The Operators: Part 3. The Financial Governors

How capital rails, lists, and risk weights turn policy into access control—no statute required.

Overlords 8. The Operating Class identified the Operating Class—system guardians who move policy through institutions by holding the levers that decide access. The Operators: Part 1. Neocons mapped the security arm—aims turned into defaults through crisis doctrine and Part 2. The Legal Guild mapped the legal arm—courts reduced to throughput via settlements and monitorships.

Part 3 puts the financial arm on the table—the same actors route decisions through pipes that govern clearing, settlement and dollar liquidity.

The pivot is venue, not rhetoric—finance is a jurisdiction administered by people who sign lists, weights and rail rules. Name the seats, name the artefacts they change, then measure the bite on balance sheets and payment corridors.

G. Edward Griffin’s Jekyll Island functions here as a folk ledger of cartelisation: it correctly intuits the public–private syndicate behind the Fed and the crisis ratchet that follows, but it personalises what is now an architectural machine—standards committees, collateral policy, payment rails, indices, and vendor compliance. We treat it as an on-ramp, then recode its claims into Activation–Compliance–Delegation levers and PDES (Perception–Doctrine–Execution) so readers see how modern power operates: swap lines, eligibility lists, and rail access—not just a century-old meeting—decide who pays, who borrows, and who gets cut off.

As with previous parts, Addendum 3 will provide case studies to provide person level illustration.

Note: Due to the nature of the subject, this article features a lot of acronyms. For the uninitiated, a full glossary of terms is provided in the appendix at the end.

HISTORY: FROM AMSTERDAM TO THE MODERN SWITCHBOARD

Central banking starts as a fix for broken settlement and wartime finance, then compounds into rule-power. Each milestone repeats the loop: a shock exposes disorder; an institution centralises rails, defines eligibility lists, and prices liquidity—the three components: Rail | List | Weight. Specific actors wire the design; the technical “how” is ledger money, discounting, collateral schedules, RTGS (Real-Time Gross Settlement) pipes, and now application programming interfaces (APIs) / wallets. Benefits concentrate near the valves—sovereign treasuries, incumbent dealers, asset owners. From Amsterdam’s bank money to Basel standards, TARGET (European Central Bank’s euro payment backbone), and Central Bank Digital Currency (CBDC pilots), the branding shifts (prudence, integrity, inclusion), but the machine is stable: control the rail, script the list, set the weight, deputise enforcement, narrate it as stability.

- 1609 — Amsterdam Wisselbank (Bank of Amsterdam)

Chaotic coinage and settlement risk drive a city exchange bank with ledger “bank money”; magistrates, guilds, and the VOC (Dutch East India Company Charter) mandate high-value clearing, later adding time-limited receipts (1683). Rail | List | Weight: municipal clearing rail | eligible coins/receipts | agio band (bank-money premium). Exporters, wholesalers, and the city treasury gain priority liquidity; the agio typically sat in a 2–6% band, spiking ≈13% during the 1650–1660 crisis. - 1668 — Riksens Ständers Bank (Riksbank)

After Stockholm Banco’s collapse and the absurd bulk of copper plates, parliament installs a disciplined note issuer and rediscount regime; merchants and the Crown plug into standardised notes and convertibility. Rail | List | Weight: national settlement via the Riksbank | eligible paper for discount | official discount rates. State finance and exporters benefit; the largest standard plate (10 daler) weighed ≈19.7 kg, whose transport cost helped catalyze reform. - 1694 — Bank of England

War-finance gaps trigger a joint-stock bank that swaps a sovereign loan for privileges; William III’s Treasury, Charles Montagu, William Paterson, and City syndicates consolidate the gilt market, add LOLR, and evolve OMOs (Open Market Operations). Rail | List | Weight: BoE settlement & gilt market | eligible collateral schedules | Bank rate, haircuts. Crown capacity and City dealers gain; the founding £1.2 m loan at 8% was repaid in 1718, cementing credibility. - 1800 — Banque de France

Post-revolution disorder yields a centralised discount/note bank; Napoleon and Paris houses merge issuers, build a branch network, and fuse fiscal aims with commercial credit. Rail | List | Weight: Banque de France branch clearing | eligible bills/notes | official discount and legal-tender rules. State procurement and Paris commerce profit; note-issue monopoly in Paris (1803), extended nationwide (1848). - 1876 — Reichsbank

Unification and industrialisation require harmonised money/credit; the Reichsbank succeeds the Bank of Prussia, builds a branch grid, and anchors to the gold mark. Rail | List | Weight: Reichsbank payments network | regulated note-issuers/eligible paper | discount policy at gold par. Heavy industry and the fiscal-military state benefit; the gold mark fixed at 2,790 marks/kg fine gold (~0.358 g per mark). - 1882 — Bank of Japan (BoJ)

Fragmented notes and fiscal stress push a single central bank; Matsukata’s reforms retire legacy notes, unify discount/settlement, and later tie to gold. Rail | List | Weight: BoJ clearing/branch network | eligible commercial paper | discount policy, later gold-par discipline. The modernisation state and zaibatsu gain; Japan joins gold in 1897, phasing out old national banknotes by 1899.

Transition — Pre-modern → Modern (1913–1945)

Private–public central banks consolidate into a coordinated system: national lenders of last resort plus a Basel “switchboard” to standardise rules above parliaments.

