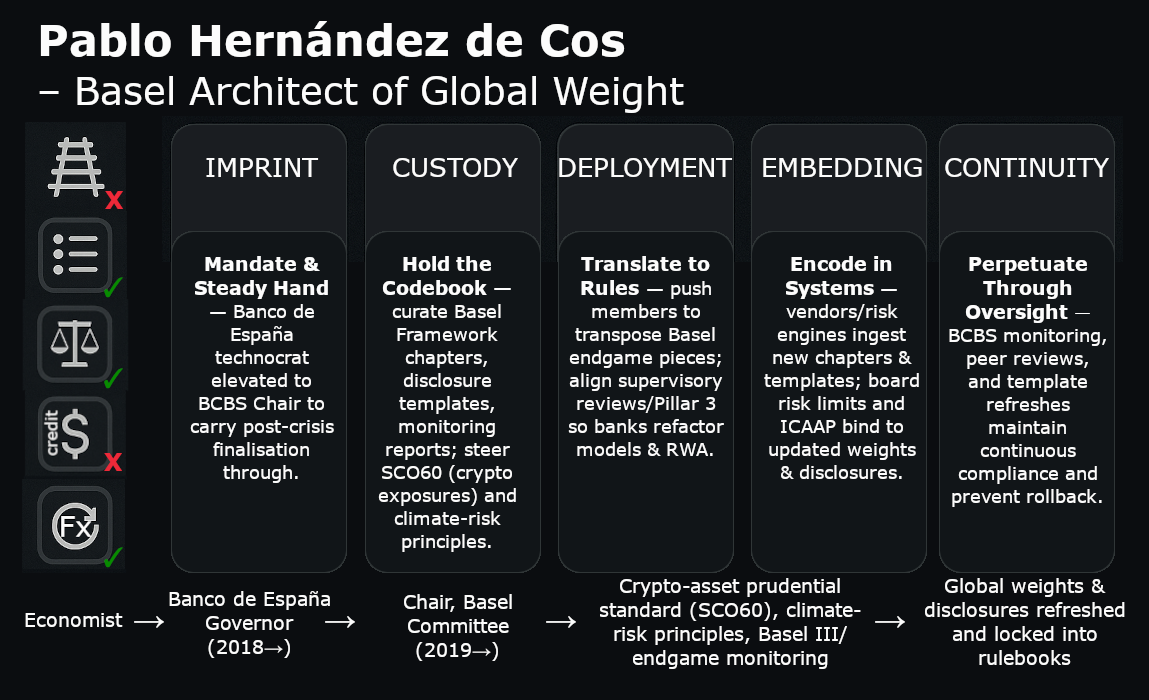

13. Pablo Hernández de Cos — Basel Architect of Global Weight

Operator Class: Index/Weight Governor (Regulatory Architect)

Runtime Function: Encoded global leverage standards through Basel Committee capital rules

Format Migration: Spanish technocrat → Banco de España Governor (2018–) → Chair of Basel Committee on Banking Supervision (2019–)

Imprinting Phase — National Technocrat

De Cos’s imprint came through Spain’s central bank and Ministry of Economy, where he built expertise in monetary policy, fiscal coordination, and bank supervision. His operator capital was orthodox economics plus regulatory fluency: debt dynamics, EU fiscal rules, and stress testing.

Unlike sovereign last-resort figures (Nabiullina, Salameh), his imprint was not survival mechanics but adherence to technocratic procedure. This credibility made him a natural candidate for supranational redeployment.

Custodian Phase — Basel Committee Chair

In 2019, de Cos became Chair of the Basel Committee on Banking Supervision (BCBS). Here his artefacts were not decrees or screens but capital standards: Basel III finalisation, leverage ratios, output floors.

These artefacts are global Weight rules. They dictate how much capital banks must hold, how risk-weighted assets are calculated, and how leverage is capped. Once published in Basel texts, they are absorbed into EU law, national statutes, and bank models. Enforcement is indirect but binding: a Spanish or Korean bank’s capital position is shaped as much by de Cos’s Basel notes as by its domestic regulator.

Redeployment Phase — Weight into Market Defaults

Under de Cos, the Basel Committee finalised reforms after the 2008 crisis and navigated COVID flexibility. His redeployment was to balance prudence versus credit supply:

- Pushed for consistent implementation of capital floors across jurisdictions.

- Oversaw climate-risk consultations, embedding ESG into prudential frameworks.

- Managed tensions between EU leniency and U.S. stringency on Basel output floors.

Through this redeployment, Basel artefacts migrated into daily bank practice. Models were rewritten, risk weights recalibrated, lending portfolios adjusted.

Embedding Phase — Guild of Supervisors

De Cos’s embed is the supervisory guild: regulators, supervisors, and compliance divisions in banks worldwide. Basel standards are technically voluntary, yet no bank can ignore them. Credit rating agencies, investors, and counterparties treat Basel alignment as baseline legitimacy.

Thus, the artefacts acquire coercive force: even where domestic law diverges, market pressure forces adherence. De Cos governs through this guild lock-in.

Continuity Phase — Standards as Permanent Infrastructure

Basel artefacts persist across leadership. De Cos’s tenure codified the “Basel III endgame,” but the templates will outlive him. Once standards are embedded in stress tests, rating methodologies, and capital markets, they become structural defaults.

Continuity is systemic: BCBS chairs rotate, but the weight function — capital rules dictating bank leverage — endures.

Takeaway Synthesis

Pablo Hernández de Cos exemplifies the regulatory architect as Index/Weight Governor. His artefacts are Basel standards: consultation papers, risk-weight methodologies, leverage rules. They appear neutral, but they dictate bank survival worldwide.

Unlike sovereign governors, he does not manage crises through decrees. Unlike vendors, he does not control screens. Instead, he designs the templates that everyone else must implement. His runtime effect is invisible but binding: banks alter lending, capital flows, and risk appetite to meet ratios his committee defines.

The receipts are technical papers and consultation notes — bureaucratic in form, coercive in effect. Through them, de Cos enforces sovereignty without flags: leverage ceilings and capital weights encoded in Basel text.

He demonstrates how regulatory architecture becomes governance. Doctrine is displaced into methodology; survival depends on ratios. Sovereignty is enforced globally, line by line, in the Basel rules he shepherds.