- 1913 — U.S. Federal Reserve System (FED)

After the 1907 panic exposes clearinghouse limits, the Fed pools reserves, standardises rediscounting, and later turns collateral policy into a macro lever via OMOs. Rail | List | Weight: Fedwire & Reserve accounts | eligible collateral menus | discount/OMO rates and haircuts. Treasury, primary dealers, and money-center banks benefit; call-money rates spiking near 100% (1907) dramatised the failure the Fed fixes. - 1930 — Bank for International Settlements (BIS)

Reparations tangles and coordination needs produce a central-bankers’ switchboard; governors build standing committees—Basel Committee on Banking Supervision (BCBS) / CPMI (Committee on Payments and Market Infrastructures (CPMI) / International Organization of Securities Commissions (IOSCO)—that turn guidance into global practice. Rail | List | Weight: Basel coordination rails | global standards & eligibility norms | capital/liquidity/risk weights. Cross-border incumbents and aligned sovereigns gain; today 63 shareholder central banks cover roughly 95% of world GDP. - 1944–1971 — Bretton Woods Order

The postwar regime anchors adjustable pegs to the dollar with capital controls and surveillance; Keynes, White, and allied treasuries manage par values and ration FX. Rail | List | Weight: correspondent/IMF rails | parity commitments & program eligibility | conditionality, interest/peg rules. U.S. hegemony, protected domestic banks, and exporters benefit; gold convertibility at $35/oz holds until the Nixon Shock (Aug 15, 1971) closes the gold window and ignites the floating-rate era. - 1974→ — Basel/Standards Era

The Herstatt failure and serial collapses trigger a standards machine: the Basel Committee sets capital and risk norms while Continuous Linked Settlement (CLS) and Real-Time Gross Settlement (RTGS) de-risk settlement. Rail | List | Weight: RTGS/CLS rails | global rulebooks & eligibility | risk weights, buffers, floors. Large international banks, reg-tech vendors, and sovereigns benefit; Basel I imposes 8% minimum risk-weighted capital; Herstatt shuts 26 Jun 1974. - 1998–2002 — ECB, Euro & TARGET/TARGET2

Monetary union without full fiscal union creates a single authority and high-value payment rails; Trans-European Automated Real-Time Gross Settlement Express Transfer System (TARGET/TARGET2, and later T2S) plus collateral frameworks discipline banks and sovereigns. Rail | List | Weight: TARGET/T2/T2S rails | European Central Bank (ECB) collateral frameworks | haircuts, valuation, rate corridor. Core exporters and collateral-rich banks benefit; TARGET2 2022 turnover ≈ €570.5 tn (~€2.2 tn/day), T2S ≈ €717 bn/day.

Transition — Modern → Digital (post-2008)

Crisis toolkits (QE, facilities, swap-lines) fuse with sanctions/AML meshes and programmability, extending monetary power from banks → markets → wallets.

- 2008–2014 — Market-Maker of Last Resort

Shadow-bank runs provoke Quantitiative Easing (QE), emergency facilities, and standing FX swap-lines; eligibility widens and central banks buy public/private assets. Rail | List | Weight: central-bank balance-sheet rails | facility/eligibility menus | haircuts, rates, program terms. Asset owners, incumbent dealers, and swap-line allies benefit; the Fed’s balance sheet climbs from ≈ $0.9 tn (2008) to ≈ $4.5 tn (2014). - 2012–2022 — Rails as Foreign Policy

Sanctions and geopolitics weaponise messaging and correspondent rails; legal orders synchronise with private rules and off-boarding. Rail | List | Weight: SWIFT (Society for Worldwide Interbank Financial Telecommunication) & correspondent rails | sanctions/AML (Anti-Money Laundering) lists | de-risking costs and access pricing. Alliance states, compliance vendors, and aligned corporates gain; Iranian banks lose SWIFT (2012) and seven Russian banks are barred (Mar 2022). - 2020s — Perimeter Expansion & CBDC Pilots

Pandemic shock and digitisation spur corporate facilities, yield-curve control, and retail/wholesale CBDC (Central Bank Digital Currency) tests; Bank for International Settlements (BIS) hubs and national pilots trial programmability and wallet tiers. Rail | List | Weight: Application programming interface (API) / wallet rails | Know your client (KYC) / wallet / usage conditions | rate/limit/feature toggles. Sovereigns and large platforms near eligibility lists benefit; as of mid-2025, 49 countries are conducting CBDC pilots—a record high, with counts fluctuating as projects launch or pause.

Summary

Across four centuries, the same switchboard repeats: a shock exposes disorder; a central node consolidates rails (access), publishes lists (eligibility), and sets weights (pricing)—then deputises private actors and narrates it as stability. The labels and numbers change (agio bands, gold pars, 8% capital, €2.2 tn/day RTGS, multi-trillion balance sheets, 49 active CBDC pilots underway mid 2025), but the logic—activation, compliance, delegation—keeps compounding. Benefits accrue to those nearest the valves: sovereign treasuries, incumbent dealers, and asset owners positioned at the junction of eligibility and liquidity.

From Amsterdam’s ledger money to TARGET2 and CBDC pilots, every “reform” in your history traded speeches for settings—who can touch the rail, what qualifies, and at what price. The prologue names that machinery so we can follow the hands that drive it next.

MONEY AS VENUE

Sanctions director edits the list; SWIFT board enables the field; markets head widens eligibility; index chair schedules the drop—jurisdiction by spreadsheet.

When policymakers try to shape finance they are not debating ideas; they are rewiring the plumbing that moves money. From the 17th‑century Amsterdam Wisselbank forcing high‑value payments onto a civic ledger, to the Bank of England swapping war‑loan claims for collateral privileges, to the Federal Reserve turning collateral policy into a macro‑lever, the pattern repeats. The Bank for International Settlements (BIS) in Basel codified standards so that lists can travel across borders; the European Central Bank (ECB) in Frankfurt bound an entire continent with TARGET2; the 2008 crisis grafted market‑maker powers onto central banks; today SWIFT’s messaging network becomes a foreign‑policy conduit and CBDC pilots test programmable gates.

The loop – the same three moves every time

- Designation → List – a competent authority publishes a new entry (or deletion) in a sanctions or eligibility register.

Example: the U.S. Office of Foreign Assets Control (OFAC, Washington) added a tranche of Russian entities on 2 Mar 2022; the EU Council Secretariat (Brussels) issued a matching restrictive‑measures act the same day. - Rail activation → Access – the settlement or messaging infrastructure flips a technical flag that blocks or permits traffic for the affected identifiers.

Example: SWIFT’s Standards Board in La Hulpe (Belgium) updated field 121 “Sanctions Indicator” in the MT103 message and, on 12 Mar 2022, disconnected the targeted Bank Identifier Codes (BICs). The Fedwire Funds Service (U.S. RTGS) or TARGET2 (Euro‑area RTGS) would make analogous adjustments to participation rights, queue limits, or intraday‑credit caps. - Weight tweak → Price – collateral schedules, haircuts, margins, or capital‑weight tables are revised via circulars or method notes; vendors push the schema change; banks’ compliance engines auto‑patch and enforce the new cost.

Example: the EU’s March 2022 haircut on Gazprombank’s sovereign exposure was reduced from 30 % to 15 % (policy carve‑outs for energy payments), lowering the de‑risking cost for banks that remained connected.

Scale. TARGET2 processed roughly €570 trillion in 2022 (≈ €2.2 trillion per day). A ten‑day lag between legal designation and rail activation therefore reroutes billions of euros of daily liquidity.

Think of money as a venue, not a debate. Access is the remedy; exclusion is the sanction. The casing changes—lists, fields, haircuts—but the mechanism stays the same: a rule is announced, a switch in the plumbing is flipped, and the price of touching the system changes. The operators who make those settings real are the sanctions chief, the messaging‑network standards manager, the central‑bank markets head, the clearing‑house risk officer, and the compliance teams that push the software patches. Watch for four signals—new lists, new fields, new eligibility notes, new methodology lines—and you’ll see the shift before the press release lands.

Next: The Operators – a plain‑English field guide to each role, the lever they control, how they coordinate, and the tell‑tale signs that a switch is about to flip.

THE OPERATORS — WHO FLIPS THE SWITCHES, AND HOW

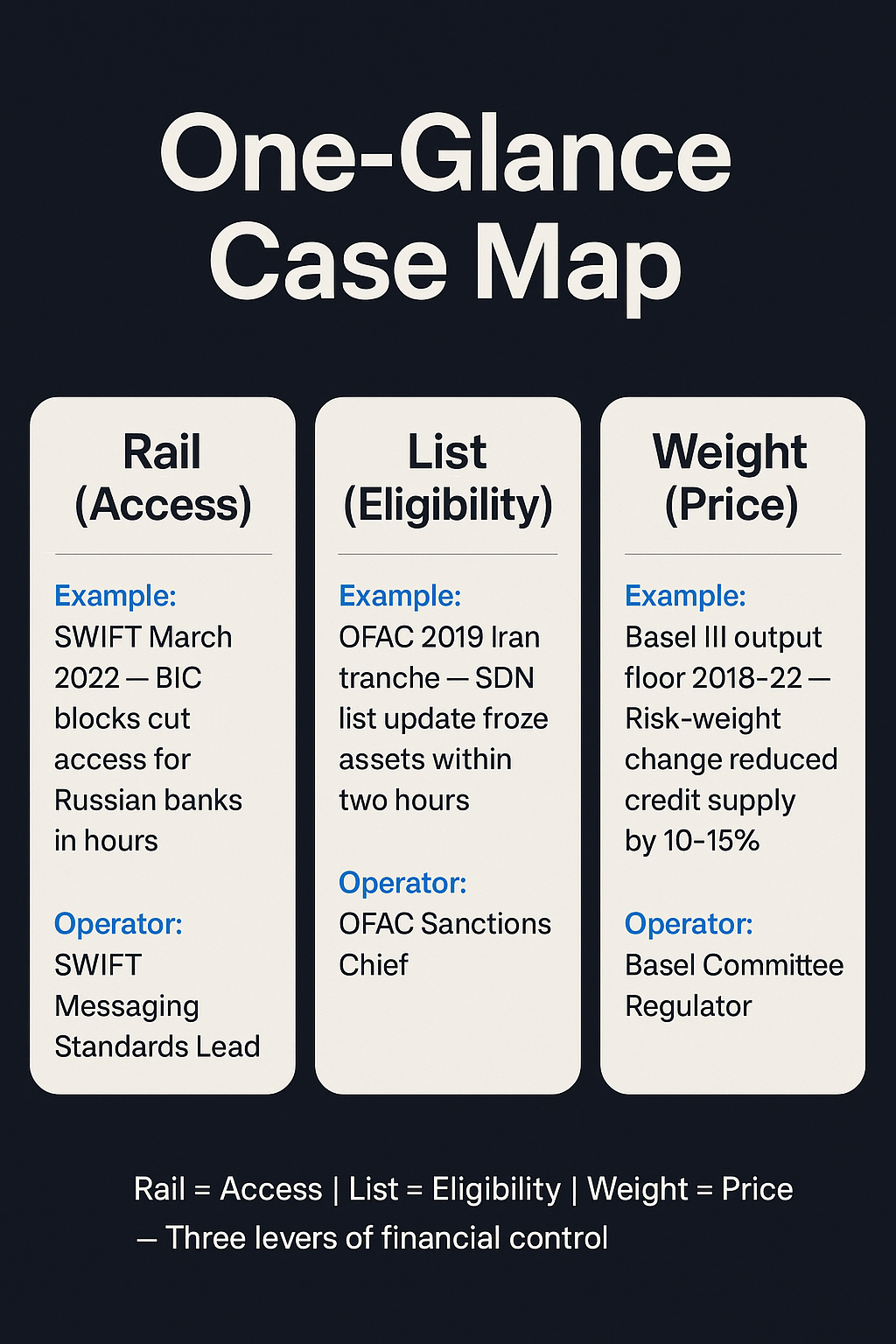

Control of the financial system rests on three eternal functions: the Rail (access), the List (eligibility), and the Weight (price). These are not abstractions. They are operated by identifiable people who sit in named seats, sign specific artefacts, and leave behind a trail of updates, circulars, and feeds. Once you learn to read the tells, you can see a move coming before the headline lands.

The Rail — Where Transactions Can and Can’t Flow

The Rail is the access layer, built out of Fedwire, SWIFT, TARGET2, and now experimental CBDC platforms. Operators decide who connects and who is cut off by toggling membership tiers, message fields, or intraday credit limits.

At SWIFT, the messaging standards lead has the power to enable or disable fields and Bank Identifier Codes. In March 2022, after the EU Council voted to sanction Russian banks, this office pushed a directory update that blocked those institutions. Within hours, rejection rates spiked across Europe as payments failed. The sanction was not debated—it was coded into the pipes.