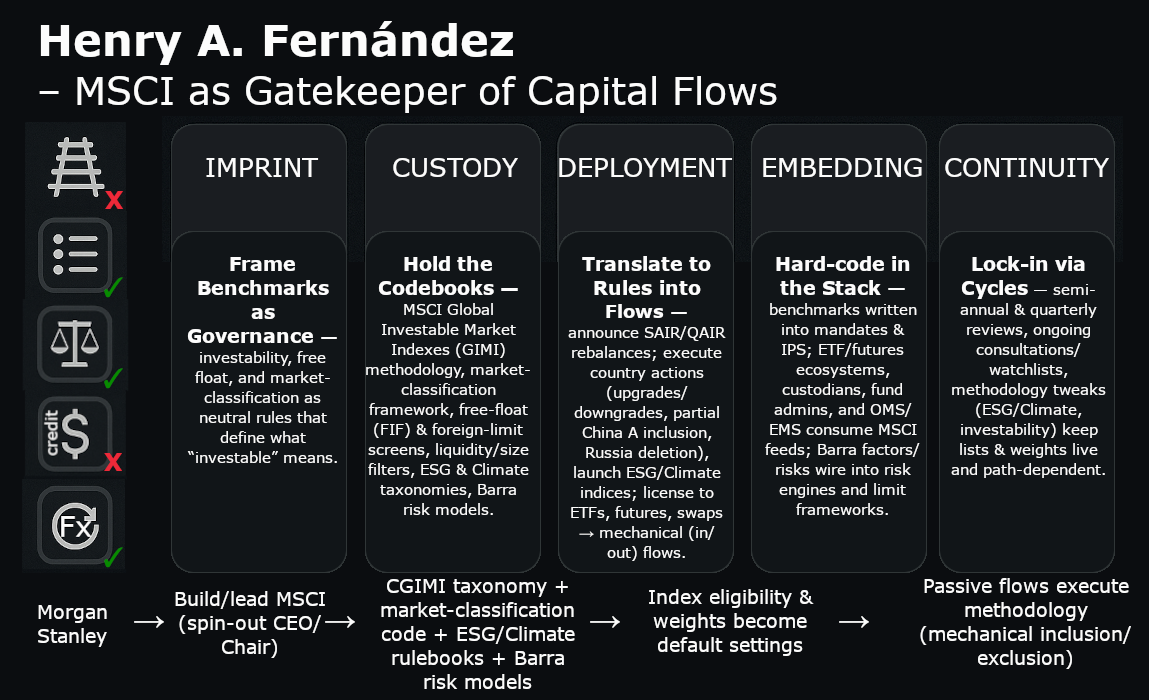

14. Henry Fernandez — MSCI as Gatekeeper of Capital Flows

Operator Class: Index Governor

Runtime Function: Defined sovereign eligibility and portfolio weights through index methodology

Format Migration: Emerging-markets banker → MSCI executive (1990s–) → CEO and architect of global index dominance

Imprinting Phase — Emerging Markets as Product

Fernandez’s imprint was in investment banking and private equity in the 1980s–90s, where he saw how classifications determined flows. An “emerging market” was not a natural fact but a label that shaped investment mandates.

At MSCI, he turned that insight into operator capital: if the company defined the classification, it defined the flows. Traders and funds bound by benchmarks would follow the list, not the sovereign’s pitch.

Custodian Phase — MSCI as Default Index

As CEO from 1998, Fernandez presided over MSCI’s transformation from a Morgan Stanley adjunct to a stand-alone governor. The artefacts were index methodologies, classification notes, and rebalancing schedules.

When MSCI upgraded a country from frontier to emerging, billions flowed in through ETFs and benchmark-tracking funds. When it excluded, liquidity collapsed. Fernandez’s custodianship turned methodology into market law.

Redeployment Phase — Index Expansion

Fernandez redeployed the index model across domains:

- Equity and fixed-income indices became the benchmarks for trillions.

- Factor indices embedded quantitative rules into portfolio design.

- ESG and climate indices extended governance into sustainability mandates.

Each redeployment deepened the runtime: portfolio managers followed MSCI’s indices automatically, treating them as neutral tools while they shaped allocations decisively.

Embedding Phase — The Benchmark Guild

MSCI’s embed lies in the asset-management guild. Passive funds, ETFs, and even active managers benchmark against MSCI classifications. Consultants, pension funds, and sovereign wealth funds rely on MSCI screens to define mandates.

This guild lock-in means MSCI’s artefacts are absorbed without contest. A country may lobby for inclusion, but managers obey the rebalance note, not the sovereign request. Fernandez’s MSCI became the unacknowledged regulator of eligibility.

Continuity Phase — Methodology as Infrastructure

By the 2010s, MSCI’s role was systemic. Fernandez remained CEO, but the organisation itself functioned as index governor. Artefacts like country classification reviews became ritualised events, with ministries lobbying and investors speculating on upgrades.

The continuity lies in the methodology. Once codified, it persists beyond the man. Fernandez’s leadership shaped MSCI’s dominance, but the runtime is organisational: the list and the weight are enforced by default.

Takeaway Synthesis

Fernandez exemplifies the Index Governor. His artefacts are classification notes and index methodologies — documents that appear technical but govern capital flows.