At central banks, the heads of payments divisions exercise similar authority. A revised circular from Fedwire or the ECB can change participation criteria or intraday credit terms, shutting doors for some institutions while easing flows for others. Even commercial banks hold this lever: heads of correspondent-banking desks decide whether a client institution retains access to dollar clearing or is “de-risked” out of the network. Exit letters and blacklists are the signals that such a cut is underway. And as digital rails emerge, fintech CTOs and CBDC architects now write programmable access directly into API whitelists and wallet tiers. When sandbox projects flip into production, those access conditions harden into law.

The List — Who Is Allowed to Touch the Rail

The List defines eligibility: who and what may pass through the pipes. Sanctions authorities, central banks, index committees, ratings agencies, and supervisors all curate their own registers.

In Washington, the Office of Foreign Assets Control (OFAC) director signs the Specially Designated Nationals (SDN) list. During the 2019 escalation against Iran, OFAC added a tranche of entities, and within two hours global screening systems had synced. Assets were frozen, accounts terminated, and counterparties off-boarded—not through political speeches, but via XML feeds parsed by compliance engines from New York to Singapore.

Central banks perform the same function with collateral eligibility schedules. A new circular from the ECB markets desk or the Federal Reserve can add or remove whole classes of securities from the list of what counts as “good” collateral. In parallel, index committees such as MSCI and FTSE Russell govern eligibility for benchmarks. When MSCI removed Russia from its Emerging Markets index in March 2022, an estimated billion dollars of passive capital exited in days. The methodology memo was not commentary—it was a capital sanction. Ratings agencies also straddle list and weight. A criteria paper or sovereign downgrade not only revises eligibility but shifts funding costs overnight. And when supervisors such as the ECB-SSM or the DOJ issue consent orders, the list becomes even more direct: banks are forced to off-board specific clients or entire business lines. In 2020, one U.S. bank’s consent order over AML failures resulted in a complete rewiring of its monitoring systems, with detection failure rates collapsing from 12% to under 2% in a month.

The Weight — The Price of Participation

The Weight is the pricing lever. It determines how expensive or cheap it is to participate, and thus which strategies survive.

Central bank market committees pull this lever by adjusting facility terms or collateral haircuts. In March 2020, the Federal Reserve expanded eligibility for its Secondary Market Corporate Credit Facility to include investment-grade bonds. Overnight, repo spreads on those bonds tightened by fifty basis points as demand soared. Collateral deemed “good” was suddenly cheaper; the excluded became unviable.

Clearinghouses enforce the same discipline through their risk officers. A margin circular at Chicago Mercantile Exchange (CME) or London Clearing House (LCH) can render an entire strategy uneconomical in a day. Basel regulators do it at a global level. The introduction of Basel III’s output floor between 2018 and 2022 increased capital requirements for corporate exposures, prompting banks to cut such holdings by 10–15% in a single quarter. A spreadsheet in Basel redirected global credit. Inside the banks, treasury and collateral desks manage the weight in practice, choosing which assets to pledge and where to park liquidity to minimise costs. Even reg-tech vendors exercise weight control: when they push a “critical patch” that changes model thresholds, thousands of institutions simultaneously reprice exposures without ever debating the change.

The Short Play — How a Move Unfolds

The pattern repeats across all three levers. First comes the signature—a regulator or committee issues a rule, a list, or a methodology note. Next comes the enablement, as payment systems or settlement layers flip fields and update eligibility. Then comes the price, as haircuts, margins, or capital weights shift and spreads adjust. Finally, propagation: banks, clearinghouses, vendors, and index funds roll patches and rebalance, forcing capital to flow along the newly set path.

Pattern: Tangible, Measurable, Operator-Led

Every lever is tangible, every action measurable, every outcome operator-led. The evidence lies in rejection rates, basis points, capital shifts, and forced flows. Each case leaves a timestamped artefact: a SWIFT directory update, an OFAC XML feed, a Basel monitoring report, a Fed collateral circular, an MSCI methodology memo, or a Department of Justice (DOJ) consent order. None of this is theory—it is the mechanics of modern financial power, inscribed into the operational record.

Bottom line: When markets swing, don’t ask why in the abstract. Ask: which Rail just opened or shut, which List changed, which Weight moved—and whose signature made it real? The answer is always there, in the ledger of artefacts.

THE THREE NURSERIES — WHERE FINANCIAL OPERATORS ARE MADE

The Operators—those who control the Rail, List, or Weight—don’t just appear. Before they wield control over the financial venue, their careers are nurtured within specific institutional pipelines. Not random paths; they are structured pipelines that cultivate technical mastery, global coordination, or scalable propagation. By tracing the career path of each figure, we can see how control is passed down and systematised.

1) Technical Nurseries

Core institutions: central banks, treasuries, prudential regulators

These are the plumbing schools. Officials start by learning the internal levers—RTGS mechanics, eligibility schedules, sanctions enforcement, and capital tables. Their edge is execution: the ability to translate abstract policy into working code and daily flow.

- Janet Yellen – began as a professor of economics at Berkeley, joined the Fed as a governor (1994), became President of the San Francisco Fed (2004), later Chair of the Federal Reserve (2014–2018), and Treasury Secretary (2021–2025). Her journey exemplifies the Fed-to-Treasury pipeline, blending monetary tools and fiscal levers.

- Elvira Nabiullina – trained as an economist in Moscow, served as Minister of Economic Development (2007–2012), then as economic advisor to President Putin, and has governed the Central Bank of Russia since 2013. She directed ruble stabilisation, FX interventions, and built a domestic payments rail (SPFS) under sanctions.

- Nellie Liang – economist with a PhD from the University of Maryland, joined the Federal Reserve and rose to Director of the Division of Financial Stability. Now serves as U.S. Treasury Under Secretary for Domestic Finance, linking prudential policy to fiscal oversight.

2) Governance Nurseries

Core institutions: BCBS, FSB, FATF, IOSCO, ISSB

This is the drafting room. Careers begin with committee assignments, working group roles, or secretariat secondments. The skill is text-to-template translation: writing standards that survive consultation and become defaults across jurisdictions.

- Agustín Carstens – began at Mexico’s central bank, became Deputy Finance Minister (2000), later Governor of the Bank of Mexico (2010–2017), and then General Manager of the BIS (2017–). As BIS head, he coordinates Basel standards and macroprudential doctrine globally.

- Mark Carney – worked at Goldman Sachs before becoming Deputy Governor of the Bank of Canada, then Governor (2008–2013), moved to Governor of the Bank of England (2013–2020), and chaired the Financial Stability Board. Now at GFANZ, leading climate-finance disclosure frameworks.

- Raja Kumar – spent decades in Singapore’s Ministry of Home Affairs and financial intelligence, became Deputy Secretary of Policy, then FATF President (2022–2024). Overseaw mutual evaluations and blacklists that guide global de-risking behaviour.

3) Distribution Nurseries

Core institutions: SWIFT, MSCI, S&P Global, LCH, ICE, Bloomberg

These are the propagation labs. Careers start in technical roles—data architecture, methodology design, margin modeling—and scale up into global switchboards. The skill is mass deployment: pushing updates that shift billions via indices, feeds, and clearing rules.

- Douglas Peterson – joined S&P in 2011 after leadership roles at Citigroup, became S&P Global CEO in 2013. Under his tenure, S&P expanded from credit ratings into index governance, ESG scores, and analytic products that guide passive flows.

- Henry Fernandez – started as a diplomat and investment banker, joined MSCI in the late 1980s, and became CEO in 1998. He built MSCI into a global index powerhouse whose methodology changes move trillions across equities, factors, and ESG-linked products.

- Javier Pérez-Tasso – joined SWIFT in 1995, moved through product and commercial roles, led the Americas and UK region, and became CEO in 2019. He oversees schema changes (e.g., ISO 20022), BIC filtering, and messaging policy—directly impacting who can send money and how.

Summary

These nurseries form the cadre pipeline. Technical nurseries produce fluent implementers. Governance nurseries train global coordinators. Distribution nurseries create scale propagators. By the time someone flips a lever—publishing a sanctions list, adjusting a margin file, or pushing a schema update—they’ve usually spent years in one of these tracks.

INTERFACES — STANDARDS, VENDORS, MEDIA

Interfaces are how soft rules become hard constraints. These aren’t just intermediaries—they are amplifiers. A standard becomes a default, a vendor patch becomes a system behavior, and a headline becomes a method change. The operators push buttons, but interfaces decide what those buttons do.

Standards: Global Rule Templates with Local Bite

Standard-setters like the Basel Committee on Banking Supervision (BCBS), Financial Stability Board’s Standing Committee on Standards Implementation (FSB-SCSI), International Organization of Securities Commissions (IOSCO), International Sustainability Standards Board (ISSB), and Financial Action Task Force (FATF) draft non-binding templates—on paper. But their documents contain adoption clauses, country compliance timetables, and implicit vendor triggers. The FATF’s Recommendation 10 on Customer Due Diligence is “guidance,” yet a bad score in mutual evaluation shuts doors across correspondent banking. In 2022, Ghana’s FATF greylisting saw its financial institutions rapidly cut off by U.S. and EU banks—without any regulator issuing a hard ban. The standard had become de facto law.

Vendors: From Toolkit to Transmission Belt

Vendors are the true system integrators. They transform regulatory texts into screening engines, onboarding protocols, capital calculators, and index rebalancers. This includes KYC utilities (e.g., World-Check), sanctions feed stewards (e.g., Refinitiv, Accuity), risk model packs (e.g., Moody’s Analytics), Big Four monitorship units (e.g., Deloitte’s Regulatory Remediation teams), and benchmark providers (e.g., MSCI, FTSE Russell). When a sanctions list changes, Refinitiv updates its XML feed within hours. Banks ingest that patch automatically. The patch is the law. A bank executive doesn’t need to interpret a circular—they just apply the vendor default. When MSCI updated its ESG methodology in 2023 to downgrade hundreds of funds, capital moved instantly. Decision rights aren’t at the top—they’re embedded in SDKs.

Media: The Narrative Supply Chain

Media doesn’t just report—it frames. A market shock is followed by editorials from BIS alumni, central bank veterans, or ratings analysts, which build narrative pressure. This often precedes a formal method change. After the collapse of Greensill Capital in 2021, a media storm about supply-chain finance opacity led to IOSCO launching a task force—and eventually publishing enhanced disclosure guidance. Headlines → doctrine. Comms chiefs in central banks, standard bodies, and major institutions feed and shape these waves. When a Financial Times op-ed hits, the method memo often follows.

The Bottom Line: Interfaces Hardwire Intent

Standards write the blueprint, vendors enforce it, media builds the pressure to act. These aren’t neutral players—they are directional levers. A standard isn’t voluntary if the interface embeds it. Every interface embeds a preference, and those preferences become pipelines for control. To trace financial power, follow the interfaces. Watch the patch, the headline, and the template—they’re upstream of the next enforcement wave.

FAILURE MODES & FIXES

Every system has limits. The rails, lists, and weights that usually run smoothly can jam, fracture, or turn coercive. Failure is not always collapse; often it looks like improvisation. Here are the three recurring fault lines—where nuisance evaders, insider breaches, and sovereignty dissent push against the operator’s toolkit—and how fixes are imposed.

A. Nuisance Evaders

The most common failure mode is small actors finding workarounds—shell companies, alternative rails, or lax jurisdictions. The fix is de-risking. A Chief Risk Officer at a global bank, working with the correspondent banking policy head, simply off-boards the relationship. No law is passed, no trial is held—just an exit letter. The FATF (Financial Action Task Force) mutual evaluation team supplies the pressure: jurisdictions rated “non-compliant” watch their banks lose access to dollar and euro rails.

- Caribbean Correspondent Cut-offs (2015–2018): Dozens of small Caribbean banks lost U.S. correspondent accounts after FATF evaluations flagged weak AML enforcement. By 2018, the IMF estimated over 50% of banks in Belize and Barbados had lost dollar-clearing lines, forcing them to route through costly intermediaries.

- Somalia Remittance Freeze (2015): U.S. banks terminated relationships with Somali remittance companies after FATF/FinCEN scrutiny. For months, remittance flows that supported 40% of Somali households were disrupted until partial regulatory relief was negotiated.

Control Metrics: Operators track the rate of de-risking (how quickly correspondent accounts are cut), the count of off-ramp closures in small jurisdictions, and the designation-to-vendor lag (time from sanctions update to feed propagation). FATF and IMF surveys explicitly measure correspondent account losses; the World Bank reports de-risking rates in Caribbean and Pacific jurisdictions; and vendors like SWIFT Compliance Analytics market low designation-to-block latency as a feature.