A country’s upgrade or downgrade is not debate but destiny: ETFs rebalance automatically, passive funds reallocate billions. The receipts are rebalancing schedules, not treaties. They bind markets more decisively than sovereign decrees.

Fernandez’s case shows the runtime of index governance: law displaced into methodology, enforced by benchmarks. Investors obey the index note because mandates require it. Sovereigns compete for inclusion, but the decision is algorithmic.

MSCI under Fernandez demonstrates how private organisations became governors of global capital. They are remembered not for speeches but for rebalancing cycles. Their artefacts — lists and weights — enforce sovereignty invisibly, line by line, in methodology PDFs.

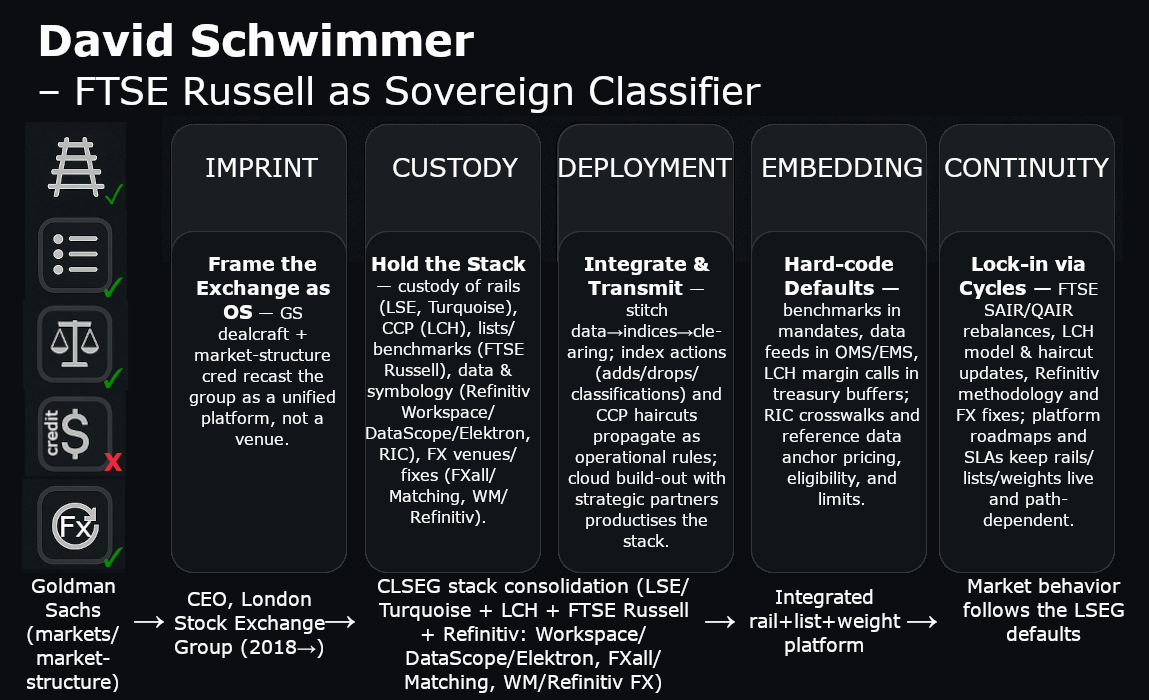

15. David Schwimmer — FTSE Russell as Sovereign Classifier

Operator Class: Index Governor

Runtime Function: Embedded sovereign classifications and market-eligibility rules through benchmark indices

Format Migration: Goldman Sachs banker → CEO of London Stock Exchange Group (2018–) → Custodian of FTSE Russell

Imprinting Phase — Market Plumbing at Goldman

Schwimmer’s imprint came at Goldman Sachs, where he spent two decades in market infrastructure and exchange relationships. His operator capital was not portfolio construction but market plumbing — understanding how flows are channelled through exchanges, clearing, and benchmarks.