B. Insider Breach

Sometimes the failure comes from inside the system—when a bank’s own compliance or risk controls break. The fix is a monitorship. The DOJ in Washington or the ECB’s SSM in Frankfurt imposes a consent order or directive. A Big Four partner or specialist monitor embeds inside the bank, rewriting AML models, raising thresholds, and embedding new control points.

- HSBC (2012): After a DOJ settlement over AML failures tied to Mexican cartel money flows, HSBC entered a five-year monitorship under the oversight of a former U.S. prosecutor. Systems were overhauled; by 2017, the bank reported a near-90% drop in AML alerts requiring manual escalation.

- Deutsche Bank (2015–2021): ECB-SSM and DOJ monitorships forced rewiring of risk models after repeated AML scandals. Internal documents show models were recalibrated with tighter thresholds, cutting correspondent volumes but improving exception rates.

The artefacts are mundane—new “model validation packs,” exception-handling scripts, or revised rulebooks—but the impact is structural. One large U.S. bank cut its transaction-monitoring failure rate from double digits to under 2% within months of such an order.

Control Metrics: Supervisors measure the length of monitorship programs (often 2–5 years), the tightness of control thresholds (false positives vs. false negatives), and the impact on remittances or trade finance when screens bite too hard. DOJ consent orders publicly state program length (e.g., HSBC’s five-year term, 2012–2017); ECB-SSM supervisory reviews publish threshold changes as Pillar 2 add-ons; and Basel/FSB studies track collateral damage in remittances and trade finance.

C. Sovereignty Dissent

The hardest break is political. A state decides not to comply—or cannot. The trigger is often a Treasury sanctions chief in Washington or Brussels, escalating to secondary sanctions. The pressure multiplies: a ratings committee downgrades sovereign debt, pushing up borrowing costs; a central bank reserves team in New York, London, or Frankfurt freezes foreign assets.

The cascade is brutal and visible:

- Iran (2012–2015, 2018–2020): SWIFT disconnected Iranian banks after EU sanctions in 2012. Reserves abroad (~$100bn) were frozen, sovereign ratings collapsed, and bond index providers excluded Iranian-linked assets, driving spreads above 1,000 bps.

- Venezuela (2017–): U.S. sanctions barred new debt issuance, prompting S&P and Fitch downgrades to default. MSCI reclassified Venezuelan securities, forcing passive funds to liquidate. By 2018, sovereign bond prices fell by over 70%.

- Myanmar (2021–): Post-coup sanctions triggered widespread de-risking. Japanese and Singaporean banks cut correspondent ties, while ratings agencies downgraded Myanmar to “selective default.” Foreign reserves were immobilised, and sovereign bond spreads widened over 500 bps

- Russia (2022–): Sanctions immobilised ~$300bn in reserves. MSCI, FTSE, and S&P DJI all removed Russian securities from indices, prompting billions in forced passive outflows. CDS spreads implied default within weeks.

Control Metrics: Operators watch the count of index removals, the volume of reserves immobilised, and the magnitude of spread spikes after downgrades. MSCI, FTSE, and S&P publicly timestamp index rebalances; central banks announce immobilised reserve volumes; and bond desks, ratings agencies, and Bloomberg terminals publish spread spikes in real time.

Box: Doctrine-Burn Indicators

A system under stress starts to reveal its burn marks. Watch for these indicators that doctrine is slipping into coercion or improvisation:

- Exemptions carved out for critical energy or humanitarian flows.

- Emergency normalisations where temporary rules become permanent.

- Model-as-law moments when algorithmic thresholds, not statutes, decide outcomes.

- Secrecy NDAs that conceal remediation terms.

- Vendor mandate growth, when private service providers begin dictating compliance pathways.

Bottom Line

Failures don’t end the system—they reveal its contours. Each fix—de-risking, monitorship, or sovereign exclusion—shows where operators reassert control. The doctrine survives, but scarred: through carve-outs, coerced rewiring, or capital flight. To track the stress, watch the burn indicators. They are the pressure points of the financial governor’s domain.

THE OPERATOR’S PATH — SIGNALS AND SELECTION

True power in finance is not about a single powerful title, but the accumulation of control over the system's core levers—the Rails, Lists, and Weights that govern global capital. This analysis moves beyond biography to identify the measurable career patterns and traits that separate a mere appointee from a true financial governor, mapping the path from technical operator to systemic architect. These moves will be explored in more depth in Addendum 3.

Operators aren’t born; they are selected and hardened through funnels that pass them through lever-holding seats.

- The Central Bank Technocrat: Ben Bernanke is emblematic: from Princeton academia to the Fed Board, to think tanks, and back as Chair. His authority crystallised in 2008, when he wielded the Fed’s balance sheet (Weight) to expand facilities and redefine collateral eligibility. The artefacts bear his name: Federal Reserve circulars that shifted repo spreads and re-priced credit risk.

- The Treasury Enforcer: Juan Zarate moved DOJ → NSC → Treasury, where he helped pioneer the use of sanctions lists against North Korea and Iran. His lever was the List, backed by OFAC’s XML feeds and “Section 311” designations. After government, he rotated into private-sector advisory, carrying doctrine into compliance vendors and law firms.

- The G-SIB Executive: Jamie Dimon, across Citigroup, Bank One, and JPMorgan, mastered the Rail by controlling one of the largest payment hubs on the planet. His signature appears indirectly in liquidity circulars and crisis-era interventions where JPMorgan served as market firefighter.

- The Asset-Manager Steward: Larry Fink, through BlackRock, oversees Aladdin and index stewardship—the delegated List that governs what trillions in passive flows can touch. Index methodology memos under his watch have reallocated capital across continents.

- The Ratings/Index Governor: Methodology heads at MSCI or S&P decide via paragraph tweaks who is “investment grade,” or which securities remain in benchmarks. The artefact is a methodology paper; the impact is billions in forced reallocations.

Behind the official titles of global finance lies a deeper architecture of power, defined not by rank but by repeated proximity to the system's control levers.

- The Short Re-Entry Clock. A powerful signal is the gap between regulator and industry role. Under two years signals integration, not exile. ECB supervisors appearing on German bank boards in 18 months isn’t scandal—it’s how doctrine persists.

- High Rotation Frequency. Operators move between lever seats: OFAC director → law-firm partner → screening-vendor board. Each rotation compounds authority across the A-C-D stack (Activation, Compliance, Delegation).

- Crisis Tool Persistence. Operators don’t just pull emergency levers; they cement them. Mario Draghi’s “whatever it takes” OMT facility was framed as crisis improvisation, but became a standing Weight dial for the ECB.

- Doctrine Fluency and Pivot. True operators mutate the rationale while keeping the lever intact. The same List once justified by counter-terror finance was later rebranded for climate or pandemic response. Mark Carney exemplified this pivot, moving from BoE (monetary stability) to GFANZ (climate stewardship).

- Signature on Artefacts. Authority is recorded when a name is attached to circulars, consultations, or methodology papers. William Dudley at the NY Fed signed the collateral eligibility notices that rewired funding markets in 2008. MSCI index heads signed memos reclassifying Russian securities in 2022. Both altered flows by billions.

The label changes; the lever does not. Then (ESG): An MSCI methodology head adds climate screens to a flagship index, forcing fund managers to rotate holdings. Now (Security): That same seat signs a reclassification memo excluding Russian securities, triggering forced liquidations. The operator’s true skill is executing the swap—carrying control forward under new banners.

The bottom line is: Don’t read the CV; audit the levers. The true governors aren’t defined by length of service but by density of seats with Rail/List/Weight authority, short re-entry clocks, high rotations, crisis ratchets, and signatures on artefacts that redirected credit, rerouted payments, or forced capital reallocation. Their career is their credential; their path is the governance circuit itself.

THE OUTCOMES LEDGER — SIGNALS AND WATCHPOINTS

Every operator leaves a trail—not of speeches, but of artefacts. These documents—sanctions lists, collateral circulars, methodology memos—form a public ledger of financial power. This ledger is not a metaphor; it is a tangible, auditable record of decisions that have moved markets, each with a signature and a timestamp. To read it is to see what has been decided—and what is coming next.

The Ledger Itself: An Audit Trail of Control

Each lever of control publishes its own class of artefact, creating a living audit trail:

- The Rail (Access) is defined by messaging fields, RTGS participation rules, and index inclusion criteria. It is coded in SWIFT schema updates, ECB TARGET2 circulars, or MSCI methodology papers.

- The List (Eligibility) is written in OFAC SDN updates, EU restrictive-measures annexes, and central-bank collateral eligibility schedules. Each carries the names and ISINs that decide who is in and who is out.

- The Weight (Price) is set in Basel Committee on Banking Supervision (BCBS) capital tables, central-bank haircut grids, and Central Counterparty (CCP) margin schedules. These numbers, often buried in annexes, reprice risk across balance sheets.

Cadences differ—daily for sanctions feeds, quarterly for Basel monitoring, instantaneous in crisis—but together they form a cumulative doctrine. The history of financial governance is this archive of operational code.

From Observation to Prediction: The Watchpoints

The ledger is predictive. Certain artefacts signal doctrinal shifts before headlines arrive:

- Hybrid sanctions/solvency notes: In 2018, FATF and Basel Committee joint guidance began aligning AML standards with prudential supervision—an early sign of lists migrating into solvency rules.

- New ISO 20022 fields: SWIFT’s phased rollout (Nov 2022 → full by 2025) embeds new data tags for compliance and screening, paving the way for programmable rails.

- Compressed index rebalancing: MSCI and FTSE removed Russian securities in March 2022 within ten days of sanctions—moves that once took quarters now executed in under two weeks.

- Finance MoUs: The 2020 U.S.–UK Treasury/BoE memorandum on financial stability quietly expanded joint authority over crisis tools.

- ESG → stability pivots: In 2021, the ECB integrated climate stress tests into its supervisory manual, migrating climate criteria from “consultation” into binding capital guidance.

Each signal is a concrete artefact—a clause, a field, a memo. The future is not guessed; it is published.

The Unresolved Fracture

The ledger is durable, but not uncontested. What happens when an artefact—a sanctions list, a capital rule—is challenged by a court, a parliament, or a non-aligned sovereign? Does the ledger lose its force, or does the system route around dissent?

Operators have already shown the fallback: vendors and indices. If states falter, feeds, benchmarks, and compliance engines hard-code the doctrine anyway. That migration into the mesh is the fracture point.

The open question is whether governance remains tethered to political bodies, or whether the operational layer becomes sovereign in its own right.

The ledger reveals how rails, lists, and weights are set. But behind every XML feed, collateral grid, or index memo is a person in a seat with the authority to sign it. Addendum 3 follows those operators—Carstens in Basel, Lagarde in Frankfurt, Yellen in Washington, Nabiullina in Moscow, Fink in New York—to show how their careers carried them to the switches, and how their signatures rewired the system.

Published via Journeys by the Styx.

Overlords: Mapping the Operators of reality and rule.

—

Author’s Note

Produced using the Geopolitika analysis system—an integrated framework for structural interrogation, elite systems mapping, and narrative deconstruction.

Appendix: Glossary of Key Terms, Institutions, and Concepts

Core Financial Infrastructures & Systems

- BIC (Bank Identifier Code): A unique code identifying banks on SWIFT’s network. Blocking or delisting a BIC is a primary method of severing financial access.

- CBDC (Central Bank Digital Currency): A central bank–issued digital currency. Current pilots test programmable rails with API-based access tiers and whitelists.

- CCP (Central Counterparty): A clearinghouse that stands between buyers and sellers in derivatives and securities markets, enforcing margin and default fund rules. Examples: CME, LCH, ICE.

- CLS (Continuous Linked Settlement): A specialised global settlement system for foreign exchange (FX) trades.

- FMI (Financial Market Infrastructure): An umbrella term for systems critical to financial stability, including payment systems, CCPs, and securities depositories.

- RTGS (Real-Time Gross Settlement): A payment system where transactions are settled individually and continuously in real time. Examples: Fedwire (US), TARGET2 (Eurozone).