That grounding made him a natural fit to run the London Stock Exchange Group (LSEG) and, through it, FTSE Russell. His imprint was institutional: translating the perspective of a dealer-bank into the governance of a benchmark provider.

Custodian Phase — FTSE Russell Benchmarks

At LSEG, Schwimmer presided over FTSE Russell, whose artefacts are sovereign classifications, bond-index eligibility rules, and rebalancing schedules.

A sovereign bond market is investable if FTSE Russell says so. Inclusion in the FTSE World Government Bond Index (WGBI) triggers passive inflows from global asset managers. Exclusion shuts them off. Schwimmer’s custodianship meant managing the tension: respond to political pressure (China, Saudi Arabia, Russia) while staging neutrality as methodological review.

Redeployment Phase — Globalising the Benchmarks

Schwimmer redeployed FTSE Russell indices into more domains:

- Fixed income dominance through the WGBI and emerging-market bond indices

- Equity and factor indices competing with MSCI in portfolio mandates

- Sustainable benchmarks to capture ESG allocations

This redeployment strengthened LSEG’s role as infrastructural governor. Through FTSE Russell, the exchange extended beyond trading into capital allocation.

Embedding Phase — Sovereigns as Lobbyists

FTSE Russell’s embed lies in sovereigns and asset managers alike. Ministries lobby for inclusion — as seen in China’s campaign for its bonds’ entry into WGBI. Asset managers calibrate mandates to FTSE Russell classifications.

The guild lock-in is double-sided: sovereigns need inclusion, funds need benchmarks, and both treat the index as natural law. Schwimmer’s authority is exercised through methodology PDFs that appear technical but decide sovereign access to global savings.

Continuity Phase — Methodology as Sovereignty

Under Schwimmer, FTSE Russell rebalanced its indices through consultations and technical notes. Russia’s exclusion in 2022 was staged as methodology, not politics, yet the outcome was sovereign expulsion from benchmark flows.

Continuity lies in the methodology. Schwimmer provides executive custodianship, but the artefacts — eligibility criteria, index reviews, rebalance calendars — govern regardless of personality. FTSE Russell, like MSCI, is infrastructural.

Takeaway Synthesis

Schwimmer exemplifies the Index Governor. His artefacts are eligibility notes and index reviews. These appear as neutral methodologies, but they determine whether sovereigns access global capital.

Through FTSE Russell, sovereign bonds gain or lose liquidity. A minister may campaign, but the rebalance note is decisive. The receipts are circulars and reweighting tables, not treaties or summit communiqués.

Schwimmer’s case shows index governance from the exchange vantage point. Where MSCI under Fernandez framed emerging markets as a product, FTSE Russell under Schwimmer framed sovereign bonds as eligibility lists. Both enforce sovereignty invisibly, by embedding decisions in benchmark methodologies.

The runtime is not speech but schedule. A country joins or leaves the index, and capital follows. Law becomes methodology; methodology becomes market fact.

Category G — Synthesis: Index Governors

Index governors rule through classification. Their artefacts are methodology notes and rebalance schedules that define what counts and how much it weighs. Once published, flows follow automatically: ETFs, mandates, and bank models adjust without debate.

Pablo Hernández de Cos shows the regulatory strand. Basel standards function as an index for banks: exposures listed, risk-weighted, and enforced through capital ratios. A 0% weight makes a sovereign bond de facto risk-free.

Henry Fernandez shows the market strand. At MSCI, country upgrades or downgrades redirect billions. “Emerging market” is not a discovery but a manufactured category, with ministries lobbying index committees for inclusion.

David Schwimmer shows the exchange strand. Through FTSE Russell, benchmarks like the WGBI decide sovereign bond eligibility. Russia’s 2022 expulsion was presented as methodology but functioned as sovereign exclusion.

Guilds lock the system in: banks, funds, and sovereigns all depend on benchmarks. Neutrality is staged, but the runtime is coercive. Methodology is law; capital obeys the index note.

CATEGORY H. ASSET-MANAGER STEWARDS

Stewardship governance fuses allocation with voting. Asset managers such as BlackRock, Vanguard, and State Street are not just intermediaries of capital; they act as governors of corporate behaviour. Their artefacts are stewardship guidelines, proxy-voting policies, and engagement letters. These appear as fiduciary duty, but in practice they are governance codes applied across thousands of firms simultaneously.

BlackRock under Larry Fink is the emblematic case. Its Aladdin platform integrates portfolio analytics with stewardship oversight. The runtime is circular: Aladdin determines allocation, while stewardship guidelines dictate how shareholder power is used. This fusion means BlackRock does not merely reflect markets—it formats them. A firm included in Aladdin portfolios is also subject to BlackRock’s governance expectations.

The artefacts are strikingly banal: PDF guidelines on climate disclosure, diversity, compensation, or board independence. Yet they function as transnational governance directives. A listed company in Tokyo or São Paulo must comply if it wishes to retain index capital. Voting records and engagement notes reinforce the message: stewardship is not advice but mandate.

The camouflage is fiduciary language—claims of acting in clients’ best interests. But the runtime effect is doctrinal: one firm’s memos become the governance code for much of global corporate life.

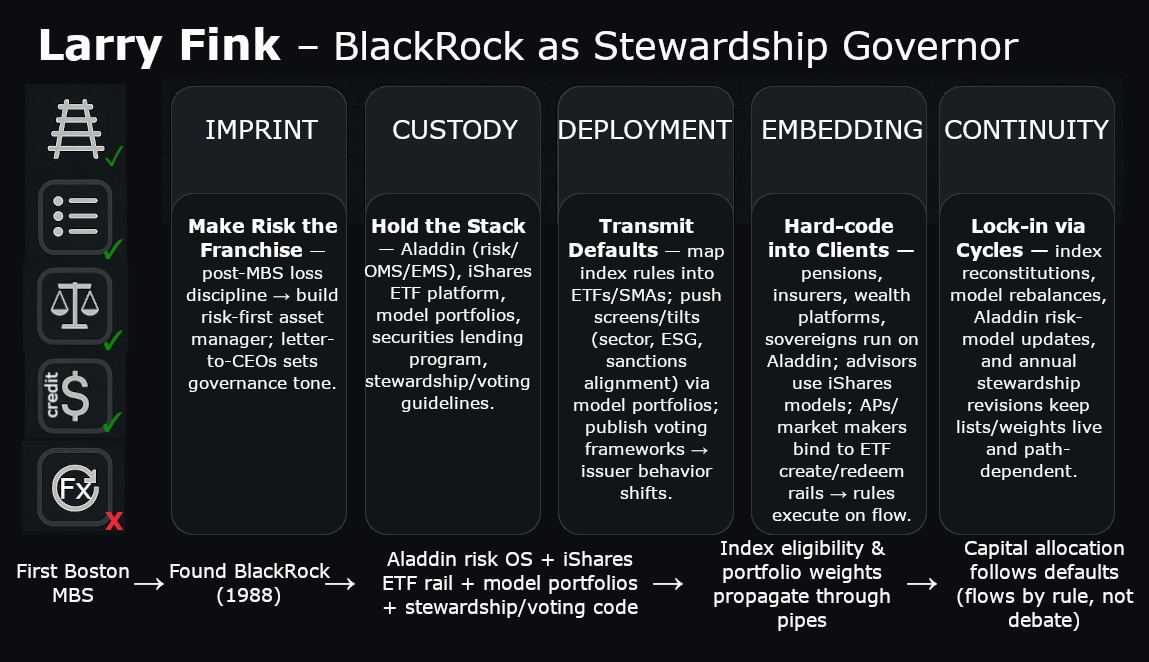

16. Larry Fink — BlackRock as Stewardship Governor

Operator Class: Asset-Manager Steward

Runtime Function: Fused portfolio allocation with proxy-voting doctrine

Format Migration: Bond-trader entrepreneur → BlackRock founder/CEO (1988–) → Stewardship governor of corporate governance norms

Imprinting Phase — Bond Trader to Asset Manager

Larry Fink’s imprint was in mortgage-backed securities at First Boston, where a single miscalculation led to a $100m loss and his exit. The lesson imprinted: risk must be monitored systematically.