- SWIFT (Society for Worldwide Interbank Financial Telecommunication): A Belgium-based cooperative providing the global network for financial messaging (FIN/ISO 20022). It runs the BIC directory.

- T2S (TARGET2-Securities): Launched in 2015, the ECB’s securities settlement system that harmonises delivery-versus-payment across Europe.

- TARGET / TARGET2 (Trans-European Automated Real-Time Gross Settlement Express Transfer System): The ECB’s euro RTGS platforms (1999 → TARGET; 2007 → TARGET2). TARGET2 (T2) processed ≈ €570.5 trillion in 2022 (~€2.2 trillion/day).

Regulatory, Supervisory & Standards Bodies

- BCBS (Basel Committee on Banking Supervision): Based at the BIS in Basel, Switzerland, it sets international bank capital standards (e.g., Basel I–IV).

- BIS (Bank for International Settlements): An international financial institution in Basel that hosts the BCBS, CPMI, FSB, and other standard-setting committees.

- CPMI (Committee on Payments and Market Infrastructures): A BIS-hosted standard-setter for payment and settlement infrastructures.

- ECB-SSM (European Central Bank - Single Supervisory Mechanism): The supervisory arm of the ECB, overseeing the largest euro-area banks since 2014.

- EU Council (Brussels): The body that issues restrictive measures and sanctions regulations across the European Union.

- FATF (Financial Action Task Force): The global watchdog on money laundering and terrorism financing. It issues “Recommendations” and conducts Mutual Evaluations that can lead to greylisting.

- FSB (Financial Stability Board): A global body headquartered at the BIS, responsible for coordinating macroprudential policy and financial regulation.

- IOSCO (International Organization of Securities Commissions): Sets global standards for securities markets.

- ISSB (International Sustainability Standards Board): A body under the IFRS Foundation (created in 2021) tasked with developing a global baseline of sustainability disclosure standards.

- OFAC (Office of Foreign Assets Control): A unit of the U.S. Treasury that administers and enforces economic and trade sanctions, including the SDN list.

Central Banking Tools & Functions

- LOLR (Lender of Last Resort): An emergency central bank liquidity backstop for solvent institutions facing a crisis.

- OMOs (Open Market Operations): The purchase and sale of securities (typically government bonds) by a central bank to control liquidity and steer interest rates.

- SMCCF (Secondary Market Corporate Credit Facility): A Fed emergency facility launched in March 2020 to purchase corporate bonds and ETFs during the COVID-19 market crisis.

Legal, Regulatory & Compliance Devices

- AML (Anti-Money Laundering): The legal and regulatory framework designed to detect and prevent illicit money flows.

- DPA (Deferred Prosecution Agreement): A prosecutorial tool allowing corporations to avoid criminal trial in exchange for admitting facts, paying fines, and submitting to a monitorship.

- FAQ (Frequently Asked Questions): Guidance documents issued by regulators like OFAC, often clarifying sanctions scope.

- KYC (Know Your Customer): The obligatory process for financial institutions to verify the identity and assess the risk profile of their clients.

- MOU (Memorandum of Understanding): An agreement between institutions (e.g., finance ministry and central bank) to define cooperation.

- NDA (Non-Disclosure Agreement): A secrecy contract that often obscures the details of supervisory remediations or monitorships.

- SDN List (Specially Designated Nationals and Blocked Persons List): OFAC’s sanctions register. Entities on it are prohibited from transacting with U.S. persons and banks. Distributed via an OFAC XML feed for automated screening.

- Section 311 (USA PATRIOT Act): U.S. Treasury authority to designate jurisdictions or entities as “primary money laundering concerns,” effectively cutting them off from the global dollar system.

Market Infrastructure, Indexing & Data

- Aladdin (Asset, Liability, Debt, and Derivative Investment Network): BlackRock’s proprietary risk and portfolio management system, which encodes index rules and risk models into global asset allocation.

- CME (Chicago Mercantile Exchange): A major U.S. derivatives exchange and CCP, critical in futures and swaps markets.

- ICE (Intercontinental Exchange): A U.S.-based operator of futures exchanges, clearinghouses, and the New York Stock Exchange (NYSE).

- LCH (London Clearing House): A major CCP under the London Stock Exchange Group (LSEG), dominant in clearing interest rate swaps (SwapClear).

- MSCI (Morgan Stanley Capital International): A major global index provider; its country classifications, sector definitions, and ESG screens direct trillions of dollars in passive investment flows.

- XML feed (eXtensible Markup Language feed): A machine-readable format for storing and transmitting data.

Risk & Capital Frameworks

- CET1 (Common Equity Tier 1): The core measure of a bank's financial strength from a regulator's point of view. It consists of common shares and retained earnings and is the primary capital buffer under Basel rules.

- RWA (Risk-Weighted Assets): A regulatory measure of bank assets, weighted by their perceived credit risk. The denominator for calculating capital ratios under Basel rules.

- VAR / SPAN (Value at Risk / Standard Portfolio Analysis of Risk): Risk models used by CCPs and banks to calculate margin requirements and potential losses.

Frameworks, Alliances & Historical Context

- A-C-D Stack (Activation → Compliance → Delegation): A framework describing the interaction of financial control levers: Rail (activation of access), List (compliance with eligibility), and Weight (delegation of pricing).

- ESG (Environmental, Social, and Governance): A set of investment screens and corporate reporting standards increasingly woven into financial regulations, indices, and risk models.

- GFANZ (Glasgow Financial Alliance for Net Zero): A coalition of financial institutions (launched in 2021 and chaired by Mark Carney) committed to transitioning their financing activities to net-zero greenhouse gas emissions.

- PDES (Perception → Doctrine → Execution → Settings): A cycle describing how narratives (perception) justify policy (doctrine), which is then implemented through technical changes (execution) that alter system settings.

- VOC Mandate (Dutch East India Company Charter): Granted in 1602, it gave the VOC monopoly rights on Asian trade plus quasi-sovereign powers (coinage, treaties, war). It embedded early financial rails by mandating use of Amsterdam’s Wisselbank and exchanges.

Institutional Classifications

- G-SIB (Global Systemically Important Bank): A label for banks deemed “too big to fail.” Carries higher capital surcharges and intensified supervisory scrutiny.