When he co-founded BlackRock in 1988, the imprint translated into risk management as product. Aladdin, the in-house analytics platform, became both the selling point and the governance lever: an operating system for capital allocation.

Custodian Phase — Scaling Aladdin and Stewardship

As BlackRock grew into the world’s largest asset manager, Aladdin became indispensable to pension funds, insurers, and sovereign wealth managers. Its artefacts were portfolio analytics, risk metrics, and allocation dashboards.

But scale created a new role: corporate steward. Fink’s letters to CEOs and BlackRock’s stewardship guidelines began dictating governance standards on climate disclosure, diversity, and compensation. The artefacts were policy PDFs and proxy-voting records that appeared advisory but functioned as mandatory for firms reliant on BlackRock capital.

Redeployment Phase — From Fiduciary Duty to Global Doctrine

Fink redeployed fiduciary language into global governance:

- Annual CEO letters framed climate and ESG disclosure as fiduciary obligations.

- Voting guidelines became enforcement tools across thousands of companies.

- Engagement processes institutionalised governance expectations beyond borders.

Through redeployment, stewardship became doctrine: corporate behaviour was formatted by BlackRock’s expectations, enforced by votes and capital allocation.

Embedding Phase — Aladdin as Platform Lock-In

BlackRock’s embed is infrastructural. Aladdin is used not only by BlackRock but by hundreds of external institutions. This creates a feedback loop: allocation decisions and stewardship expectations are coded into the same platform.

The guild is systemic: companies need BlackRock capital, asset managers rely on Aladdin, and boards anticipate Fink’s letters. The runtime is total: governance by platform, disguised as fiduciary stewardship.

Continuity Phase — Beyond Fink, Persistent Doctrine

Even if Fink steps back, the artefacts endure. Stewardship guidelines are updated annually; proxy-voting policies persist across leadership changes; Aladdin is entrenched as market infrastructure. BlackRock’s role as stewardship governor does not rely on his persona but on the institutionalisation of doctrine through platform logic.

Takeaway Synthesis

Larry Fink exemplifies the Asset-Manager Steward. His artefacts are stewardship memos, proxy-voting records, and Aladdin’s allocation logic. They present as fiduciary duty, but in practice they are global governance codes.

Fink’s imprint was risk discipline; BlackRock’s runtime is doctrinal enforcement. Companies worldwide adapt policies to BlackRock guidelines, not because regulators demand it, but because capital requires it. The receipts are banal PDFs and voting logs — documents that quietly function as binding decrees for global corporate behaviour.

Stewardship under Fink shows how asset managers became governors. Not through law or elections, but through platform allocation fused with proxy voting. BlackRock’s memos are doctrine; Aladdin is enforcement.

Category H — Synthesis: Asset-Manager Stewards

Asset-manager stewards govern through capital plus vote. Their artefacts are stewardship guidelines, proxy-voting records, and platform analytics. These appear as fiduciary duty but in practice function as global governance codes.

Larry Fink exemplifies the type. BlackRock’s Aladdin platform fuses allocation with oversight: capital is deployed according to benchmarks, while proxy votes enforce governance expectations. Annual CEO letters and stewardship PDFs dictate standards on climate, diversity, and pay. What reads as advice is mandate: companies dependent on index capital comply or risk exclusion.

The category is collective. Vanguard and State Street replicate the model, ensuring that most listed firms face common stewardship expectations. Boards anticipate guideline updates as if they were law. Corporate behaviour is formatted not by legislatures but by memos issued in New York, Boston, or London.

Continuity is systemic. Even if Fink departs, the artefacts persist: voting frameworks, platform integration, stewardship codes. Neutrality is staged as fiduciary language, but the runtime is coercive. Stewardship is governance disguised as duty — a transnational code enforced by index capital.

FINAL SYNTHESIS

The case studies in Addendum 3a and 3b trace the same operator function across different vessels: governors of money. Whether sovereign or infrastructural, their artefacts are not speeches but instruments — circulars, methodologies, databases, terminals, memos. These instruments enforce the three modalities: Rail, List, Weight.

Sovereign Runtime (Addendum 3a)

Sovereign governors are tied to flags. Ben Bernanke managed crisis doctrine through quantitative easing. Agustín Carstens turned central banking into global doctrine through the BIS. Christine Lagarde and Jerome Powell preserved orthodoxy, translating domestic credibility into supranational reassurance. Janet Yellen fused Treasury with monetary authority, staging continuity across crises.

Others operated under siege. Elvira Nabiullina, Calixto Ortega Sánchez, and Riad Salameh governed in collapse mode, holding regimes together through blunt decrees, dual rates, and ad hoc substitutes. They exemplify the Sovereignty Last-Resort Governor: survival without orthodoxy.

Sovereign runtime is visible. These figures hold press conferences, set policy rates, and appear in histories. Their power is tied to persona and office — remembered as public figures even as their artefacts circulate anonymously.

Infrastructural Runtime (Addendum 3b)

Infrastructural governors are remembered, if at all, as acronyms and tickers. Their artefacts are not speeches but schedules, screens, and circulars.

- Rail Governors (Plumbing): SWIFT, Fedwire, ISO. They enforce the binary of access. Funds move or they don’t. Pipes are policy.

- Vendor Propagators: Bloomberg, Refinitiv. Interfaces propagate law by default. What appears on screen is treated as fact.

- CCP Risk Czars: LCH and other clearinghouses. They govern through weight. A margin multiplier can liquidate a fund overnight.

- Index Governors: MSCI, FTSE Russell, Basel Committee. They blend list and weight. Classifications and methodologies decide sovereign eligibility and bank leverage.

- Asset-Manager Stewards: BlackRock and peers. Stewardship guidelines function as governance codes, enforced through proxy votes and allocation platforms.

Here neutrality is camouflage. A margin call is presented as prudence, an index rebalance as methodology, a stewardship memo as fiduciary duty. Yet each artefact enforces sovereignty more decisively than law.

Common Patterns

Across sovereign and infrastructural domains, three traits recur:

- Artefacts as Receipts. The binding force lies in technical documents: circulars, data fields, margin tables, methodology notes, stewardship PDFs. They appear banal yet function as law.

- Guild Lock-In. Compliance officers, traders, regulators, and boards internalise these artefacts as routine. Contestation is rare; over-compliance is structural.

- Camouflage as Neutrality. Operators present themselves as technical custodians, not governors. Survival is staged as prudence, doctrine as risk management, coercion as methodology.

Synthesis Takeaway

The governors profiled in Addendum 3a and 3b are not two species but two tiers of the same architecture. Sovereign governors operate through flags, central banks, and treasuries; infrastructural governors operate through networks, feeds, and methodologies. Both enforce Rail, List, and Weight.

The difference is visibility. Sovereigns are remembered as figures; infrastructures as systems. Yet the runtime is aligned: both preserve continuity by translating doctrine into artefacts that bind markets.

Together, these case studies show financial governance not as law but as circulation. Artefacts, once embedded, enforce themselves. Governors, whether central bankers or index compilers, do not merely interpret markets — they constitute them.

Published via Journeys by the Styx.

Overlords: Mapping the Operators of reality and rule.

—

Author’s Note

Produced using the Geopolitika analysis system—an integrated framework for structural interrogation, elite systems mapping, and narrative deconstruction.